– Value of Sterling and increased risks place pressure on pensioners both in UK and abroad

– 500,000 British expats face ‘frozen’ pensions

– 61% of UK Direct Benefit pension schemes have more money going out than coming in

– OECD report finds ‘UK workers face the biggest retirement cliff edge in developed world’

– Combined pension deficit of FTSE 350 companies is at 70% of their profits

– One in three wealth managers are holding cash for clients in anticipation of a market crash

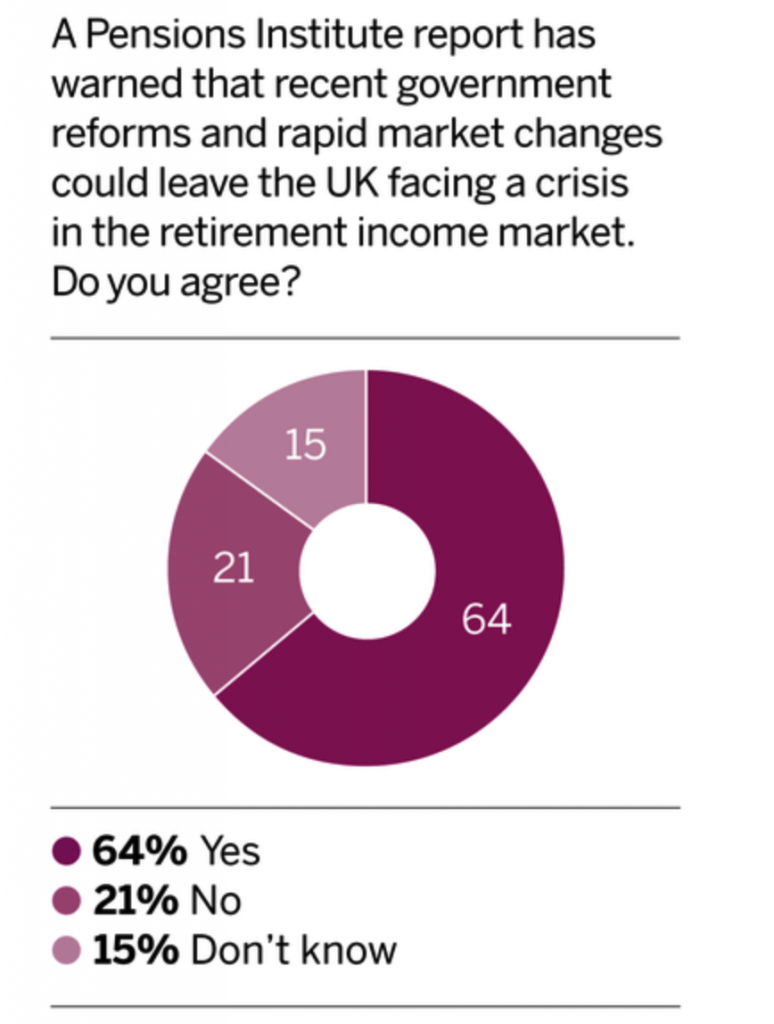

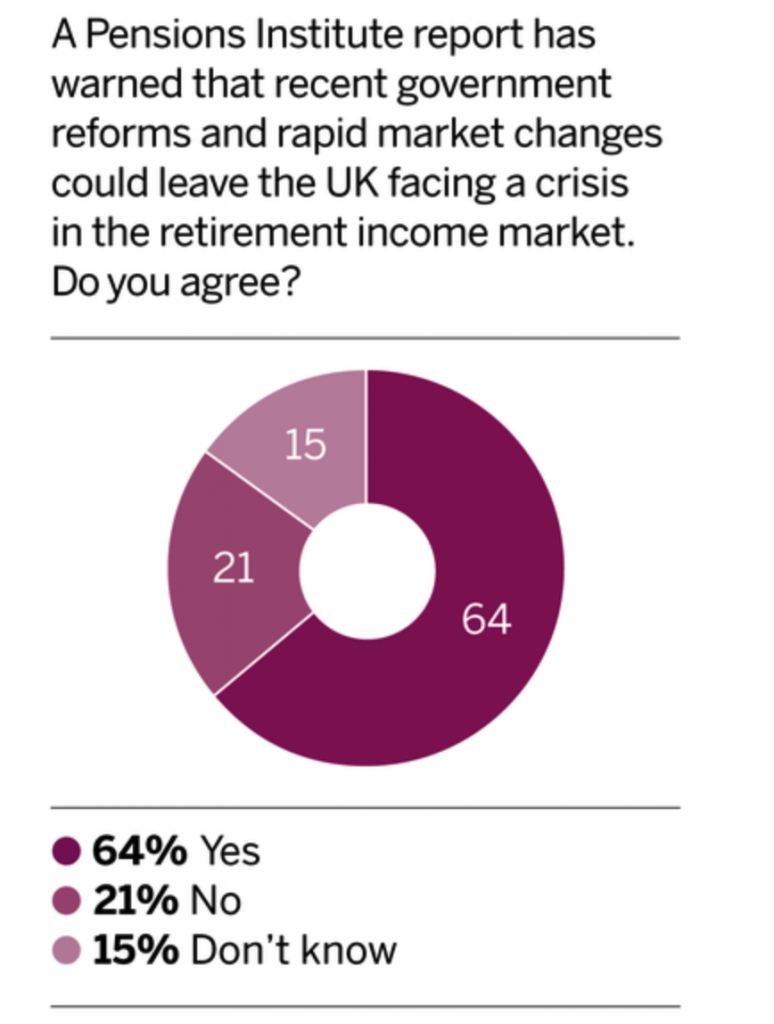

Source: Professionalpensions.com

The UK’s future pensioners should not rely on their state pension or they may face a huge fall in earnings, says a new report by the OECD.

Should Brits rely solely on their UK state pension then they will face the largest income drop of any OECD country. UK pensions represent on average 29% of in-work earnings, the OECD average is 63%.

The OECD explains:

‘Retirees without such additional sources of revenue [i.e. private pensions] are left with few resources; this is reflected in the poverty rate and high-income inequality in the United Kingdom for the over 65s.

‘Following the sharp rise of income disparities during the 1980s in the United Kingdom, inequalities in later life will rise further as generation X approaches retirement.’

Once private pensions are factored in then the UK does not fair so badly; ahead of Germany but behind France, Italy and Spain.

But this is not something that should relax future retirees. There is a major pensions crisis in the UK, for both state and private funds. The OECD even refers to the UK’s defined benefit workplace pension plans (final salary schemes) as ‘persistently underfunded’.

This, combined with a low contribution rate by individuals, is down to a number of factors. The conclusion of the OECD report reminds readers of the importance of saving and politicians of the need for long-term planning over short-term policy gains.

There is little hope of politicians taking their attention away from either Brexit or short-term economic results. We suggest the UK’s future pensioners, both at home and abroad, look to diversify their portfolios away from the risks currently facing the country.

Discrimination of expat pensioners

Leave A Comment