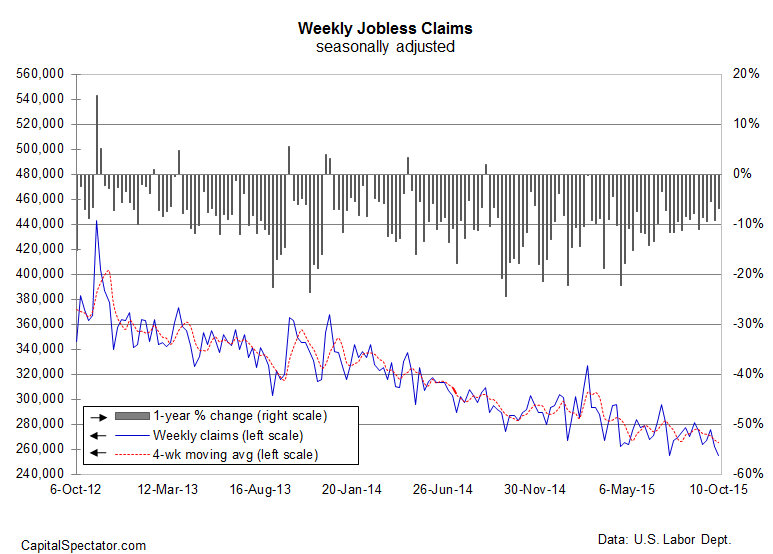

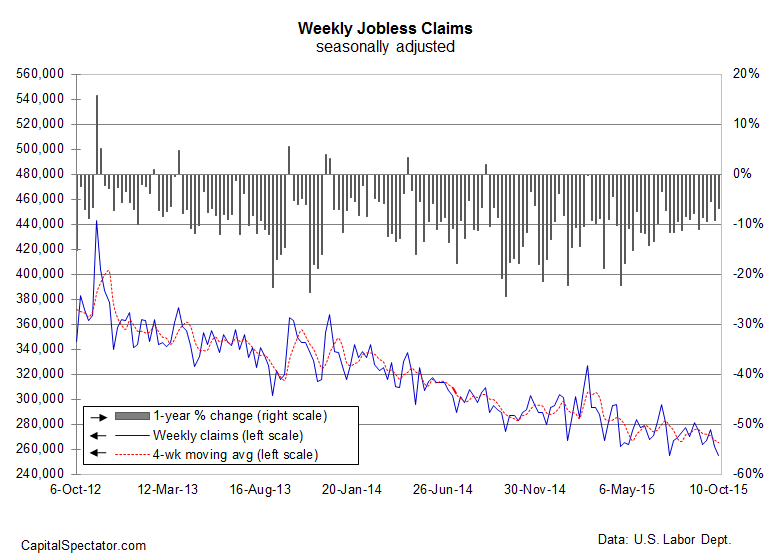

The ongoing decline in jobless claims looks too good to be true, and by some accounts that’s all that you need to know. The historical record tells us otherwise, but if the bullish signal embedded in the low number of new filings for unemployment benefits is misleading. as implied by Challenger’s estimate of rising job cuts, we’ll know soon enough. Meantime, the Labor Department reports that claims fell last week to a seasonally adjusted 255,000–the second time since July that claims have touched a 42-year low. Taken at face value, the numbers imply that the weak pace of growth in payrolls in recent months will soon perk up.

“These numbers are pretty impressive,” Brian Jones, senior U.S. economist at Societe Generale, opines via Bloomberg. “Both the initial and continuing claims numbers are consistent with the fact that we have a labor market that’s fairly tight and continues to improve.”

The trend certainly looks convincing on a year-over-year basis. Claims continue to fall at a robust pace vs. the year-earlier level. Last week’s filings dropped 9% vs. the same week from a year ago. The trend in claims, in other words, is still flashing a bullish message for payrolls.

There was also some upbeat news in Bloomberg’s weekly update of the mood on Main Street. The Consumer Comfort Index inched higher for the fourth straight week through Oct. 10. The five-point rise over past four-week period is the biggest advance for any comparable period in six years, Bloomberg reports. The upbeat numbers hint at the possibility that consumer spending will remain steady and perhaps strengthen as we head into the holiday spending season.

On the dark side is manufacturing. Today’s updates from the New York and Philadelphia Fed banks offer an early look at the October data for this sector and the numbers continue to show a bearish trend. Although the headline indexes in both cases reflected a slightly softer rate of descent, it’s clear that deceleration (or worse) is still the path of least resistance for manufacturing.

Leave A Comment