You can’t keep a good dog down. There are some wonderful traders I follow that have been calling for imminent collapse of the U.S. stock market index. They offer very sound, thoughtful, thorough and persuasive reasons why the U.S. stock market should not be at present levels. They have even doubled down in recent weeks on their bets. The problem is that the U.S. stock market could care less about the thinking these traders hold forth. They will likely be right … eventually. But price is always King.

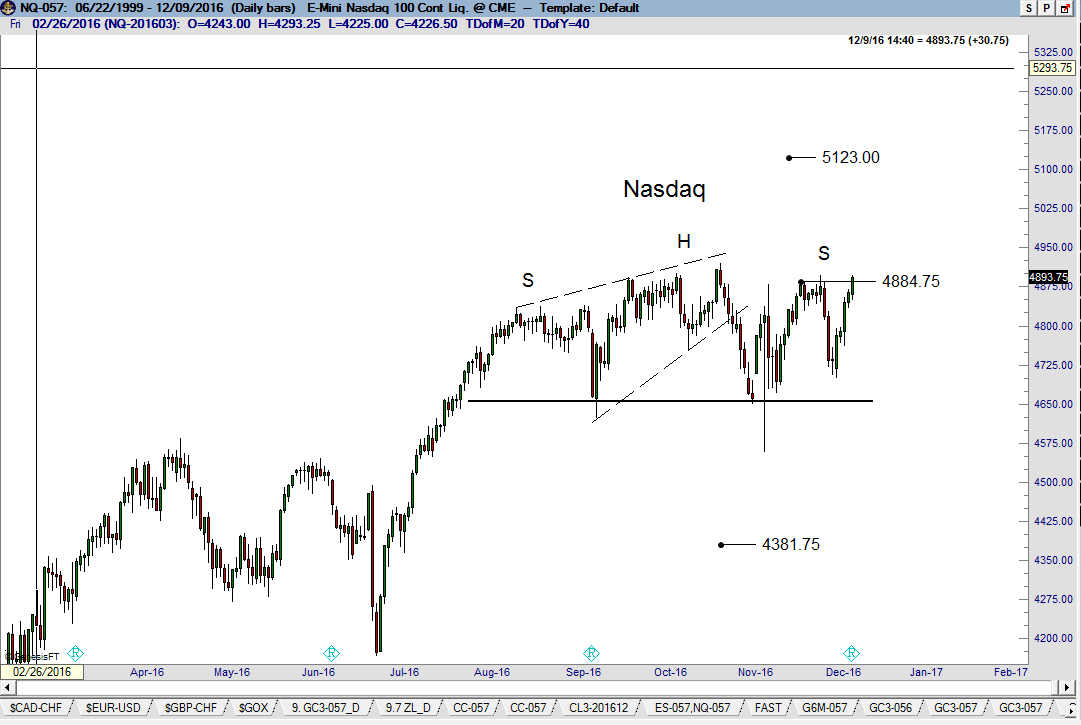

Personally, I believe the U.S. stock market is in the final blow-off in the bull market that began in early 2009 – but blow-offs can be very rewarding for longs capable of catching the eventual turn in trend. The Nasdaq index is constructing a possible H&S failure pattern on the daily graph – requiring a decisive close above the right shoulder high at 4897. A H&S failure pattern would establish a profit target of 5123.

I am interested in this possible buy signal if I can find a low risk way to play it. H&S failure patterns are not unknown to the Nasdaq Index. In fact, a massive H&S failure pattern was completed on the weekly graph in Jul (see below). If I do not find a spot to buy Nasdaq with less than a 20 or so point risk I will just watch the balloons float away.

Leave A Comment