There are some things that have happened in real life which, had you told someone not that far in the past, they would find it incredible. And I mean “incredible” in the literal sense – not credible – impossible – beyond belief. Not simply “gosh, gee whiz.”

For instance, teleport yourself back to the sprawling Sun Microsystems campus in the summer of 2000. Announce to the thousands of Sun employees gathered around you that a high school kid is going to write a web site, and the company based around that web site will become much, much larger than Sun Microsystems. Also mention to them that their organization won’t even exist in a few years, and the high schooler’s company will occupy not only their entire campus, but will need to build an entire city next to that complex to support all its employees.

They wouldn’t believe you, of course. But you know better, because you know the high school student Mark Zuckerberg would, in just a few years, create Facebook, and that Sun would be laid waste (not by FB, but just by the nature of change).

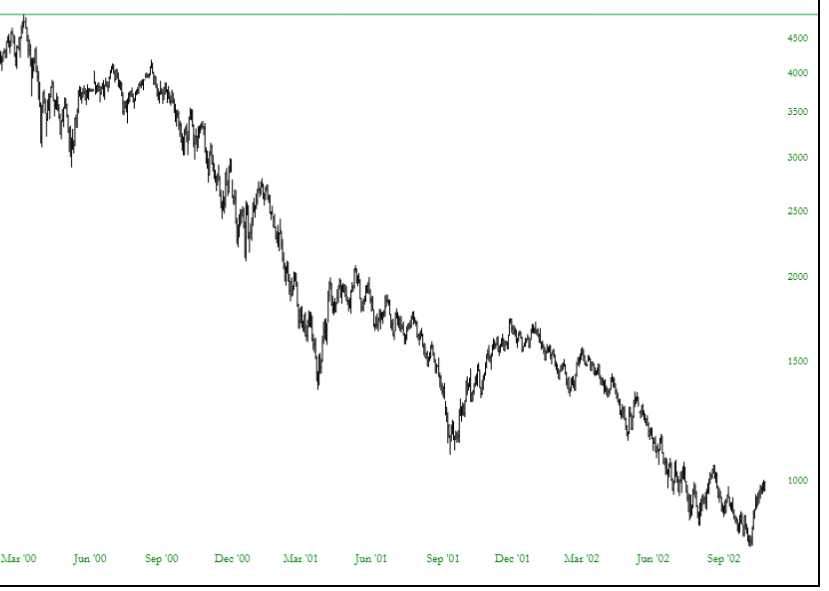

So let’s use this as the basis to me to show you this chart:

Perhaps it looks familiar to you. It is the Nasdaq from March 2000 through October 2002. During that time, it lost almost its entire value.

Many traders these days would find that hard to believe. Absolutely incredible. The difference, of course, is that our time traveling exercise with my Sun/Facebook fantasy is one thing, whereas modern-day traders know that, yes, historically, a Nasdaq bear market honestly did take place.

All the same, though, eight solid years of The Government Will Never Permit a Bear Market policy has surely beaten the notion of a bear market out of the heads of many traders. A persistent down market seems like fiction. Fantasy. Unreal. If the above chart weren’t grounded in reality, few would think such a thing possible.

Leave A Comment