So far “Triple Threat Thursday” has been a dud. In the day with the greatest concentration of market-moving risk events so far in 2017, market action – at least for the time being – has been a whimper, with European stocks and US futures modestly higher ahead of the ECB’s rate decision and Comey’s testimony (which has now been fully publicized, removing much of the risk), as the U.K. voting is underway. Asian stocks fell led by a decline in Japan as the yen first strengthened, only to tumble later in the session. The Dollar is little changed while oil recovered from the steepest decline in more than a year Wednesday, while U.K. government bonds led the region’s debt lower as the nation chooses its next government a general election.

A quick summary of events courtesy of the always whimsical Kit Juckes from SocGen:

The ECB is edging towards the exit from extraordinary policies, the BOJ is recalibrating its exit communication strategy, whatever that means, the US is preparing for the start of the Comey show, and the UK is going to the polls, or the dogs, or both. In the meantime, markets are pretty quiet, with bond yields globally recovering a bit, and equity market edging higher with the exception of the Nikkei.

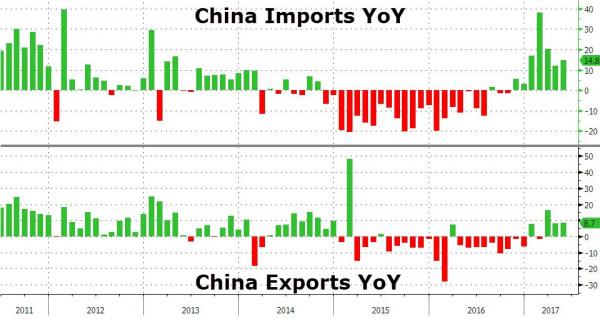

Starting in Asia, JGBs sold off aggressively and the curve bear steepened in reaction to reports of the BOJ considering future exit communications, pressuring USTs in early European trade. As USD/JPY reversed the entire knee-jerk move lower, core fixed income weakened further and the USD ground higher across G-10. European equity markets opened higher led by financials and basic resources sectors.The PBOC injected net 60 billion yuan of liquidity, weakening theCNY fixing for first time in seven days while China watchers exhaled after stronger than expected Chinese trade data gave support to industrial metals.

European stocks rose while U.S. futures edged higher before today’s event trifecta. Copper led industrial metals higher as data showed an acceleration in stronger than expected Chinese trade data while oil recouped a small portion of the more than 5 percent plunge triggered by a report showing a rise in U.S. crude stockpiles. Stock markets in London, Frankfurt and Paris were flat to 0.2% higher helped by reports of another bank rescue, this time in Italy, and energy shares as oil steadied after 5 percent drop the previous day. Italy’s bonds also cheered the banking sector talk and the pound and the euro were at $1.2937 and $1.1233 respectively, the former near a two-week high and the latter just off a seven-month high.

The big FX story of the session so far was the USDJPY which took a beating early in the session after the market was spooked by a Bloomberg article stating that the BoJ is shifting its stance on its exit strategy. The article reported that the BoJ no longer intends to reiterate that “to discuss the exit strategy is premature” and that policymakers will focus on more effective communication with the markets. “The BoJ is re-calibrating its communications to acknowledge that it is thinking about how to handle a future exit from monetary stimulus, according to people with knowledge of discussions at the central bank.” The strength lasted briefly though, and after sliding as low at 109.40, the USDJPY has since surged back over 110 and was trading at 110.10 last, as this particular trial balloon was digested and found severely lacking.

In economic data, Japan disappointed “bigly” earlier in the session when its Q1 GDP was revised to just 1.0% annualized, missing the 2.4% expected. The Japanese government’s second estimate for Jan-Mar (1Q) 2017 real GDP came in at +1.0% qoq annualized, a sharp downward revision from +2.2% in the preliminary reading. However, this was mainly attributable to inventory, and the Japanese economy still looks to be trending firmly once this volatile factor is stripped out.

This was however offset in Europe by a small beat in Europe’s GDP, which printed at 0.6%, fractionally above the 0.5% expected.

We gave a full UK election preview earlier, but for those pressed for time, here is a quick cheat sheet. For all the scenarios of a hung-parliament or Labour-led coalition, the central assumption is for a slightly increased majority for the ruling Conservatives and averaging the very diverse opinion poll projections points to the same. Spot sterling has been firm in recent days, although the jump in overnight implied volatility readings to some 30 percent – its highest since July – at least shows some pricing of possible risks over the next 24 hours.

Likewise for those curious what Draghi may do, our preview can be found here. Soundings on downgraded inflation forecasts and background trepidation about banking sector stability make it highly unlikely it will signal any major tightening of policy ahead later.

“We expect the ECB to tweak its forward guidance by dropping the easing bias on interest rates, while leaving the rest of its guidance largely unchanged, including the easing bias on asset purchases,” UniCredit said in a note.

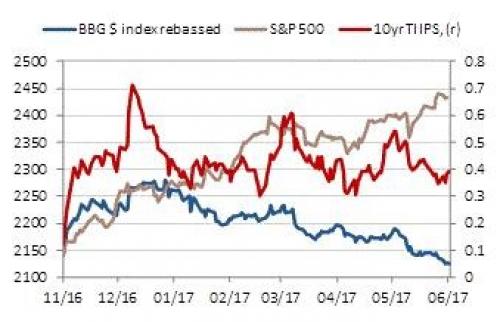

Commenting on the ECB, a somewhat bemused SocGen’s Kit Juckes notes that “it goes without saying that recalibrating a communication strategy in advance of a decision to change policy, isn’t the same as actually doing something. The BOJ meets next week and faces a -0.8% y/y GDP deflator in Q1, while the most recent core CPI reading is at zero. BOJ policy is geared to fighting deflation and as other central banks revise inflation forecasts lower, the idea that they could declare victory soon seems strange. For now, US yields – especially TIPS, are holding the lower end of rangers rather than breaking free, and we expect USD/JPY and EUR/JPY to do the same, before moving higher.”

Former FBI Director James Comey’s will be grilled by Washington politicians later over his claims that President Trump asked him to drop an investigation of former national security adviser Michael Flynn as part of a probe into Russia’s alleged meddling in the 2016 presidential election. Although it keeps pressure on Trump, Wall St markets largely shrugged it off after Wednesday’s written testimony as not toxic enough to ratchet up the threat of an impeachment.

Here is how DB’s Jim Reid saw the release of the prepared Comey remarks:

In summary the general feeling was that it failed to contain a smoking gun and markets mostly ended up ignoring it. There were mentions of Trump asking for assurances on “loyalty” and also a reference to Trump requesting “let this go” with respect to the investigation into former National Security Advisor Michael Flynn. But Comey also confirmed that he did not understand the President to be talking about the broader investigation into Russia or possible links to the campaign. The White House released a statement shortly after Comey’s testimony was released saying that the President was pleased that Comey confirmed that Trump was not under investigation in any Russian probe and also that the President “feels completely and totally vindicated”. After briefly dipping lower midway through the session the S&P 500 (+0.16%) limped to a small gain by the close suggesting that the risk premium around the event has perhaps diminished. Should that change today then it’s worth noting that President Trump may live tweet if he feels the need to respond during the testimony according to the Washington Post which could make for some entertainment.

Leave A Comment