DAX falls after retail sales slump, Eurozone inflation is due

The Dax is heading lower after disappointing German retail sales data and ahead of eurozone inflation figures.German retail sales tumbled -2.5% MoM in December after rising 1.1% MoM in November. The drop was significantly worse than the 0.1% decline that analysts had expected and highlights the struggles households are facing in amid still high inflation and record interest rates.Eurozone inflation data is expected to rise to 2.9%, up from 2.4%. Meanwhile, core inflation is expected to tick lower to 3.5% from 3.6%. The figures come after German inflation also ticked higher to 3.8%, up from 3.2% a month earlier, casting doubts over investors’ hopes that the ECB will start cutting interest rates as early as March.Hotter-than-expected inflation data today would support recent ECB warnings that interest rates will stay higher for longer.Looking ahead, attention will turn to US non-farm payroll reports which could influence expectations surrounding Federal Reserve rate cuts.

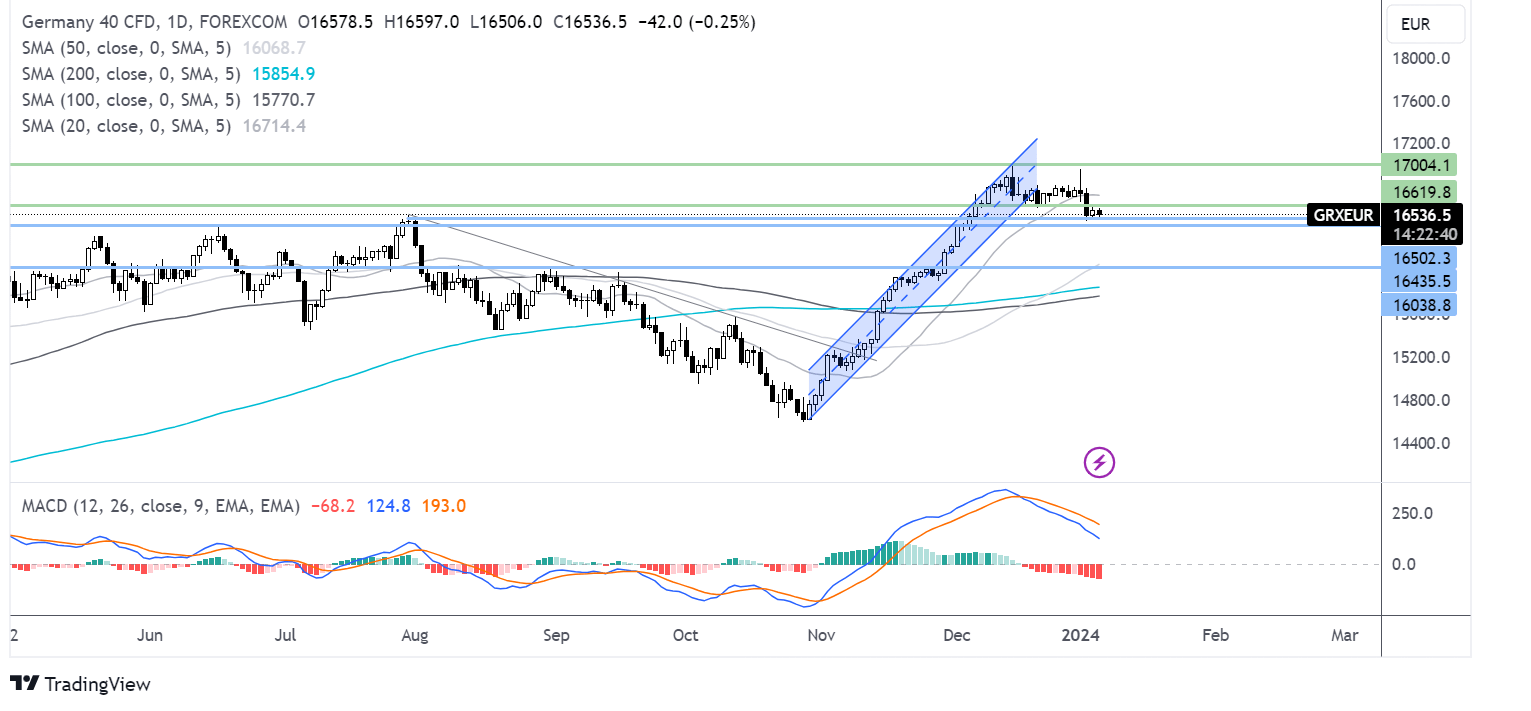

DAX forecast – technical analysisThe DAX has fallen away from the January high of 16960, breaking below the 20 SMA, and is consolidating between 16615 and 16450, the weekly low and the June high. The bearish MACD keeps sellers hopeful of further losses.Sellers will need a break below 16450 to extend losses towards 16000. Meanwhile, any recovery will need to rise above 16615, the mid-December low to test the 20 SMA and rise to 17000 round number.

USD/JPY rises ahead of the US non-farm payroll report

USD/JPY is rising for a fourth straight day as investors continue to rein in Fed rate cut bet ahead of the US non-farm payroll report.Expectations are for 150,000 jobs to be created in December this is down modestly from the 199,000 added in November. Meanwhile, the unemployment rate is expected to tick higher to 3.9%, up from 3.8% in the previous month.The lead indicators this week, including jobless claims, ADP payrolls, and challenger job cuts, all came in ahead of expectations, suggesting that we could see a beat in payrolls today.A stronger-than-expected US non-farm payroll report could see the market dial back further Federal Reserve rate cut expectations.According to the CME fed watch tool, the market is pricing in A 60% probability of a rate cut in March. This is down from almost 100% in December. A stronger report could see this reined in further to 50/50 odds, which would lift the US dollar and could propel USD/JPY for a weekly close above 145.00.

USD/JPY forecast – technical analysisUSD/JPY is extending its recovery from 140.25, the December low, rising above the falling trendline and 200 SMA. This combined with the RSI rising above 50 keeps buyers hopeful of further gains.Buyer will need to rise above 145.00 resistance to extend the rally towards 146.50 and towards 148.00.Rejection at 145.00 could see the price fall back towards the 200 SMA at 143.20. A break below here opens the door towards 140.80 the 2024 low ahead of 140.25.  More By This Author:Two Trades To Watch: EUR/USD, USD/JPY – Thursday, Jan. 4

More By This Author:Two Trades To Watch: EUR/USD, USD/JPY – Thursday, Jan. 4

Nasdaq 100 Forecast: Stocks Extend Losses Ahead Of FOMC Minutes

Two Trades To Watch: GBP/USD, DAX – Wednesday, Jan. 3

Leave A Comment