Graham’s Musings: What is more remarkable; the fact that anyone would still fall for the idea of inflation protected securities or that alleged ‘professionals’ and ‘experts’ in the financial community would continue to push the notion that the US Government can continue to rack up debt continuously without consequence? I have never in my entire career seen such delusion.

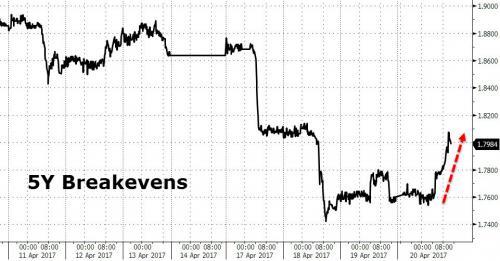

As RBC’s head of cross asset strategy remarked yesterday, a key validation of whether the reflation trade may be coming back, was the market’s response to remarked yesterday, which priced at 1pm.

So those looking for confirmation that the reflation trade has at least another life left in it, will be glad to know that today $16.0 billion 5-year TIPS auction this afternoon went especially well, in line with all of last year’s TIPS auctions, and the cherry on top was a record buyside takedown suggesting that at least for now, bidders believe that reflationary forces remain.

The auction stopped at -0.049%, which was firmly through the 1:00 p.m. bid side of around -0.026%, resulting in a 1/8% coupon for the issue. The 2.52 bid/cover was also strong, and the buyside takedown figures were tremendous. Both the Indirect and Direct bidder takedown figures were strong, and the combined buyside takedown (Indirect + Direct bidders) was a record 83.3%.

Indirect bidders were also strong, in with a $14.745 billion bid for the issue today, which is the largest since August 2015, and that bid was also aggressive enough to generate a 74.2% Indirect bidder takedown. That is a record for new issues, and is the second largest overall, behind only the 76.4% takedown in August 2015. The strength of the Indirect bid correlates very strongly with the strength of investment fund demand.

The Direct bid was also good this month. The $2.004 billion size of the bid wasn’t anything out of the ordinary, but it was a much more aggressive bid than typical, judging by the well above average hit ratio, leading to a 9.2% takedown. That is the largest Direct bidder takedown since December 2013. The strength of the Direct bid has a more mixed relationship with the strength of foreign demand.

Leave A Comment