Tyson Foods, Inc. (TSN – Free Report) posted second-quarter fiscal 2018 results, with earnings and sales improving year over year. Performance in the quarter under review continued to benefit from steady growth in the Beef, Chicken and Prepared Foods segments.

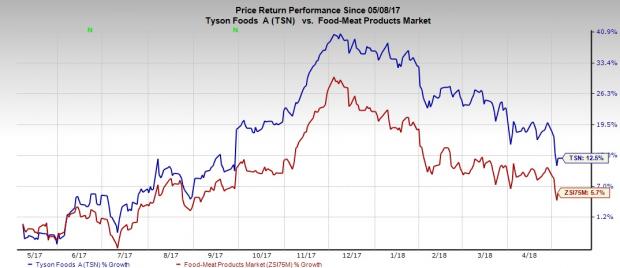

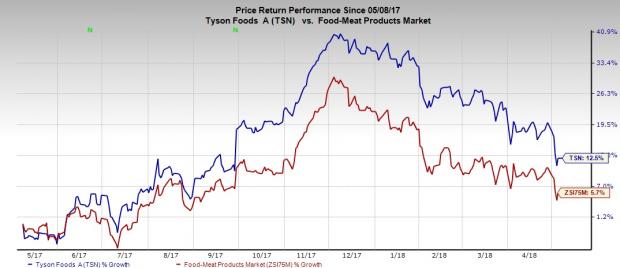

However, both the top and the bottom line missed the Zacks Consensus Estimate. This along with weak gross margin dampened investors’ optimism, evident from the 3.4% decline during pre-market trading hours. Nevertheless, Tyson Foods’ shares have moved up 12.5% in the past year, compared with the industry’s gain of 5.7%, courtesy of steadily rising demand for protein-rich products.

Coming back to the company’s quarterly results, adjusted earnings for the period came in at $1.27 per share that missed the Zacks Consensus Estimate of $1.32. Adjusted earnings depicted a growth of 25.7% year over year. Performance during the quarter were driven by higher sales, cost savings of $65 million from Financial Fitness Program and 17 cents positive impact from lower tax rates.

Revenues and Margins

Net sales improved 7.6% to $9,773 million, courtesy of improved Beef, Chicken and Prepared Foods sales. Sales volume increased 1.9% during the quarter, while average sales price rose 5.6%. However, sales missed the Zacks Consensus Estimate of $9,944 million

Gross profit for the second quarter came in at $1,020 million, down 2.6% from the prior-year quarter’s tally. Gross margin also contracted 110 basis points (bps) to reach 10.4%.

Tyson Foods’ adjusted operating income rose 11.4% to reach $694 million. Also, adjusted operating margin for the period came in at 7.1%, up 20 basis points (bps).

Tyson Foods, Inc. Price, Consensus and EPS Surprise

|

Segment Details

Chicken: Sales in the segment jumped 5.7% to $2,959 million. Sales volume improved 2% year over year owing to higher demand for chicken products and increased volumes resulting from the AdvancePierre buyout. Average sales price in the quarter increased 3.6%, courtesy of change in sales mix. Adjusted operating income rose 23.6% to $288 million, while adjusted operating margin rose 140 bps to 9.7% during the quarter. Also, operating income growth in the segment was led by cost savings from Financial Fitness Program, gains from AdvancePierre buyout and lower feed expenses, partly negated by higher labor, growout and freight costs.

Leave A Comment