This should be a big week but the reality is, we’d have to get completely blindsided for the outlook to materially change despite the data deluge. We’ll get the Fed, but not really (there’s no presser and no Economic projections) and we’ll get NFP which could potentially be interesting in terms of econ signaling given the lackluster Q1 GDP read and last month’s epic miss. PCE is also worth watching.

There’s a French presidential debate on Wednesday, but Macron would probably have to murder someone on camera for that to change the outcome of the May 7 runoff.

For those interested in a more comprehensive week ahead preview, you can find some color from Barclays below followed by the full calendar from BofAML.

Via Barclays

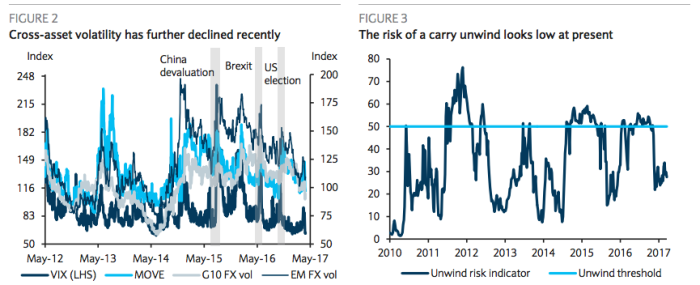

Global risk sentiment remains supportive, despite the lack of clarity on US fiscal policy and moderation in global data surprises, with upbeat US earnings and reduced European political uncertainty acting as the main catalysts recently. The reduction in European political uncertainty, in particular, has helped further depress cross-asset volatility (Figure 2), a trend we think will remain intact. Altogether, the low volatility environment continues to favour high carry positions, with our Carry Unwind Index showing little risk of an immediate unwind (Figure 3).

Despite the generally positive backdrop, however, commodities underperformance has led to a breakdown of the correlation with equities to its weakest level since mid-2014. This has resulted in mixed high-beta G10 and EM FX performance versus the USD in the past couple of weeks, with currencies that would normally benefit from a positive risk environment through sentiment-sensitive capital inflows failing to rally (Figure 4).

Leave A Comment