This week, the Institute for Supply Management released their manufacturing and service sector indexes. Both were generally positive and each contained bullish anecdotal comments. While the service number declined a few points, it fell to a still very positive 55.2. Production and new orders were also off a bit, but each is still high (58.9 and 58.9, respectively). The only weakness came from employment which fell to 51.6. The manufacturing number also fell slightly, moving .5 lower to 57.2.17 of 18 sectors reported growth. Increasing inflationary pressure was the concerning data point.

Auto sales were down 5% M/M. As this chart from Calculated Risk shows, it appears this metric may be moving sideways for the near future:

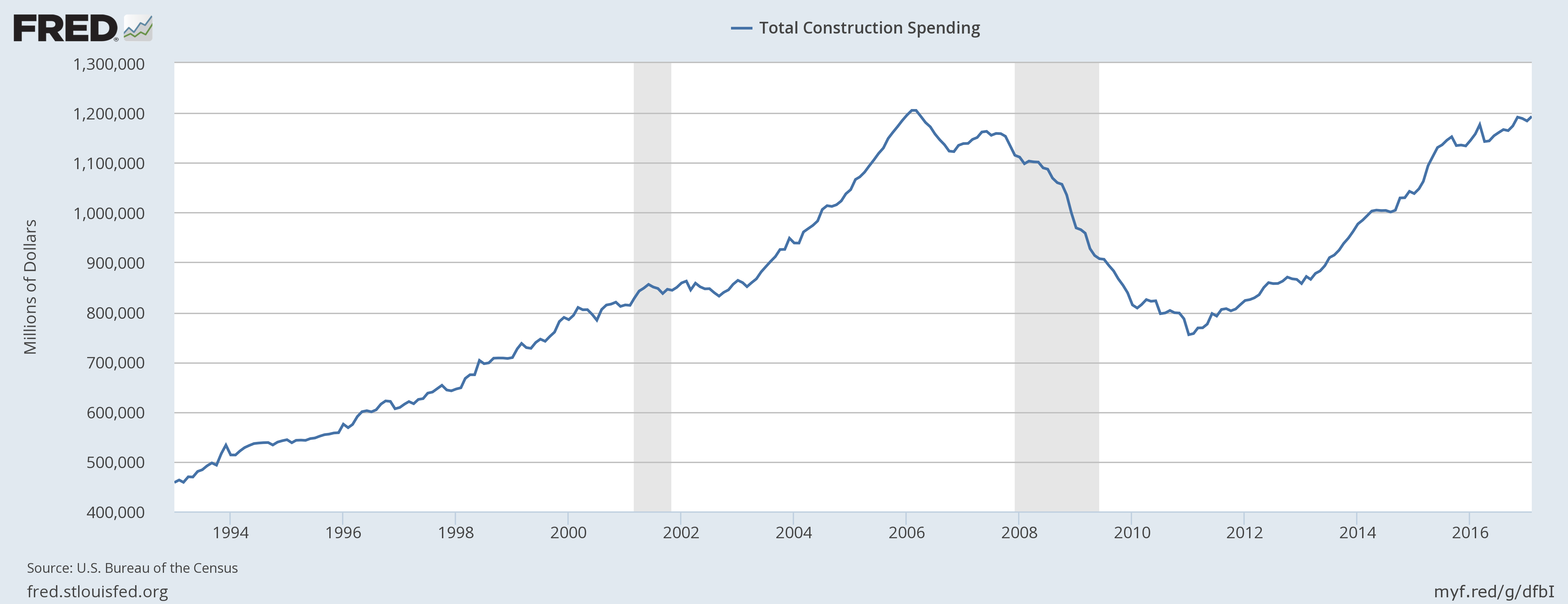

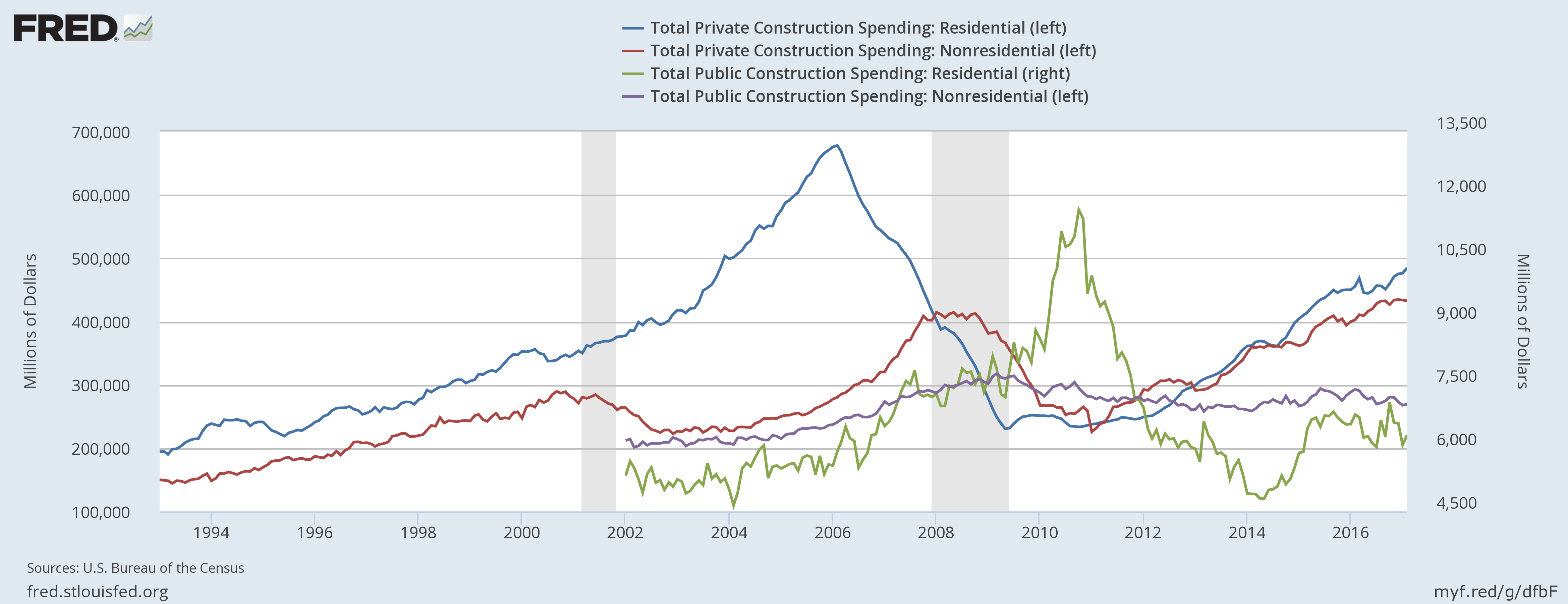

Construction spending rose .8% M/M and 3% Y/Y:

The top chart shows the composite number.While the chart continues to rise, the pace of increase is slowing a bit. The bottom shows the largest sub-sectors. Residential (in blue) and nonresidential (in red) are both in a solid uptrend that started in 2011. Public spending (in purple) has slightly decreased since the end of the recession.

Friday’s employment report was disappointing, especially in light of 269,000 ADP report. It was reported that total establishment jobs increased a paltry 98,000. Moreover, they decreased January’s and February’s report by a combined total of 38,000. In March’s report, there were large drops in construction, retail and education/health. Retail is understandable – Amazon and other online sources continue to force the sector through a massive upheaval.However, construction and health hiring is a bit more concerning. Earnings are up 2.7% Y/Y.

Economic Conclusion: this week’s economic news was generally bullish. Both ISM reports paint a rosy picture of their respective sectors. The construction spending report shows some level of fixed investment continues. On the other hand, the employment report was an economic curve ball, especially compared to the very bullish ADP numbers earlier in the week. But this is not the first time during this expansion that we’ve seen 1 month of very weak establishment job growth:

Leave A Comment