By now it is clear to even the most tenured economists that the half of the US economy, the one that deals with manufacturing and industrial production, is sliding into, if not already, in recession with today’s contractionary Chicago PMI and subzero Dallas Fed data confirming this deterioration.

But while the NBER is notoriously behind the curve when it comes to determining the onset of recessions, the market may have already spoken, and nowhere louder than in the collapse of corporate cash flow generation. This collapse in EBITDA is also what we cautioned three weeks ago is

the biggest risk facing the economy.

This drop in cash flow is also one of the key catalysts listed by JPM in its report (noted earlier) which said it is time to lower allocation to US equity exposures as “the long period of indiscriminately buying any dip might be coming to an end.”

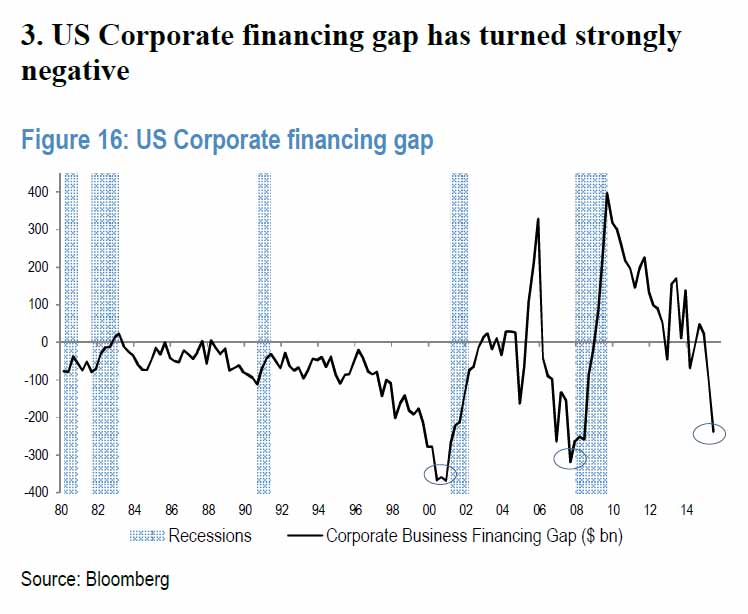

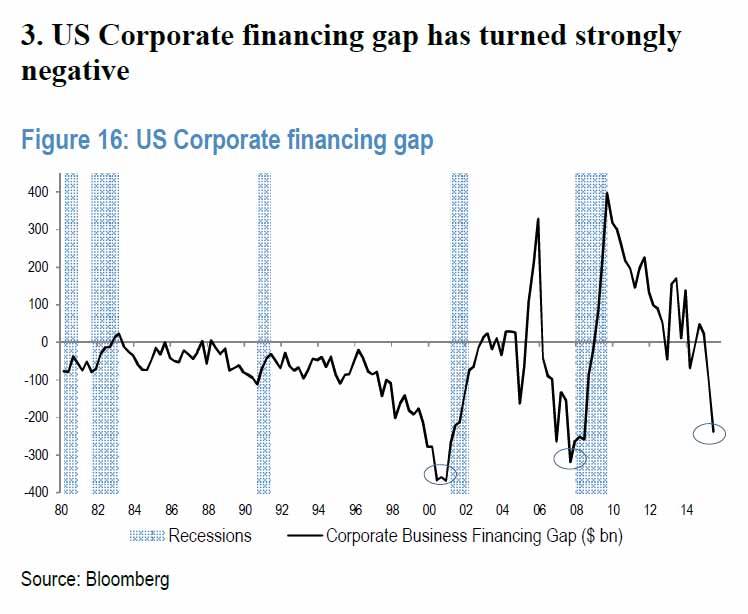

Specifically, JPM looks at the corporate financing gap, the difference between organic cash flow and the outflow on dividends and buybacks, and is very concerned with what it sees.

The current deterioration in the credit market is particularly worrying at a time when corporates are becoming more and more dependent on external sources of liquidity. The US corporate financing gap – the difference between cash flow generation and spending on capex and dividends – has turned strongly negative. In the past, when the financing gap went strongly negative, the next downturn was just around the corner.

And here is the chart which JPM believes suggests the next downturn may be “just around the corner.”

Will it be different this time? Here JPM is pessimistic again, for the simple reason that any attempts to extrapolate profit margins, the lifeblood of corporate cash flows, suggests that much more pain is ahead: “If we were to perform a simple modelling of NIPA margins, using as inputs the unemployment rate, wages and nominal GDP growth, we get as a result a clear deceleration in profit margins next year.”

Leave A Comment