As amazing as it now sounds, companies deemed to be highly risky were able to borrow money from US investors for less than 6% as recently as June 2014. To put this in perspective, 6% is not far from the US government’s average 10-year borrowing rate for the past 50 years. And here were frackers, ultra-high-leverage retail chains and various other close-to-the-edge entities slurping up a torrent of cash from yield-starved investors who had forgotten about the other side of the risk/return equation.

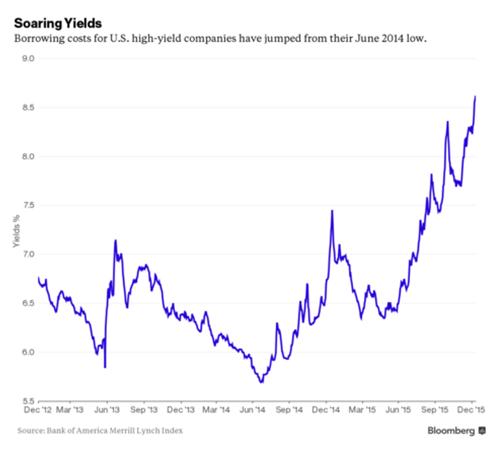

That this hasn’t worked out so well is not much of a surprise. But the speed with which it has gone bad is still breathtaking. The following chart from Bloomberg illustrates just how fast an illogical market can be brought back to reality:

Now a growing number of reach-for-yield investors are finding that not only are they down on their bets but they can’t get at their capital. Also from today’s Bloomberg:

Leave A Comment