Inquiring minds are investigating a 17 page PDF of the U.S. Economy in a Snapshot by the New York Fed.

The document is formatted poorly. Nearly every line is an image, requiring retyping or images snips of what appears to be (and should be) text.

Here are some image snips along with my comments.

Overview

Mish Comment: Manufacturing is in a recession, inventories are too high, consumer spending is weak, autos are unsustainable and employment is a severely lagging indicator. The “fundamentals” are poor and sentiment is essentially useless.

Mish Comment: Inflation expectations are another totally useless idea, at least within normal bounds. At the point of hyperinflation, when people will buy anything to get rid of money, expectations have some meaning. There are signs of wage growth, but that will hurt profit margins and employment as spending stalls.

Output, Natural Unemployment Rate

Mish Comment: The natural rate of unemployment is that which would exist in a free market without interference from the Fed, from governments, from tariffs, etc. It’s downright idiotic to pretend to know what the natural rate is, in any environment, let alone the highly manipulated state of affairs of today. Similarly, it is equally ridiculous to propose potential GDP levels.

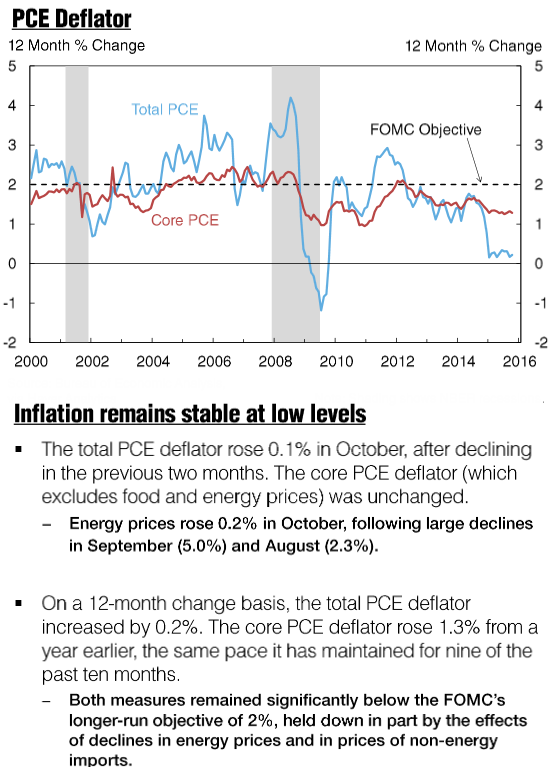

PCE Deflator

Mish Comment: Price inflation (not monetary inflation) is subdued due to lack of demand, overcapacity, debt, beggar-thy-neighbor devaluation tactics, demographics, etc.

Falling oil prices are a symptom, not a cause of price deflation.

Manufacturing and ISM

Mish Comment: The manufacturing recession is far more problematic than the Fed realizes.

Disposable Income, Consumption

Mish Comment: A rising savings rate is a healthy thing, but the Fed will not see it that way.

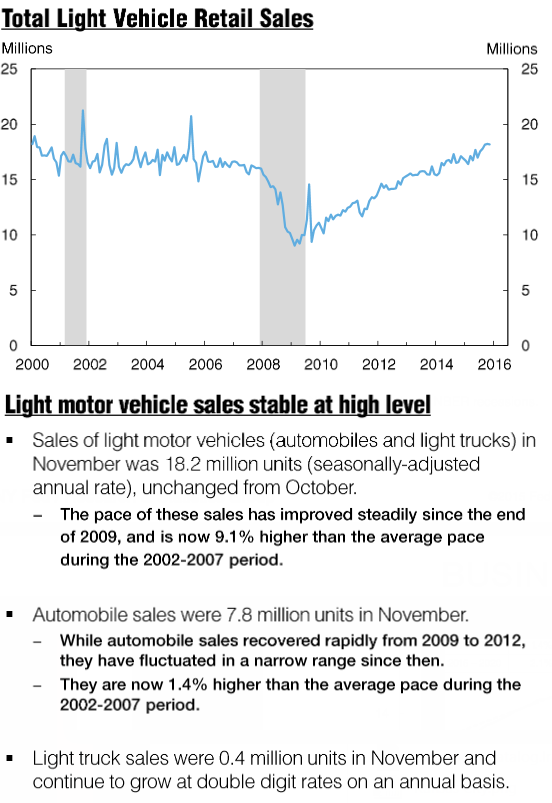

Motor Vehicle Sales

Mish Comment: The missing key words are in quotes at the end of this sentence: Motor vehicle sales are stable at high levels “for now”. There is no pent up demand for autos, and autos were one of the few consistent bright spots during the recovery. But inventories are high and rising while sales are weakening. In reality, this spinning top is starting to look rather wobbly.

Leave A Comment