EUR/USD falls as recession worries rise

EUR/USD is heading lower after three days of gains, as recession fears rise following weaker-than-expected PMI data. EUR/USD rallied over 1% yesterday on USD weakness after the more dovish-than-expected Federal Reserve rate decision earlier in the week and after the ECB pushed back on rate cut expectations. However, gains in the euro have run out of steam following PMI data today, which has raised concerns over the health of the eurozone economy and questions over whether the ECB can keep interest rates high for longer. The eurozone composite PMI unexpectedly fell to 47 from 47.6 in November, defying expectations of a rise to 48. Breaking this down further, manufacturing remained unchanged at 44.2 while the service sector contracted 48.1 in December, down from 48.7. The data points to the eurozone economy contracting again in the final quarter of the year after contracting -0.1% in Q3 and tipping the economy into recession. In stark contrast, the US economy is showing resilience after retail sales unexpectedly rose in November and industrial production later today is also expected to rebound, rising to 0.3% MoM in November after falling -0.6% in October. US PMI data is due to be released. The services PMI is set to remain in expansion at 50.6, down slightly from 50.8. Even so, the US dollar is struggling around 4-month lows after the Federal Reserve unexpectedly pointed to three interest rate cuts in 2024, up from 2 forecast in September.

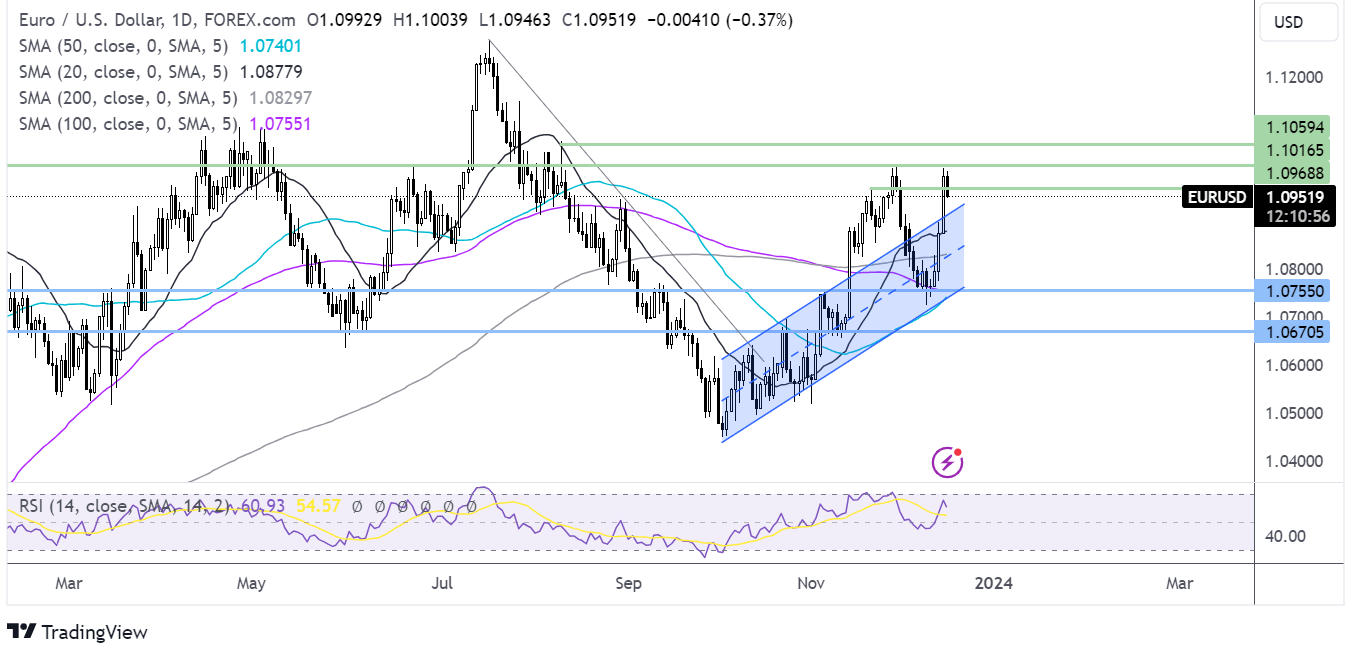

EUR/USD forecast – technical analysis EUR/USD rebounded from the 1.0750 December low, rising above the 200 SMA and breaking out above the rising channel to 1.10. The price has eased back from this 2-week high, taking our support at 1.0970. Sellers will look towards 1.0920, the rising trendline support, with a break below here opening the door to the 200 SMA at 1.0825. Buyers need to rise back above 1.0970 to test 1.1020 ahead of 1.1050.

GBP/USD rises after BoE & PMI data

GBP/USD is rising and is on track to book gains of almost 2% across the week. The pound is being supported by stronger-than-expected service sector PMI data which showed solid expansion in December. Services PMI in December is 52.7 up from 50.9 in November and well ahead of the 51 that was forecast. Strength in the service sector overshadowed ongoing weakness in the manufacturing sector which contracted by more than expected at 46.4 now from 47.2. Growth in the dominant service sector is inflationary and supports the Bank of England’s view that interest rates will need to stay higher for longer, which was reiterated in the BoE meeting yesterday. Governor Andrew Bailey pushed back on expectations of rate cuts early next year, saying that the fight against inflation still hasn’t been one. Looking ahead BoE David Ramsden is due to speak, and U S industrial production and PMI data will be in focus later today.

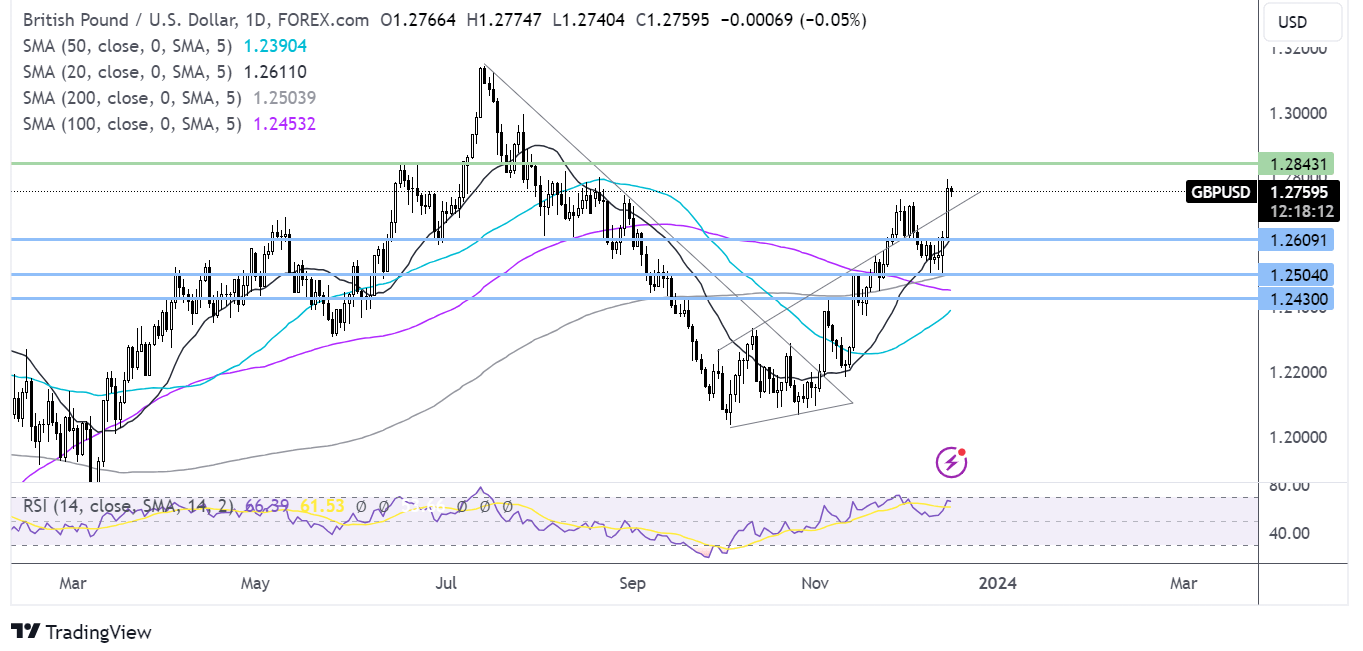

GBP/USD forecast – technical analysis GBP/USD rebounded from the 200 SMA, pushing above 1.26 and the rising trendline before running into resistance at 1.2792. The price is consolidating around 1.2750. A rise above 1.2792 is needed to create a higher high and extend gains towards 1.2840 the June high. Support can be seen at 1.27 the rising trendline support. A break below here brings 1.26 in focus ahead of the 200 SMA at 1.25.  More By This Author:Two Trades To Watch: GBP/USD, DAX – Thursday, Dec. 14

More By This Author:Two Trades To Watch: GBP/USD, DAX – Thursday, Dec. 14

Nasdaq 100 Forecast: Stocks Scale Higher Ahead Of The FOMC Rate Decision

Two Trades To Watch: GBP/USD, USD/JPY – Tuesday, Dec. 12

Leave A Comment