Talk of a pre-Santa Claus rally, market correction have yet to materialize but the same can be said of the rally itself. Yesterday, the stock market remained in same static mode. FreepikWednesday the S&P 500 closed at 4,551, down 4 points, the Dow closed at 35,430, up 13 points. and the Nasdaq Composite closed at 14,258, down 23 points.

FreepikWednesday the S&P 500 closed at 4,551, down 4 points, the Dow closed at 35,430, up 13 points. and the Nasdaq Composite closed at 14,258, down 23 points. Chart: The New York TimesMost actives were led by Tesla (TSLA) down 1%, followed by Ford (F), up 2.1% and PG&E (PCG) down 1.9%.

Chart: The New York TimesMost actives were led by Tesla (TSLA) down 1%, followed by Ford (F), up 2.1% and PG&E (PCG) down 1.9%. Chart: The New York TimesIn morning futures trading, S&P 500 Market futures are up 8 points, Dow market futures are trading up 157 points and Nasdaq 100 market futures are trading up 35 points.TalkMarket contributors share thoughts about the state of the market, corporate earnings and prospects of a 2024 downturn/recession.Contributor Marc Lichtenfeld writes Why We Won’t See A Stock Market Crash Anytime Soon.”On Thanksgiving, I was speaking with a relative’s friend, who was new to our Thanksgiving table this year. He is a full-time real estate investor, and he seemed to be very successful.With real estate prices surging nearly everywhere, I asked him how he’s approaching new investments. He told me he’s sitting on the sidelines.“Everything is going to crash,” he replied. “Real estate, stocks, everything.”When I pressed him on why he thinks so, he told me, “Inflation is too high, mortgages are too high and unemployment is too high.”I couldn’t argue with him about mortgages. After years of ultra-low interest rates, a 7.5% mortgage feels very high, especially combined with inflated housing prices.And while inflation is coming down significantly, our guest still had a point: That decline isn’t providing much relief. Lower inflation simply means prices are rising at a slower pace. It doesn’t mean prices are coming down. (Now, energy prices have fallen recently, but I don’t expect that to last.)I was stumped by his statement that unemployment is too high, though. There are plenty of things that aren’t going well in the United States right now. Unemployment is not one of them…Perhaps our guest was referring to the fact that the number of new jobs being created is dropping. As we came out of the pandemic in 2021, more than 600,000 jobs were being created each month. Last year, the number was 400,000. This year, it’s fallen again to an average of 239,000 jobs added per month, including just 150,000 in October.So nearly anyone who wants a job can get one, and with wages increasing, workers are getting paid more.

Chart: The New York TimesIn morning futures trading, S&P 500 Market futures are up 8 points, Dow market futures are trading up 157 points and Nasdaq 100 market futures are trading up 35 points.TalkMarket contributors share thoughts about the state of the market, corporate earnings and prospects of a 2024 downturn/recession.Contributor Marc Lichtenfeld writes Why We Won’t See A Stock Market Crash Anytime Soon.”On Thanksgiving, I was speaking with a relative’s friend, who was new to our Thanksgiving table this year. He is a full-time real estate investor, and he seemed to be very successful.With real estate prices surging nearly everywhere, I asked him how he’s approaching new investments. He told me he’s sitting on the sidelines.“Everything is going to crash,” he replied. “Real estate, stocks, everything.”When I pressed him on why he thinks so, he told me, “Inflation is too high, mortgages are too high and unemployment is too high.”I couldn’t argue with him about mortgages. After years of ultra-low interest rates, a 7.5% mortgage feels very high, especially combined with inflated housing prices.And while inflation is coming down significantly, our guest still had a point: That decline isn’t providing much relief. Lower inflation simply means prices are rising at a slower pace. It doesn’t mean prices are coming down. (Now, energy prices have fallen recently, but I don’t expect that to last.)I was stumped by his statement that unemployment is too high, though. There are plenty of things that aren’t going well in the United States right now. Unemployment is not one of them…Perhaps our guest was referring to the fact that the number of new jobs being created is dropping. As we came out of the pandemic in 2021, more than 600,000 jobs were being created each month. Last year, the number was 400,000. This year, it’s fallen again to an average of 239,000 jobs added per month, including just 150,000 in October.So nearly anyone who wants a job can get one, and with wages increasing, workers are getting paid more. PixabayThat doesn’t feel crashy to me.No doubt, shoppers are looking for bargains and for ways to cut spending with prices higher than they were last year. We’ll see soon where holiday retail sales come in. That could be a good signal of the health of the consumer in 2024.There are a lot of moving parts that affect the economy and markets, but as long as unemployment stays very low, I have a hard time envisioning “everything” crashing…Since 1957, the S&P 500 has returned an average of 10.7% annually with dividends reinvested. That’s a very solid return and includes many crashes, such as the COVID-19 crash in March 2020, the global financial crisis from 2007 to 2009, the dot-com crash at the beginning of the century, the 1987 crash, etc.Away to avoid fearing a crash is to take any money out of the market that you’ll need within around three years. This way, your long-term money will still be invested and growing while the funds you’ll need in the short term to pay bills will be protected.”TM contributor Tim Knight looks at the fork in the road between US equity markets and Chinese equity markets in Diverging Paths: Dow Hits Record High, While China’s Equity Market Crumbles.”Well here’s quite the contrast. Below is the DIA (the Dow Industrials), which is at the highest price level in the history of the universe.

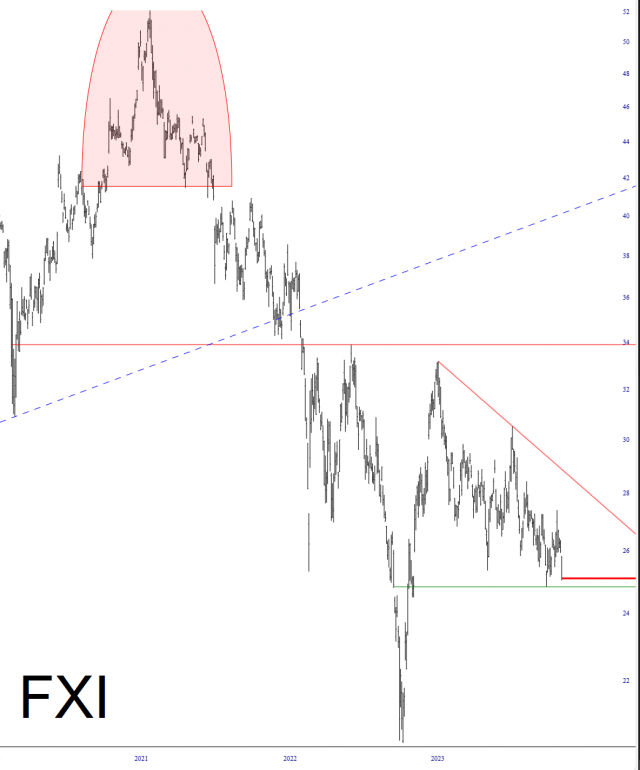

PixabayThat doesn’t feel crashy to me.No doubt, shoppers are looking for bargains and for ways to cut spending with prices higher than they were last year. We’ll see soon where holiday retail sales come in. That could be a good signal of the health of the consumer in 2024.There are a lot of moving parts that affect the economy and markets, but as long as unemployment stays very low, I have a hard time envisioning “everything” crashing…Since 1957, the S&P 500 has returned an average of 10.7% annually with dividends reinvested. That’s a very solid return and includes many crashes, such as the COVID-19 crash in March 2020, the global financial crisis from 2007 to 2009, the dot-com crash at the beginning of the century, the 1987 crash, etc.Away to avoid fearing a crash is to take any money out of the market that you’ll need within around three years. This way, your long-term money will still be invested and growing while the funds you’ll need in the short term to pay bills will be protected.”TM contributor Tim Knight looks at the fork in the road between US equity markets and Chinese equity markets in Diverging Paths: Dow Hits Record High, While China’s Equity Market Crumbles.”Well here’s quite the contrast. Below is the DIA (the Dow Industrials), which is at the highest price level in the history of the universe. And here is China, by way of the symbol F, which continues to crumble and is worth HALF, yes HALF, what it was at the start of last year.

And here is China, by way of the symbol F, which continues to crumble and is worth HALF, yes HALF, what it was at the start of last year. China’s economy, by the way, has blown the DOORS off our own. But, for whatever reason, their equity market stinks. Is it because Communism can’t be trusted? Because the rule of law really doesn’t apply inside China? Maybe. It’s just interesting to know that the two top dogs in the global economy have some wildly different outcomes.”With regards to corporate earnings TalkMarkets contributor Sheraz Mian is Looking Ahead To Q4 Earnings.

China’s economy, by the way, has blown the DOORS off our own. But, for whatever reason, their equity market stinks. Is it because Communism can’t be trusted? Because the rule of law really doesn’t apply inside China? Maybe. It’s just interesting to know that the two top dogs in the global economy have some wildly different outcomes.”With regards to corporate earnings TalkMarkets contributor Sheraz Mian is Looking Ahead To Q4 Earnings.

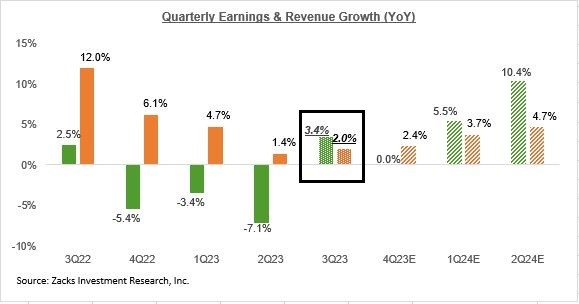

Image Source: Zacks Investment ResearchThis is a bigger decline in quarterly estimates compared to what we had seen in the comparable periods to either of the preceding two quarters. This is a reversal of the favorable revisions trend we have spotlighted in this space since April 2023.Not only is there a bigger magnitude of cuts to Q4 estimates, but the pressure is also widespread, with estimates for 12 of the 16 Zacks sectors getting cut since the start of October. The biggest cuts to estimates have been for the Autos, Medical, Consumer Discretionary, Transportation, and Basic Materials sectors…The chart below shows the overall earnings picture on a quarterly basis.

Image Source: Zacks Investment ResearchThis is a bigger decline in quarterly estimates compared to what we had seen in the comparable periods to either of the preceding two quarters. This is a reversal of the favorable revisions trend we have spotlighted in this space since April 2023.Not only is there a bigger magnitude of cuts to Q4 estimates, but the pressure is also widespread, with estimates for 12 of the 16 Zacks sectors getting cut since the start of October. The biggest cuts to estimates have been for the Autos, Medical, Consumer Discretionary, Transportation, and Basic Materials sectors…The chart below shows the overall earnings picture on a quarterly basis. Image Source: Zacks Investment ResearchAs you can see from these quarterly earnings-growth expectations, the long-feared recession doesn’t appear in this near-term earnings outlook…The big-picture view of corporate profitability doesn’t leave much room for that development either. However, we know that macroeconomic growth is moderating, which should have a negative impact on estimates. We showed earlier how estimates for the current and coming periods have started coming down lately, a trend that will most likely remain in place for some time.”Contributor Katya Stead takes a stab at Dissecting 2024 Forecasts From Financial Giants.”JPMorgan prophesies gloom this time next year Disregarding the prevailing optimism, JPMorgan (JPM) foresees a looming shadow of uncertainty in the upcoming year. The report, initiated with observations about market sentiments leaning towards a soft landing due to steady activity and declining inflation, asserts a more cautious stance. It predicts a potential decline in the S&P 500 index by nearly 8% in the next year, envisaging its valuation of around 4,500 by the end of 2024.Goldman SachsHowever, this stark prediction diverges sharply from Goldman Sachs’ (GS) contrasting viewpoint, as outlined in their ‘All you had to do was stay’ report, published on November 21st. Goldman Sachs forecasts a bullish scenario, envisioning the S&P 500 to reach around 4,700 by the close of 2024, marking a 5% increase over the year.Their rationale hinges on the belief that a steady U.S. economic expansion, coupled with an absence of recession, could lead to a 5% surge in earnings and an equity market valuation of around 18x, akin to the current P/E level.Wells FargoIn a more balanced perspective, Wells Fargo, in their report released on November 27th, strikes a middle ground between JPMorgan’s caution and Goldman Sachs’ optimism. Terming 2024 as a potential “soft patch”, Wells Fargo acknowledges the U.S. economy’s deceleration while maintaining a more defensive stance.Their outlook emphasizes quality investments, stating an S&P 500 index range of 4600-4800, with an earnings target of $220. This projection exceeds JPMorgan’s pessimistic forecast yet offers a broader range surpassing even Goldman Sachs’ 4700 estimate.”Contributor Dorothy Neufeld prepared a chart on Recession Risk: Which Sectors Are Least Vulnerable?.n the context of a potential recession, some sectors may be in better shape than others.They share several fundamental qualities, including:

Image Source: Zacks Investment ResearchAs you can see from these quarterly earnings-growth expectations, the long-feared recession doesn’t appear in this near-term earnings outlook…The big-picture view of corporate profitability doesn’t leave much room for that development either. However, we know that macroeconomic growth is moderating, which should have a negative impact on estimates. We showed earlier how estimates for the current and coming periods have started coming down lately, a trend that will most likely remain in place for some time.”Contributor Katya Stead takes a stab at Dissecting 2024 Forecasts From Financial Giants.”JPMorgan prophesies gloom this time next year Disregarding the prevailing optimism, JPMorgan (JPM) foresees a looming shadow of uncertainty in the upcoming year. The report, initiated with observations about market sentiments leaning towards a soft landing due to steady activity and declining inflation, asserts a more cautious stance. It predicts a potential decline in the S&P 500 index by nearly 8% in the next year, envisaging its valuation of around 4,500 by the end of 2024.Goldman SachsHowever, this stark prediction diverges sharply from Goldman Sachs’ (GS) contrasting viewpoint, as outlined in their ‘All you had to do was stay’ report, published on November 21st. Goldman Sachs forecasts a bullish scenario, envisioning the S&P 500 to reach around 4,700 by the close of 2024, marking a 5% increase over the year.Their rationale hinges on the belief that a steady U.S. economic expansion, coupled with an absence of recession, could lead to a 5% surge in earnings and an equity market valuation of around 18x, akin to the current P/E level.Wells FargoIn a more balanced perspective, Wells Fargo, in their report released on November 27th, strikes a middle ground between JPMorgan’s caution and Goldman Sachs’ optimism. Terming 2024 as a potential “soft patch”, Wells Fargo acknowledges the U.S. economy’s deceleration while maintaining a more defensive stance.Their outlook emphasizes quality investments, stating an S&P 500 index range of 4600-4800, with an earnings target of $220. This projection exceeds JPMorgan’s pessimistic forecast yet offers a broader range surpassing even Goldman Sachs’ 4700 estimate.”Contributor Dorothy Neufeld prepared a chart on Recession Risk: Which Sectors Are Least Vulnerable?.n the context of a potential recession, some sectors may be in better shape than others.They share several fundamental qualities, including:

With this in mind, the below chart looks at the sectors most resilient to recession risk and rising costs, using data from Allianz Trade. Generally speaking, the retail sector has been shielded from recession risk and higher prices. In 2023, accelerated consumer spending and a strong labor market has supported retail sales, which have trended higher since 2021. Consumer spending makes up roughly two-thirds of the U.S. economy.Sectors including chemicals and pharmaceuticals have traditionally been more resistant to market turbulence, but have fared worse than others more recently.In theory, sectors including construction, metals, and automotives are often rate-sensitive and have high capital expenditures. Yet, what we have seen in the last year is that many of these sectors have been able to withstand margin pressures fairly well in spite of tightening credit conditions.”See the full article for additional reporting on sector fundamentals and the impact of corporate profits.Closing out the column in the “Where To Invest Department” TM contributor Yashwardhan Jain looks at some ETFs In Focus As Buffett’s Cash Surge Indicates A Likely Recession.”According to Steve Hanke, as quoted on Business Insider, Berkshire Hathaway’s increasing cash reserves indicate the possibility that ‘The Oracle of Oklahoma’ is bracing for a projected economic downturn or even a recession, waiting to strategically take advantage of the slump…Economists at Deutsche Bank expect a mild recession in the first half of 2024, stemming from the U.S. economy consecutively contracting in the first two quarters of 2024 and weakening economic indicators.However, even with projecting a “mild recession” in the first half of 2024, Deutsche Bank estimates that the S&P 500 Index will surge nearly 12% by the end of next year, ending 2024 at 5,100 points. According to an article in Reuters, the bank expects corporate earnings to remain robust even in the face of an economic slump in early 2024.According to EY, the probability of the U.S. economy sliding into a recession in 2024 is around 50%. However, the economy is expected to experience tailwinds from non-inflationary growth driven by a strong labor market, a resilient consumer base, and enhanced productivity.

Generally speaking, the retail sector has been shielded from recession risk and higher prices. In 2023, accelerated consumer spending and a strong labor market has supported retail sales, which have trended higher since 2021. Consumer spending makes up roughly two-thirds of the U.S. economy.Sectors including chemicals and pharmaceuticals have traditionally been more resistant to market turbulence, but have fared worse than others more recently.In theory, sectors including construction, metals, and automotives are often rate-sensitive and have high capital expenditures. Yet, what we have seen in the last year is that many of these sectors have been able to withstand margin pressures fairly well in spite of tightening credit conditions.”See the full article for additional reporting on sector fundamentals and the impact of corporate profits.Closing out the column in the “Where To Invest Department” TM contributor Yashwardhan Jain looks at some ETFs In Focus As Buffett’s Cash Surge Indicates A Likely Recession.”According to Steve Hanke, as quoted on Business Insider, Berkshire Hathaway’s increasing cash reserves indicate the possibility that ‘The Oracle of Oklahoma’ is bracing for a projected economic downturn or even a recession, waiting to strategically take advantage of the slump…Economists at Deutsche Bank expect a mild recession in the first half of 2024, stemming from the U.S. economy consecutively contracting in the first two quarters of 2024 and weakening economic indicators.However, even with projecting a “mild recession” in the first half of 2024, Deutsche Bank estimates that the S&P 500 Index will surge nearly 12% by the end of next year, ending 2024 at 5,100 points. According to an article in Reuters, the bank expects corporate earnings to remain robust even in the face of an economic slump in early 2024.According to EY, the probability of the U.S. economy sliding into a recession in 2024 is around 50%. However, the economy is expected to experience tailwinds from non-inflationary growth driven by a strong labor market, a resilient consumer base, and enhanced productivity. FreepikInvestors can look at the below-mentioned funds and hedge themselves from the possibilities of an economic slump by increasing their exposure to the mentioned sectors…Consumer Staples Select Sector SPDR Fund (XLP)The sector includes food and beverages, household and personal products among other essential products used by a consumer. It is considered a defensive industry and may play its part in helping to withstand a recession. These products see steady demand even during an economic downturn due to their low level of correlation with economic cycles.Consumer Staples Select Sector SPDR Fund has a basket of 38 securities and has amassed an asset base of $15.62 billion. The fund charges an annual fee of 0.10% while having a dividend yield of 2.68%.Consumer Staples Select Sector SPDR Fund has an exposure of 98.92% in large-cap securities proving further security and has allocated about 68.58% of its assets to consumer non-durables.Health Care Select Sector SPDR ETF (XLV)The healthcare sector is non-cyclical in nature, providing a defensive tilt to the portfolio amid market turmoil. Further, the long-term fundamentals remain strong, given encouraging industry trends.Health Care Select Sector SPDR ETF has a basket of 64 securities and has gathered an asset base of $36.58 billion. The fund charges an annual fee of 0.10%.Health Care Select Sector SPDR ETF has an exposure of 97.63% in large-cap securities proving further security.Utilities Select Sector SPDR Fund (XLU)Being a low-beta sector, utility is relatively protected from large swings (ups and downs) in the stock market and is thus, considered a defensive investment or a safe haven amid economic or political turmoil.Utilities Select Sector SPDR Fund has a basket of 30 securities and has gathered an asset base of $13.61 billion. The fund charges an annual fee of 0.10% while having a dividend yield of 3.37%.Utilities Select Sector SPDR Fund has an exposure of 92.79% in large-cap securities proving further security and has allocated about 65.64% of its asset to electric utilities.”As always, Caveat Emptor!Have a good one.Peace.More By This Author:Tuesday Talk: A Pause Before The Santa Claus Rally

FreepikInvestors can look at the below-mentioned funds and hedge themselves from the possibilities of an economic slump by increasing their exposure to the mentioned sectors…Consumer Staples Select Sector SPDR Fund (XLP)The sector includes food and beverages, household and personal products among other essential products used by a consumer. It is considered a defensive industry and may play its part in helping to withstand a recession. These products see steady demand even during an economic downturn due to their low level of correlation with economic cycles.Consumer Staples Select Sector SPDR Fund has a basket of 38 securities and has amassed an asset base of $15.62 billion. The fund charges an annual fee of 0.10% while having a dividend yield of 2.68%.Consumer Staples Select Sector SPDR Fund has an exposure of 98.92% in large-cap securities proving further security and has allocated about 68.58% of its assets to consumer non-durables.Health Care Select Sector SPDR ETF (XLV)The healthcare sector is non-cyclical in nature, providing a defensive tilt to the portfolio amid market turmoil. Further, the long-term fundamentals remain strong, given encouraging industry trends.Health Care Select Sector SPDR ETF has a basket of 64 securities and has gathered an asset base of $36.58 billion. The fund charges an annual fee of 0.10%.Health Care Select Sector SPDR ETF has an exposure of 97.63% in large-cap securities proving further security.Utilities Select Sector SPDR Fund (XLU)Being a low-beta sector, utility is relatively protected from large swings (ups and downs) in the stock market and is thus, considered a defensive investment or a safe haven amid economic or political turmoil.Utilities Select Sector SPDR Fund has a basket of 30 securities and has gathered an asset base of $13.61 billion. The fund charges an annual fee of 0.10% while having a dividend yield of 3.37%.Utilities Select Sector SPDR Fund has an exposure of 92.79% in large-cap securities proving further security and has allocated about 65.64% of its asset to electric utilities.”As always, Caveat Emptor!Have a good one.Peace.More By This Author:Tuesday Talk: A Pause Before The Santa Claus Rally

Tuesday Talk: Thanksgiving Week

Thoughts For Thursday: The Market Is Firming Higher, Tread Carefully

Leave A Comment