Writing about blockchain and bitcoin right now is a little like buying a new computer in the 1990s. The tech was advancing so fast in those days that as soon as you brought the thing home, it was sorely outdated. Similarly, the cryptocurrency world is changing so rapidly at the moment that even before “the ink dries” on one of my posts, some important new development has already surfaced.

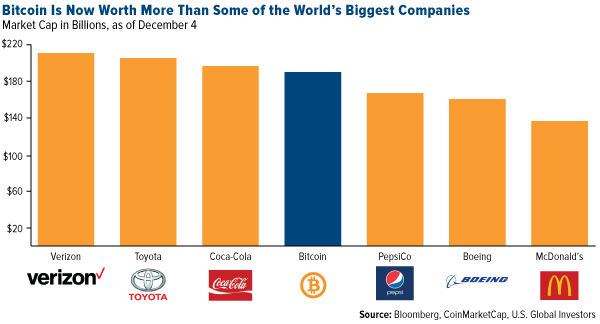

Case in point: When Bloomberg ran a particular story last Monday—““—bitcoin’s market cap hovered just above $185 billion, making it worth more than the likes of PepsiCo, Boeing and McDonald’s.

Well, here it is a week later, and this chart is already outdated. As of Monday morning, bitcoin’s market cap topped $275 billion, bringing its total value comfortably above Coca-Cola, Toyota, and Verizon (and now Bank of America, Walmart, Procter & Gamble, Pfizer, AT&T and Chevron). Next stop is Alphabet, which had a market cap of $288 billion at the end of the third quarter.

Or consider this: In May 2011, an early bitcoin investor named Greg Schoen tweeted his regret that he sold at $0.30, as the currency had then risen to $8.00 apiece.

Obviously, we’ve seen earth-shattering appreciation since then. As of my writing this, bitcoin has breached the $17,000 level, up nearly 5.6 million percent—yes, you read that right, 5,600,000 percent—from our friend Greg’s exit point in 2011.

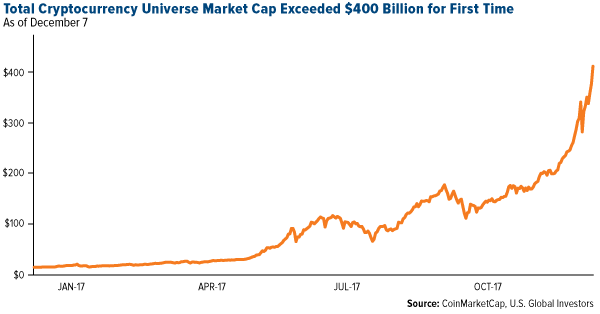

Bitcoin, of course, is just the largest fish in the entire universe of cryptocurrencies, which now number somewhere in the vicinity of 1,340, according to CoinMarketCap. If we combine the total market cap of all “altcoins” Monday morning, the amount exceeded $440 billion. That’s larger than the economies of Thailand, Nigeria, and Austria. As of my writing this, as many as 15 coins had market caps over $2 billion.

Coinbase Now Has More Accounts Than Charles Schwab

This meteoric growth has attracted not just retail investors but also, inevitably, regulators. San Francisco-based Coinbase, which allows users to trade digital currencies, now boasts more active users than fellow San Francisco-based Charles Schwab, the second biggest brokerage firm following Fidelity. As of December 1, Coinbase had 13 million accounts, Schwab 10.6 million.

Contributing to Coinbase’s attractiveness is the ease with which someone can join. Whereas it can take up to two weeks to create a Schwab account, a Coinbase account can be opened in mere minutes, and as effortlessly as a Tinder account. This is one of the many reasons why both the popular online trading platform and dating service appeal to millennials.

According to Coinbase, as much as $50 billion have been traded on its platform since its inception, but as the number of accounts grows, we’ll likely see this dollar figure surge exponentially. This is the effect of Metcalf’s law, which I featured in an earlier post and discussed with SmallCapPower during the Mines and Money conference in London last month.

Leave A Comment