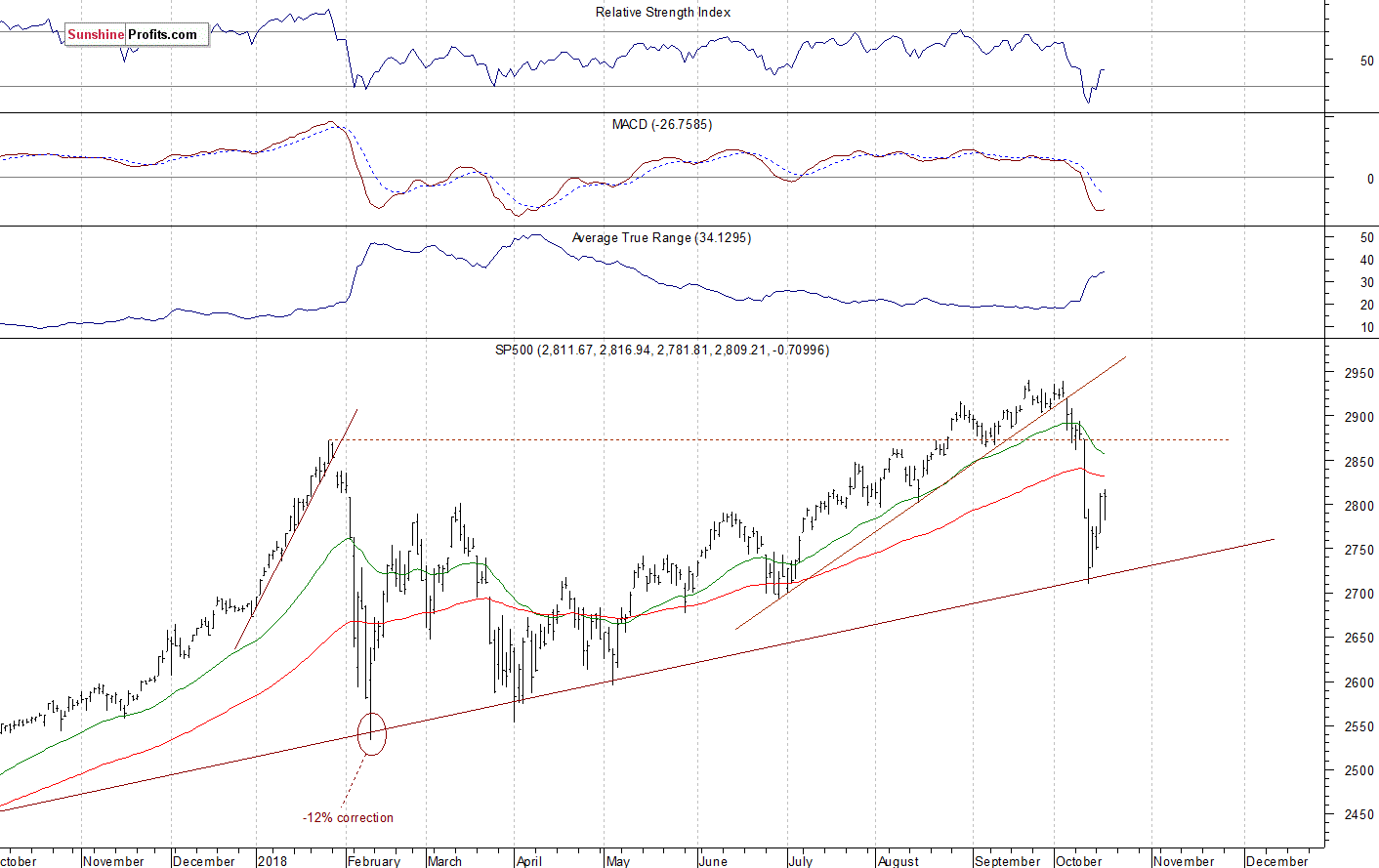

The U.S. stock market indexes were mixed between -0.4% and 0.0% on Wednesday, as investors hesitated following the recent rebound off the support level. The S&P 500 index bounced off its long-term upward trend line on Thursday. It is currently 4.5% below September the 21st record high of 2,940.91. The Dow Jones Industrial Average lost 0.4% and the Nasdaq Composite was unchanged on Wednesday.

The nearest important level of resistance of the S&P 500 index remains at around 2,825-2,830, marked by August the 16th daily gap up of 2,827.95-2,831.44. The next resistance level is at 2,850-2,860. On the other hand, the nearest important level of support is at 2,795-2,800, marked by last Thursday’s daily high. The support level is also at 2,775-2,785, marked by some recent fluctuations.

The broad stock market continued retracing its medium-term advance last week, as it got closer to 2,700 mark. Then it bounced on Friday, retracing some of the decline. On Tuesday, the index broke above the resistance level of around 2,800. Yesterday we saw a short-term consolidation. Will it continue higher? For now, it looks like an upward correction following the recent sell-off:

Consolidation Along 2,800 Mark

Expectations before the opening of today’s trading session are negative, as the index futures contract trade 0.3-0.5% below their yesterday’s closing prices. The European stock market indexes have been mixed so far. Investors will wait for some economic data announcements today: Philadelphia Fed Manufacturing Index, Initial Claims at 8:30 a.m. The broad stock market will likely extend its short-term fluctuations today. For now, it looks like an upward correction following last week’s sell-off. So will the market continue retracing that sell-off? If the S&P 500 index remains above 2,800, we could see more buying pressure at some point.

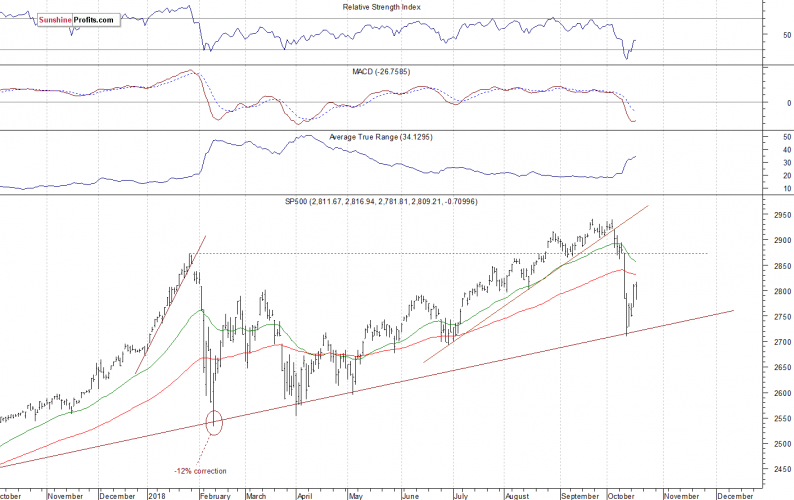

The S&P 500 futures contract trades within an intraday consolidation, as it continues to trade along the level of 2,800. The nearest important resistance level is at around 2,815-2,820, marked by the local high. On the other hand, the support level remains at 2,785-2,800. The futures contract trades slightly above the level of 2,800, as the 15-minute chart shows:

Leave A Comment