Two week’s ago, I wrote an article entitled “Oversold Bounce Or Return Of The Bull,” wherein I laid out the probabilities of a short-term rally due to the oversold condition that existed at that time.

Then, this past Tuesday, I updated that analysis with “Return Of The Bull…For Now,” as the expected rally in stocks, and reversal in bonds, took shape. (Also, review that post for individual sector and major market analysis.)

With this background, we can review the markets through the close on Friday and make some assessments of risk versus reward, and ultimately positioning, heading into next week.

Last week, the expected market rally on Monday and Tuesday was strong enough to push the S&P 500 out of its previous corrective downtrend. That’s the good news.

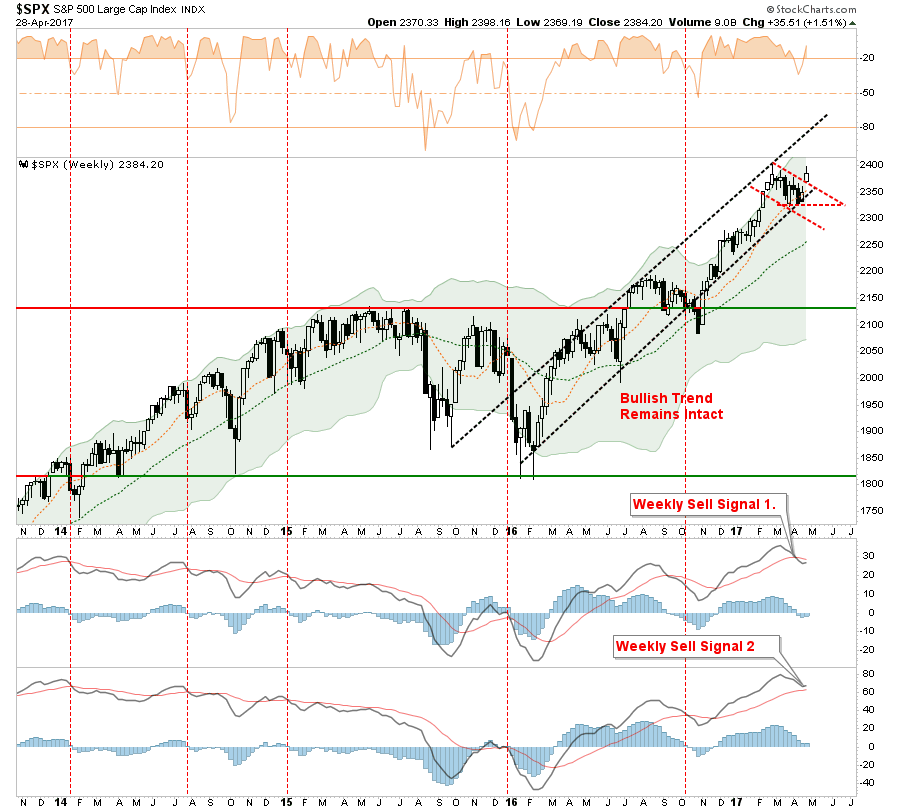

The not so good news is the market failed to obtain new highs and, as noted two weeks ago, has tripped the first signal as shown below. This “warning signal” as we discussed then, keeps a potential lid on stock prices for now particularly since it was registered from such high levels. More importantly, we are closing in on a secondary “sell signal,” also from an extremely high level, which would also suggest further price weakness and would raise caution levels higher.

If the markets can continue to rally next week, and push to new highs, then both of those signals will reverse. The problem is the reversal from high levels historically has only been short-lived before a more significant decline took place as shown in the chart below.

As I noted last weekend:

“With portfolios already hedged, as we added a lot of bond and interest rate sensitive holdings back in January, there is no action to take currently. This is why, for now, it is only an ‘alert’ that something more important is developing.”

The daily chart below shows that much of the oversold condition that existed two weeks ago has now been resolved. While not overbought as of yet, notice previous two red blocks were associated with short-term topping processes, there is currently not a tremendous amount of “fuel” left for a continued advance.

With the market on a short-term “buy signal,” deference should be given to the probability of a further market advance heading into May. With earnings season in full swing, there is a very likely probability that stocks can sustain their bullish bias for now.

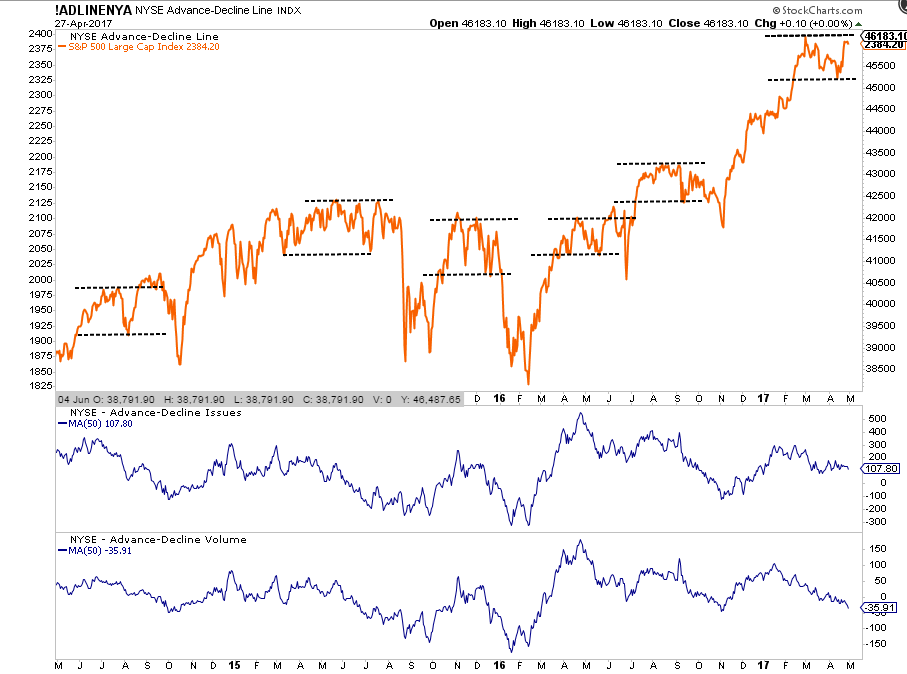

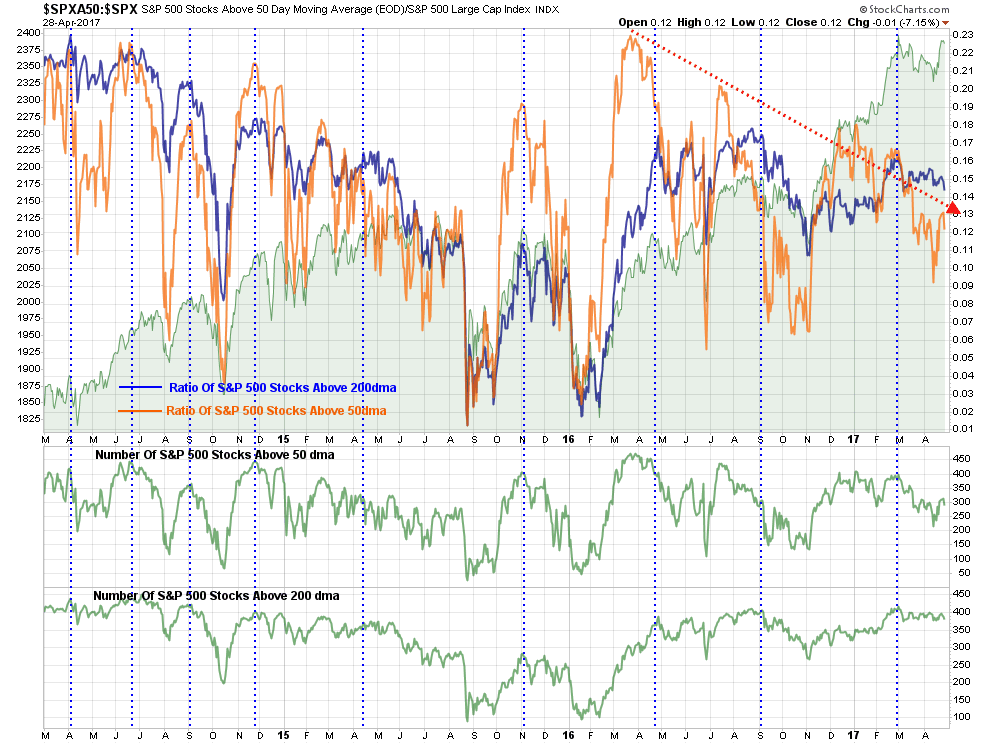

However, despite the “bullish exuberance” over the past few days, it should be noted the markets remain in a broader “topping pattern” since the beginning of March with internal measures remaining very weak. The chart below shows the previous “topping patterns” over the last couple of years and currently. Previously, these topping patterns have resolved themselves by correcting. Sure, this time could certainly be different, but the deterioration in the internals should be paid attention to.

Furthermore, both the ratio and number of stocks above their respective 50 and 200 day moving averages has also remained weak.

Importantly, I am not suggesting the markets are about to enter the next great “bear market phase,” but I am suggesting that upside is likely rather limited at the current time so maintaining reduce risk exposure, and higher than normal levels of cash, may be advisable in the near term.

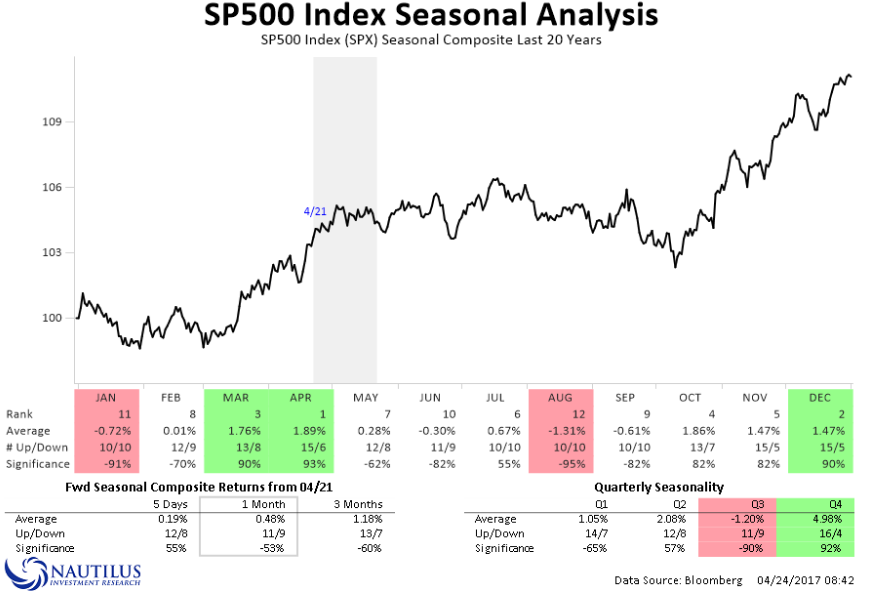

This is particularly the case as we head into typical summer weakness as noted last week by Nautilus Research.

With the understanding the markets are currently on an intermediate term sell signal and returning back to an overbought condition in the short-term, the current rally should likely be used for portfolio repositioning and rebalancing. However, such a statement does NOT mean“cashing out” of the market as the bull market trend remains intact. Maintain, appropriate portfolio “risk”exposure for now, but cash raised from rebalancing should remain on the sidelines until a better risk/reward opportunity presents itself.

From Last Week:

PORTFOLIO ACTION GUIDELINES

“Given this is only a “warning signal” currently, any RALLY in the next week should be used to take some action within portfolios. The following list provides some basic guidelines.

- Trimming back winning positions to original portfolio weights: Investment Rule: Let Winners Run

- Sell positions that simply are not working (if the position was not working in a rising market, it likely won’t in a declining market.) Investment Rule: Cut Losers Short

- Hold the cash raised from these activities until the next buying opportunity occurs. Investment Rule: Buy Low

These actions will temporarily reduce portfolio risk and raise cash levels which either provides a “hedge” against a subsequent downturn OR cash to buy better-performing assets if conditions improve.

For now, the market remains in a bullish trend. Outside of small tweaks and close monitoring, nothing has occurred, yet, which would warrant more drastic movements within the allocation model.

Caution, nothing more, is advised for now.”

Leave A Comment