In the past few months, I’ve show you how I determine which stocks to trade options on and how to select which options have the best chance at giving you a 100% return.

As I told you, finding a stock that’s going to make a move is key. Stocks that trade sideways are fine for non-directional trades, but I’m a directional trader. I like to predict which way a stock will move, and by how much, then start trading options accordingly.

As important as it is to find a stock that moves, it’s even more important to make sure that your option is going to move when the stock does.

So how can you find out ahead of time if your options are going to make a move in price? There’s only one number you need to know.

Let me show you what I mean…

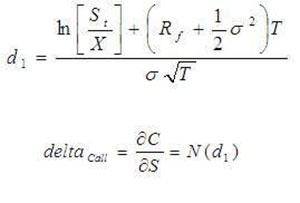

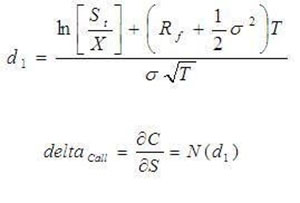

All you have to do to find the one number that will tell you how an option will move is master this formula:

C = Value of the call option

St = Current value of underlying asset

N(d1) = Rate of change of the option price with respect to the price of the underlying asset

T = Option life as a percentage of year

ln = Natural log of

Rf = Risk-free rate of return

Simple, right? Luckily, your broker will do all that for you. Here’s what you need to know…

This formula is used to calculate “delta.”

Delta is one of the options “Greeks” that comprise an option’s premium or value. It is considered by many to be the most important component of an option.

Delta can be used in a couple of different ways when you’re trading options. I’ll show you both of those and illustrate how paying attention to delta can help you when determining which option to buy.

But first…

What Is Delta?

In simple terms, delta is a numerical value given to each option that shows how much that option’s premium will move with the next $1 move in the stock.

Deltas are either a positive number (for calls) or a negative number (for puts). Call options will have a value of anywhere from 0 to 1.00, while a put option has a value anywhere from -1.00 to 0.

Leave A Comment