“A little help, please!”

So reads the subject line of an email I received recently. The reader was responding to a pervious sermon of mine about the supreme importance of earnings in determining future stock prices.

Specifically, the troubled reader wanted to know exactly which earnings metrics to monitor.

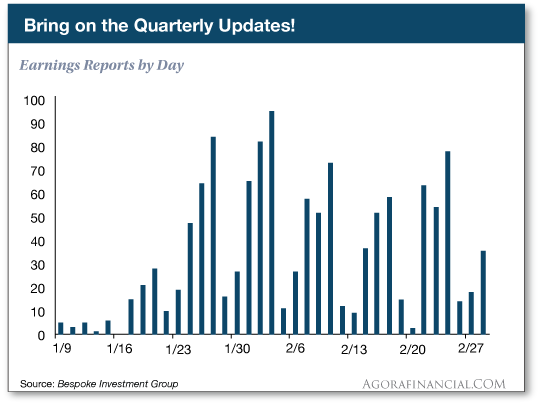

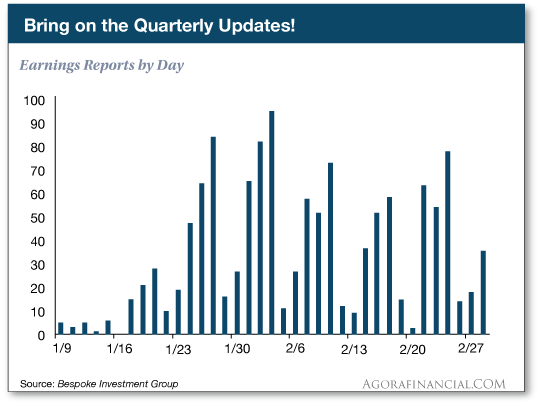

The request is certainly timely. Earnings season is now officially in high gear. As you can see in the chart below, it started in earnest last week and continues this week, with over 250 companies set to report.

Not to mention earnings are taking on a renewed importance with the transition of power in Washington, D.C. As a headline at MarketWatch points out, “Outlooks for the Age of Trump Are Top Focus of Earnings Season.”

As you know, I’m always eager to lend a helping hand. But before I share the only two metrics you need to be tracking, I must dispel a persistent myth…

What Is Alcoa Good For? Absolutely Nothing. Ever Again.

Although the practice remained popular with many investors, treating Alcoa’s results as a bellwether for the rest of the stock market has always been a big mistake.

Historically, they’ve been good for… well, absolutely nothing when it comes to predicting the trajectory of stock prices.

In case you need a refresher on why, pick your poison from the archives…

You can review my original findings from 2012 or FactSet’s statistical analysis.

The good news is this age-old debate finally got put to rest last year when Alcoa split up into two separately traded companies.

One trades under the old ticker AA, which consists of the former company’s raw aluminum operations. The other is known as Arconic (ARNC), which consists of the higher-growth business of manufactured goods for automotive and aerospace markets.

Not only did the company split in two, but each company reports on different days now. In other words, Alcoa’s results are truly meaningless when it comes to divining the future direction of the entire stock market.

Leave A Comment