Photo Credit: Sean Davis

AutoZone Inc. (AZO) Consumer Discretionary – Specialty Retail | Reports May 24, Before Market Opens

The tide has turned on retail earnings. Poor earnings of the past month are slowly turning intto strong beats in the past few days . This week retailers including DSW Shoes, AutoZone and Costco hope to continue this trend. Lately, AutoZone has been a bright spot in the retail sector. The company which is best known as one of the largest retailers of aftermarket auto parts has been on a tear of late. Earnings have seen double digit gains in each of the past 8 quarters while sales have maintained high single digit growth over the same time frame. Expectations are generally high ahead of AutoZone’s third quarter results this Tuesday.

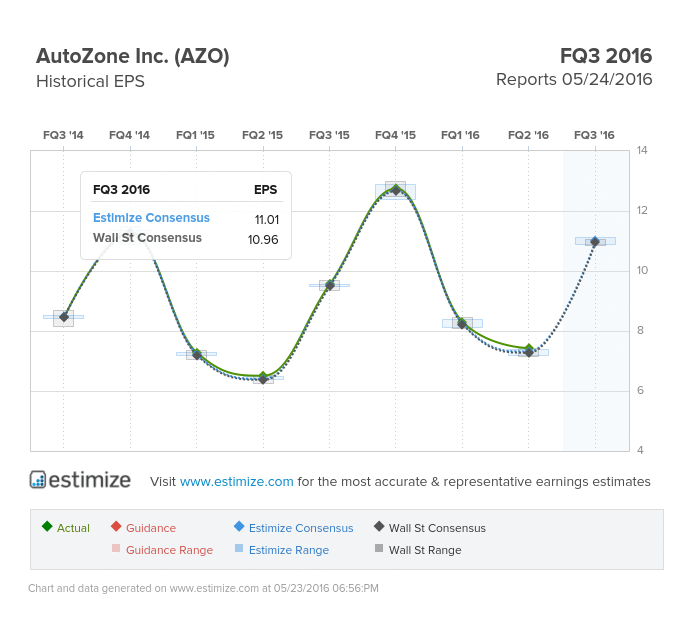

The Estimize consensus is calling for earnings per share $11.01 on $2.66 billion in revenue, 5 cents higher than Wall Street on the bottom line and $8 million on the top. Compared to a year earlier this reflects a 15% increase in earnings with sales expected to grow by 6%. Strong earnings have contributed to the success in the stock. Shares are up 10% in the past 12 months.

AutoZone’s focus on expanding stores and growing same store sales continues to pay off. Last quarter featured a 3.6% increase in same store sales coupled with improvements in net income, revenue and gross margins. A large portion of its growth has been driven by success in both the retail and commercial businesses combined with increasing store counts and regular buybacks. In Q2, Autozone opened 30 new stores in the U.S. and 9 in Mexico, adding to the 5,600 stores in operation.

That said, Autozone should expect to see expenses rise as it plans to open 2-3 new distribution centers over the next three years. They also continue to see increasing competition from Advanced Autoparts, Pepboys and even Walmart and Costco. Walmart and Costco’s business as a one stop shop for all consumer needs might deter traffic to a highly focused store like AutoZone.

Leave A Comment