Inflation is not rising so fast. Headline CPI remained unchanged at 0.6% and core inflation at 1.3%, both below expectations. MoM, prices rose by 0.3%. UK figures for July came out much better than expected, showing that Brexit is not as bad, at least not in with the initial hard data. Is August going to be different?

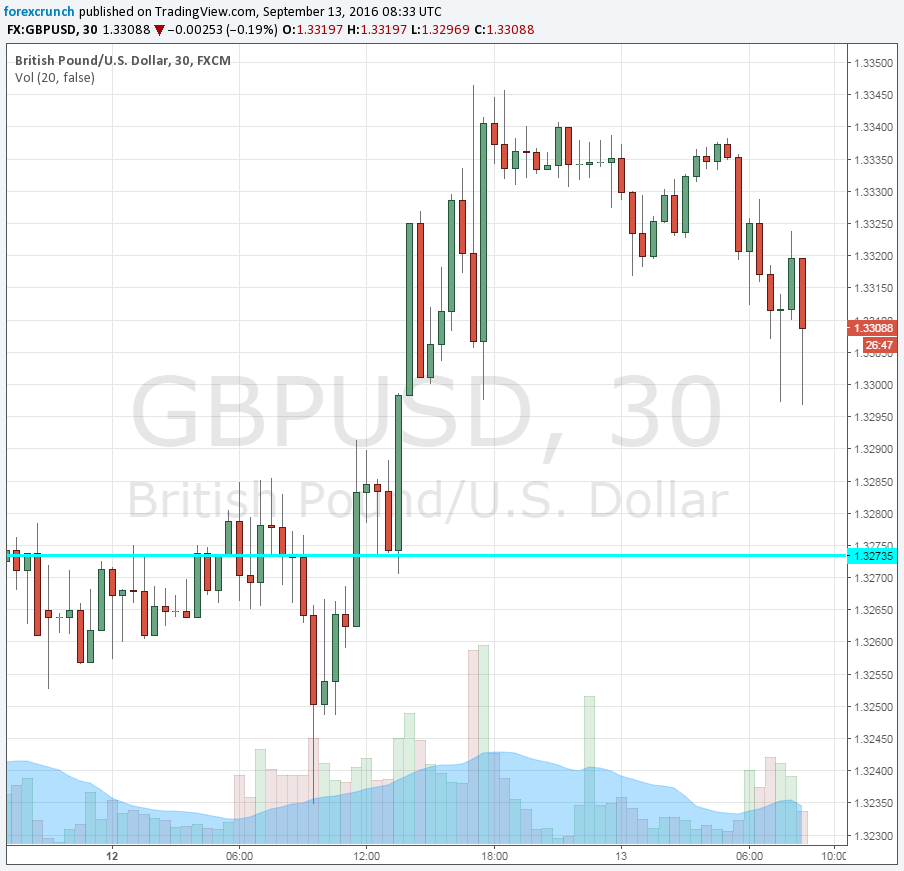

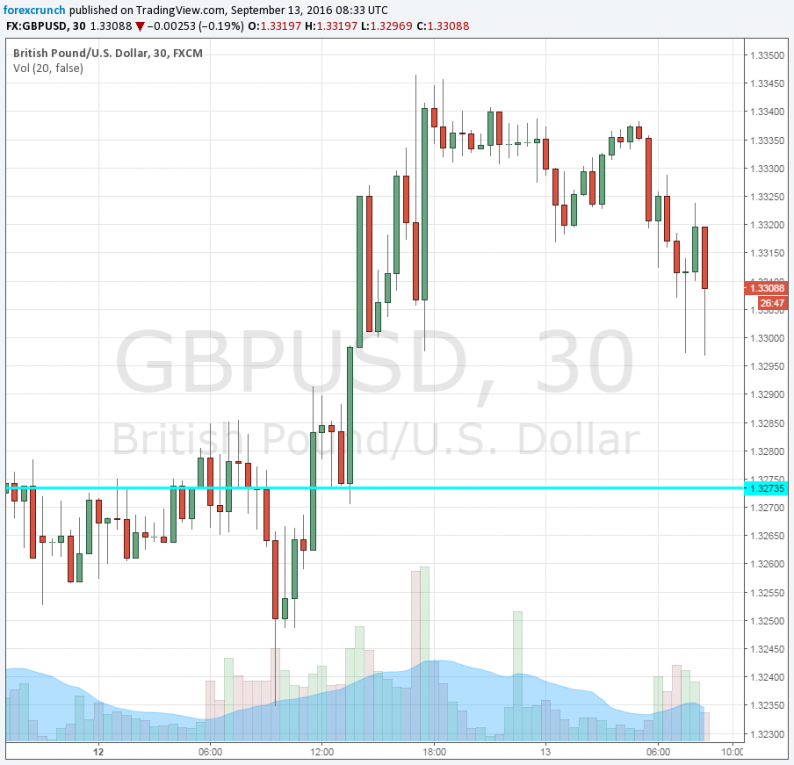

GBP/USD is sliding back down towards 1.33 in the aftermath of this small disappointment.

The UK was expected to report a YoY inflation level of 0.7% in August, up from 0.6% in July. Month over month, an advance of 0.4% was on the cards, after ‘0.1% beforehand. The expected rise in prices is due to the lower exchange rate. The pound fell sharply on the Brexit vote, and never really recovered. Core inflation carried expectations for a rise of 1.4% YoY, up from 1.3%.

GBP/USD traded steadily in range, around 1.3320. Support awaits at 1.3270 and resistance at 1.3360.

The Bank of England is getting closer to its inflation target, at least in the short run. However, if Brexit implies lower growth prospects, inflation will eventually remain subdued. Carney recently defended the Bank’s policy: warning about Brexit and introducing a comprehensive stimulus package.

The BOE convenes on Thursday this week and no policy change is expected. A second rate cut is expected for November, but the BOE, like other central banks, is data dependent.

Tomorrow, the UK publishes the all-important jobs report.

Leave A Comment