The US housing sector is doing better than expected: the score of 52.6 is a nice beat on expectations and also better than September. Any score above 50 points reflects expansion. The construction sector has led the crash, led the recovery and at the moment it is somewhat lagging in comparison to the other PMIs. After the initial post-Brexit crash, all these forward looking figures have returned to pre-referendum levels.

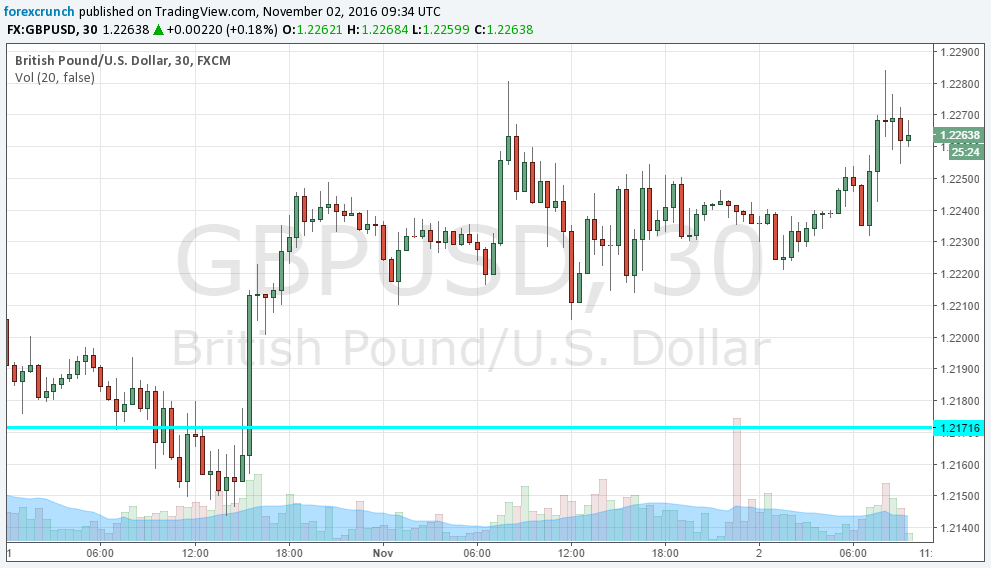

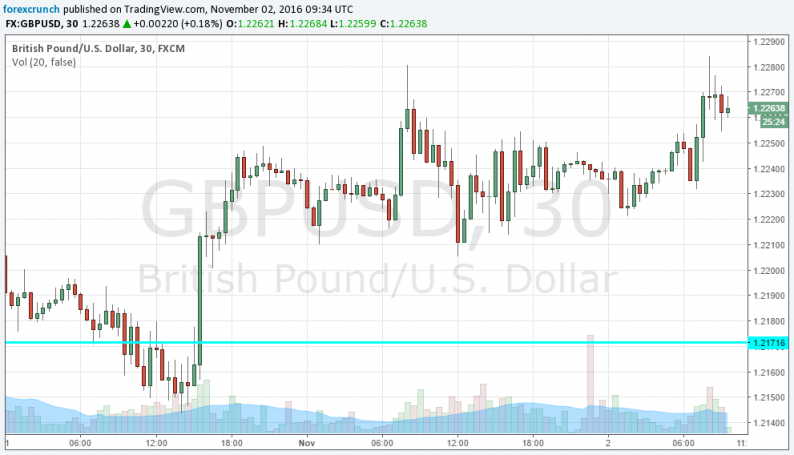

GBP/USD ticks a bit higher to 1.2260. The pound was unable to take advantage of the weakness in the greenback like the euro has surged.

Markit’s construction PMI was expected to slide from 52.3 to 51.8 points for October. This is the second out of three purchasing managers’ indices. The last one is the most important one: the services one. However, this time it is published just hours before the BOE’s “Super Thursday” – the rate decision, the meeting minutes and also the Quarterly Inflation Report.

GBP/USD was trading steadily in range ahead of the publication.

More: GBP/USD: ‘Brexit II’: L/T Charts Point To 1.05 As A Real Possibility – Citi

Leave A Comment