Turkey Signals Weakness In Emerging Markets

Turkey and the markets are revisiting 2014 since global synchronized economic growth has peaked and emerging markets are weakening. The stress in Turkey is only one example of the weakness. If Turkey was the only catalyst of strife in emerging economies’ currency and equity markets, you would easily be able to profitably fade that trade.

Turkey is a small part of the emerging markets ETF. It is a tiny part of the global economy. However, I’m considering the thesis that Turkey is a symptom of greater weakness. Therefore, there are reasons to be concerned. The emerging markets ETF is down 18.18% since its late January peak. Clearly, that’s not all because of the recent crisis in Turkey.

China is seeing a resumption of growth deceleration and Brazil’s recent data is a mess because of the trucker strike. The strike caused the biggest decline in economic activity on record in May, retail sales to weaken, and PMI to contract in June.

The good news is the strike is over. The bad news is GDP growth is only supposed to be 1.7% in 2018. The October election will determine if GDP growth can accelerate to the 2.5% growth expected in 2019.

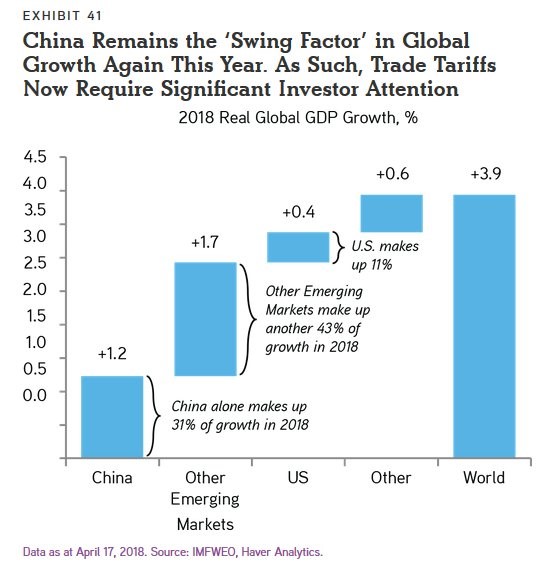

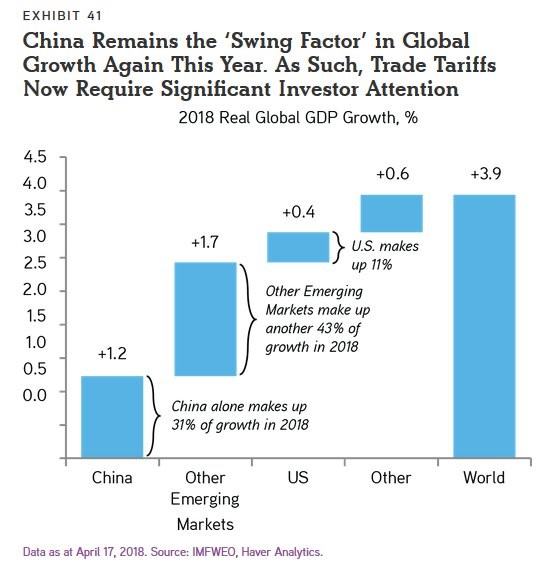

As you can see from the chart below, economic growth in emerging markets is expected to power 74% of global growth in 2018. Chinese growth is almost 3 times as important to global growth than American growth.

The point here is that if America outperforms the other advanced economies, it won’t prevent global growth from decelerating. Global growth in 2017 was 3.76%. While the estimate below is currently higher, it can easily change if results continue to miss estimates.

Turkey and the Global Economy – Is America Immune?

The saying used to be ‘when the American economy sneezes, the world economy catches a cold’. In this expansion, there have been colds and flu in various international economies which haven’t been caused by America. American markets corrected, and the economy decelerated during these crises abroad. But there hasn’t been a recession yet.

Leave A Comment