The headline residential building permits improved and construction completions were unchanged relative to last month. But we keep our eyes on the rolling averages which told us this was a weaker report than last month.

Analyst Opinion of Residential Building

The backward revisions this month were slightly upward.The nature of this industry normally has large variations from month to month (mostly due to weather) so the rolling averages are the best way to view this series – and it shows permits rate of growth slowing and completions rate of growth unchanged.

We consider this a weaker report relative to last month – and both housing starts and completions are in contraction year-over-year.

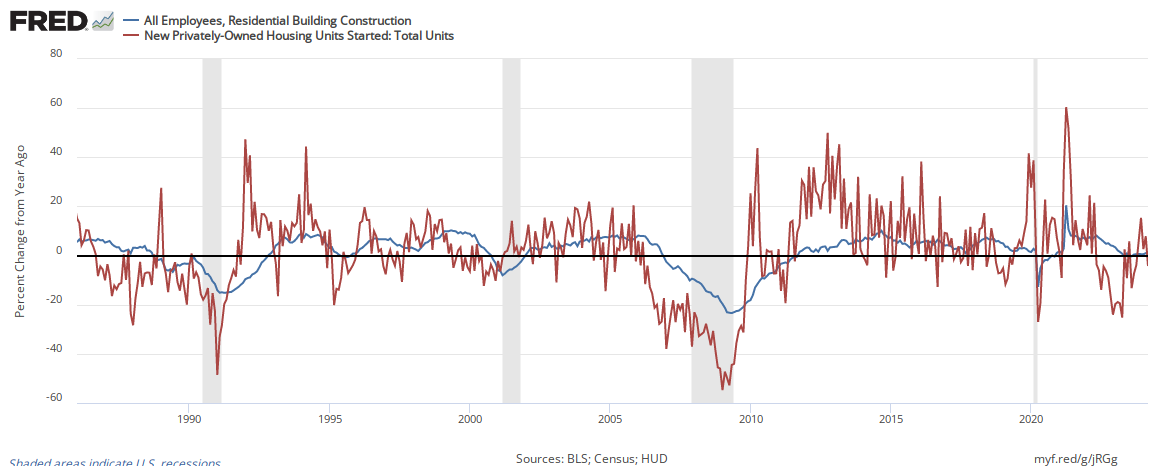

Looking at residential construction employment, the year-over-year growth of employment has a reasonable correlation with housing starts.

3 month Rolling Average for Year-over-Year Growth Unadjusted Data

Econintersect Analysis:

US Census Headlines:

Note that Econintersect analysis herein is based on UNADJUSTED data – not the headline seasonally adjusted data.

Leave A Comment