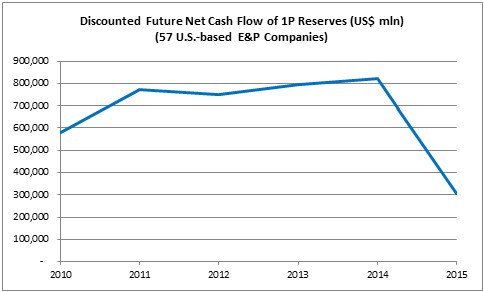

New analysis from Evaluate Energy shows that 57 U.S.-based E&P companies have seen the present value of their global proved (1P) reserves fall by a combined 63% between 2014 and 2015, a staggering $515 billion. The full breakdown of the company data provided on an annual basis shows that the overwhelming majority of this fall in value is clearly linked to the commodity price downturn.

Every year, oil and gas producing companies based in the United States have to report figures in their 10-K annual reports under the heading “Standardized Measure of Discounted Future Net Cash Flows Relating to Proved Oil and Gas Reserves.” This section of each company’s report estimates the present value of its 1P reserves, based on a number of factors and subject to a 10% discount rate, due to the future-looking nature of the data in question (see note 1). This year, 57 U.S.-based E&P companies that have all been reporting the relevant data at least since 2010, saw the combined present value of their 1P reserves plummet to just over $300 billion due to the price downturn.

Source: Evaluate Energy (see note 1)

An important fact to remember here is that these values are calculated using average commodity prices for each year. Were this data based on year-end prices, we would have seen a sharp fall in 2014 as well. But seeing as the price downturn did not begin in earnest until Q4 2014, the present value of reserves in that year were largely unaffected, and 2015, after a full year of low prices, saw a steep drop in values.

Biggest Impact of Prices on Present Values of 1P Reserves Between 2014 and 2015

If we now look at the 2-year period from 2014 to 2015, an additional 7 companies can be added to the analysis that have only started to report the relevant data more recently than 2010. Out of the group of 64 companies, the full list of which can be seen here, it was EQT Corp. (NYSE:EQT) that saw the biggest drop in its discounted future net cash flows of 1P reserves, experiencing a drop of almost 80% to $978 million.

Leave A Comment