The EUR/USD is trading above 1.1400 but below the highs and down on the day. The pair shot higher on Friday on reports that the US and China are working on a roadmap to resume trade talks. The US Dollar was sold-off on the optimism. A fresh report suggests that the world’s largest economies are aiming to reach an agreement in November.

However, another issue from the previous week is not fully resolved. The Turkish Lira remains under pressure as the central bank refuses to raise interest rates. The CBRT took measure to make lending more expensive, and the country received an emergency loan from Qatar. However, the trouble is far from over. President Recep Tayyip Erdo?an upped the ante by saying that an attack on the economy is like an attack on the flag. Some euro-zone banks are exposed to Turkey, and there is fear of contagion to other emerging markets.

Italy is also in the limelight. The euro zone’s third-largest economy is still reeling from the collapse of the bridge near Genova, a disaster that left many dead. The nation now wants to spend €80 billion in infrastructure, thus breaching EU budgetary rules. This could put the government at loggerheads with Germany and France.

The German Producer Price Index came out at 0.2%, and Germany remains the center of attention in a relatively calm day. The German central bank, the Bundesbank, releases its monthly report and its president Jens Weidmann speaks later on.

EUR/USD Technical Analysis

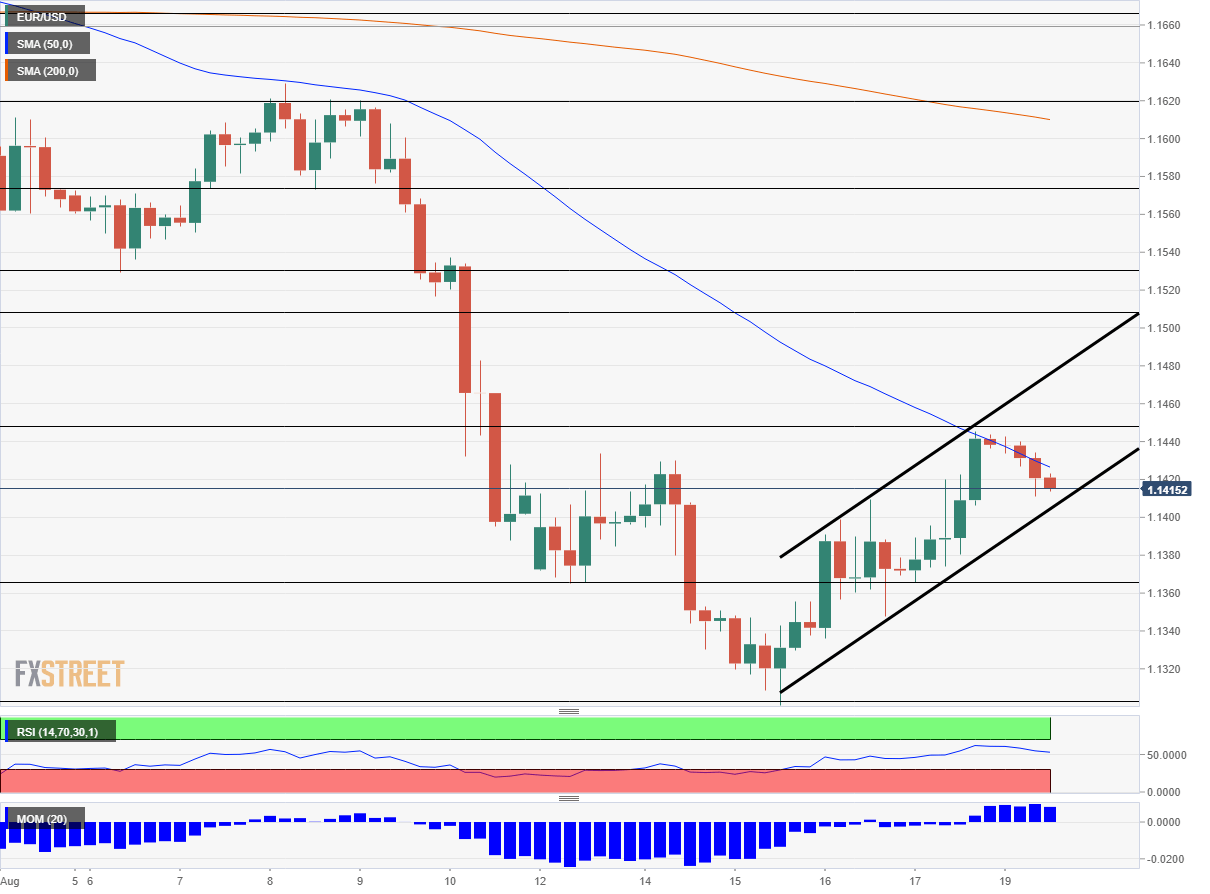

The EUR/USD is trading in an upwards channel (thick black lines on the chart). This began after the pair bottomed out at 1.1300. The recent moves put uptrend support in danger.

Momentum remains positive, and the Relative Strength Index is marginally above 50. The pair is challenging the 50 Simple Moving Average on the four-hour chart.

Leave A Comment