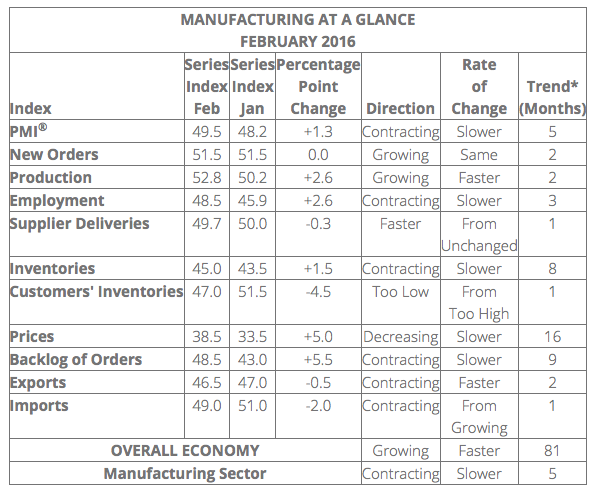

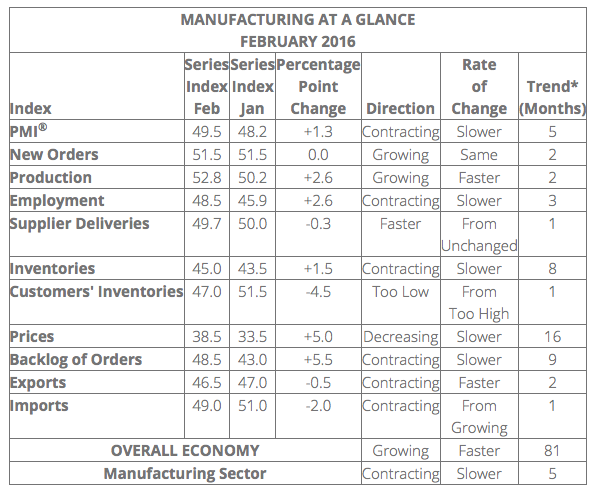

I actually saw some cheering of the ‘not quite as bad as expected’ ISM report yesterday. It bounced all the way up to a contraction level of 49.5.Full report on business.

Here’s what some of the respondents had to say…

Here is the trend in the ISM Manufacturing RoB.Sideways is fine over the long haul, but most recently we have been on a down leg and have made a lower high and lower low coming out of the post-2009 recovery. The sub-50 reading is sometimes, but not necessarily the gateway to recession (lighter shaded areas).

Machine Tool sales declined in January, predictably coming off a modest year-end bump, which was even more predictable as the buying in December is almost ritual, for tax management reasons. From EDA…

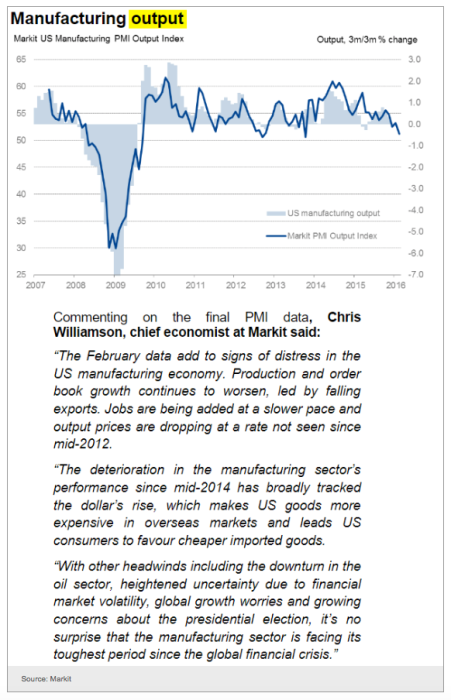

The following graphs are from sources noted, by way of the Daily Shot.

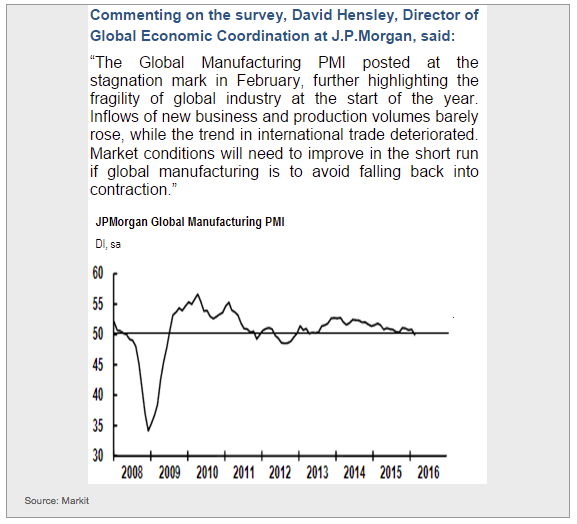

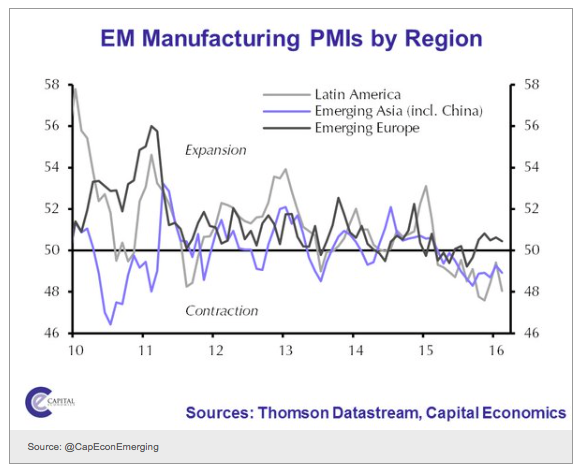

On to the global picture…

It is obvious that the state of the US dollar has a lot to do with the US deceleration and for different reasons, the Emerging Markets. Heck, for Europe too. The former two would benefit from a weaker dollar and the latter, definitely not. Europe is trying to devalue its way to prosperity. But let’s not turn this into a currency or broad market post. Let’s clip it here and simply take in the state of US and global manufacturing.

Speaking for the US, it is time for the dollar to weaken and manufacturing to bounce back up or else ISM could drop to levels that usually precede recession. ISM is at a decision point having dwelled below 50 (contraction) now for a few months in a row.

Leave A Comment