Loan Losses and Rumors

We want to briefly comment on recent news about a rise in loan loss provisions at US banks and rumors that have lately made waves in this context.

The iceberg – an excellent simile for what we know and what we don’t know… or rather, what we don’t know just

yet

Image credit: Ralph A. Clevenger

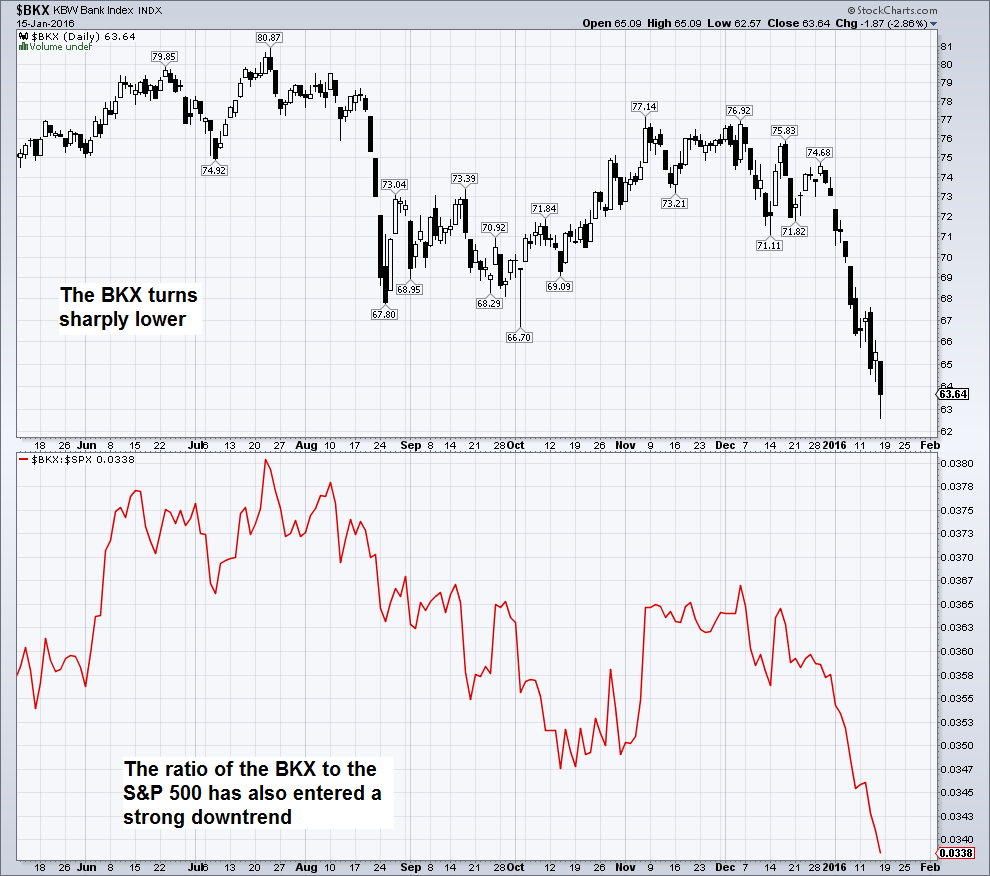

First though, here is a look at the Philadelphia Bank Index (BKX) as well as its ratio to the S&P 500:

Investors seem increasingly worried about the banking sector’s prospects – click to enlarge.

Contrary to widespread expectations, market interest rates on treasury debt have actually declined since the Fed’s rate hike, and the yield curve’s trend toward flattening (which has resumed in the summer of 2015) has yet to significantly reverse. In short, investors may inter alia well be fretting about the fact that an expected improvement in interest margins has as of yet failed to occur (in fact, bank stocks peaked concurrently with the yield curve reaching its widest point of the year in 2015).

10 minus 2 year treasury yield: while the curve widened from February to July 2015, bank stocks rallied and exhibited relative strength. They peaked right around the time when the yield curve reached its widest point of the year – click to enlarge.

However, there is more to it than that. In mid December, on the heels of a secondary peak in the BKX after which the the bulk of the recent leg of the decline occurred, there were two days that saw unusually large trading volume in the stock of a regional bank in Oklahoma, BOK Financial (BOKF). We suspect that well-informed investors decided to get out while the getting was still reasonably good. As reported by Zerohedge, the bank announced in January that it had to book an unexpectedly large credit loss from loans to just a single energy producer. Although the amount was relatively small from a big picture perspective, the decline in bank stocks promptly accelerated.

Unusual trading activity in BOKF shortly after the resumption of the decline in bank stocks, followed by the announcement of energy-related loan losses – click to enlarge.

Since then several more banks, including the biggest ones, have stated that they will have to increase loan loss provisions for energy-related loans. ZH reported over the weekend that the Dallas Fed has reportedly advised banks not to “mark energy-related loan losses to market” and to try their best to work out problem loans in the sector without forcing borrowers into bankruptcy (i.e., they are to employ extend and pretend tactics, presumably in the hope that oil prices will recover sooner rather than later). As Mish points out though, given that mark-to-market accounting has essentially been repealed in early 2009 already, the former advice seems superfluous.

Leave A Comment