What’s inside:

S&P 500

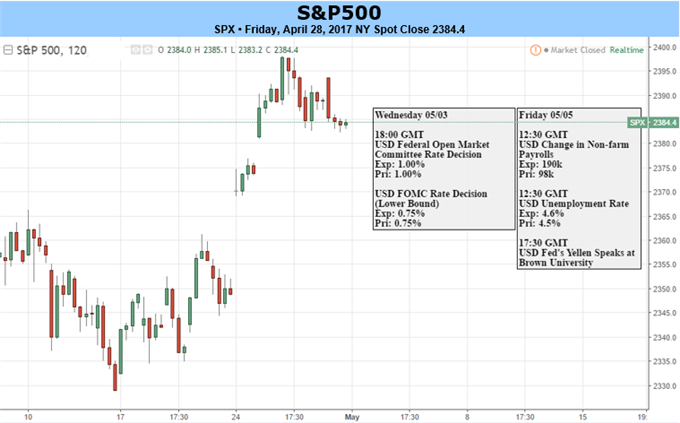

U.S. markets started off last week gapping sharply higher on the outcome of the first round of the presidential elections in France; the CAC 40 traded up over 4% on optimism of a Macron victory over Le Pen at the upcoming May 7 run-off election. Not only did the gap hold in the U.S., but the Nasdaq 100 continued notching new record highs throughout the week. The S&P 500 turned lower on Wednesday after coming just three points shy of the 2401 mark, but maintained a large chunk of the weekly gains.

Looking ahead, Monday may be relatively quiet with major financial centers in Europe closed for holiday. In terms of scheduled ‘high’ impact data events, we have Core Personal Consumption Expenditure (PCE) and ISM Manufacturing on Monday; and the big event of the week coming on Friday when the April jobs report is due out. The market will be looking for a strong rebound in NFPs (+180k estimate) after the big miss in March of only +98k. For details, see the economic calendar.

There was a minor reversal day on Wednesday from just shy of the March 1 record high, and it is still unclear if it will hold further bearish implications. The longer the market hangs out at elevated levels, though, the more likely it was only a sign of short-term exhaustion. Looking to support, not far below lies the November trend-line and April 5 high at 2378. It would require a sharp break for us to start thinking about a gap-fill from last Monday, but should the market trade beneath the gap-day low of 2369 then the likelihood will increase significantly. All-in-all, a breakout to new record highs could be in store for the as long as support levels hold.

Leave A Comment