The energy sector is a tricky place to invest right now, with a fine line separating the next bankruptcy candidate from a tenbagger. Chen Lin of the popular newsletter What Is Chen Buying?, What Is Chen Selling? helps investors navigate this minefield with three companies he believes will come out on top.

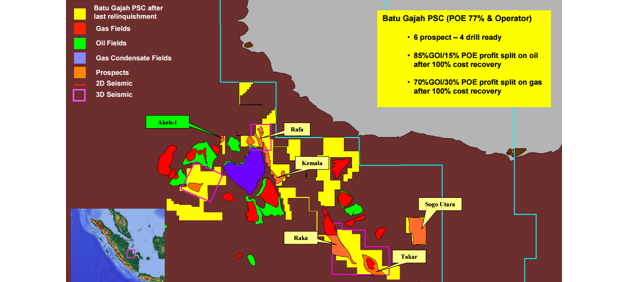

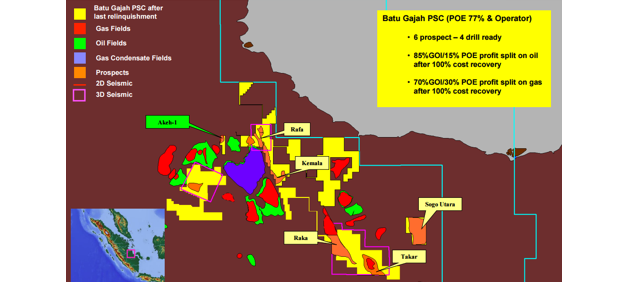

Pan Orient’s Batu Gajah, Indonesia

The recent news of Pacific Exploration and Exploration Corp. (PRE:TSX) offers fresh reminder to energy investors how dangerous the investment field of energy stocks can be. When a company goes to bankruptcy, in most cases shareholders get wiped out. Your shares, no matter how low the cost basis is, are worth zero! Recently, the day traders have been chasing “trash” stocks, stocks that are heavily in debt and close to bankruptcy. Every long-term investor needs to double and triple check reality before putting his/her hard-earned money into these names. You need to make sure your companies can “make it” first.

The problem I see is that many heavily indebted energy companies really depend on the market, or a higher oil price, in order to survive bankruptcy. If you invest in a few of these companies, you will need to check the oil price every day and night. That’s why I have been advocating that investors put money in companies with strong balance sheets and strong free cash flows. These types of companies not only offer great upside with minimum risks, they can also take advantage of the downturn and come out as winners.

Pan Orient Energy Corp. (POE:TSX.V)(POEFF) is at the top of my list. At the current share price of CA$1.10, if you can hold on to the stock for at least one year, I believe there is almost no downside. Let me explain why. The company is in the process of selling off assets and returning cash to its shareholders. It just distributed CA$0.40 back to the shareholders this year. Not long ago it distributed another CA$0.75 to shareholders.

Right now Pan Orient has about CA$0.80–CA$0.90/share in cash and no debt. It has been in the process of selling all of its assets in Canada, Thailand and Indonesia, except for the one that Talisman Energy Inc. (now part of Repsol Oil & Gas) will pay for and drill in Q4/16. With the rebound of oil, the interest in buying oil assets worldwide has been on the rise. If Pan Orient can successfully sell the assets during 2016, I can see its cash balance increase to around CA$2/share by the end of 2016.

Leave A Comment