There was little meaningful economic news for the US this week. So, in this column, I’ll take a look at the long-term chart of various averages along with other measures of market breadth. The charts will show that the market continues to weaken, meaning, at best, we’ll see consolidation around current price levels.

Let’s start with a look at the SPYs weekly chart:

Starting in 2Q15, the SPYs hit resistance in the 210-212 area. They sold off to ~180 in 3Q15, rallied to near previous levels and then sold-off again at the beginning of the year. The area highlighted in green shows that prices are generally consolidating in the 180-210/212 price area. However, momentum is declining and prices are weaker.

Let’s combine that information with weekly charts of the mid-cap and small-cap sectors:

The IJHs (mid-cap, top chart) and IWMs (small-cap, bottom chart) have the exact same price characteristics. Starting in 2Q15, each printed lower lows and lower highs, which is a classic market sell-off pattern. And like the SPYs, momentum (the MACD) is weaker.Price strength for both, however, is picking up a bit, with both RSIs ~50.

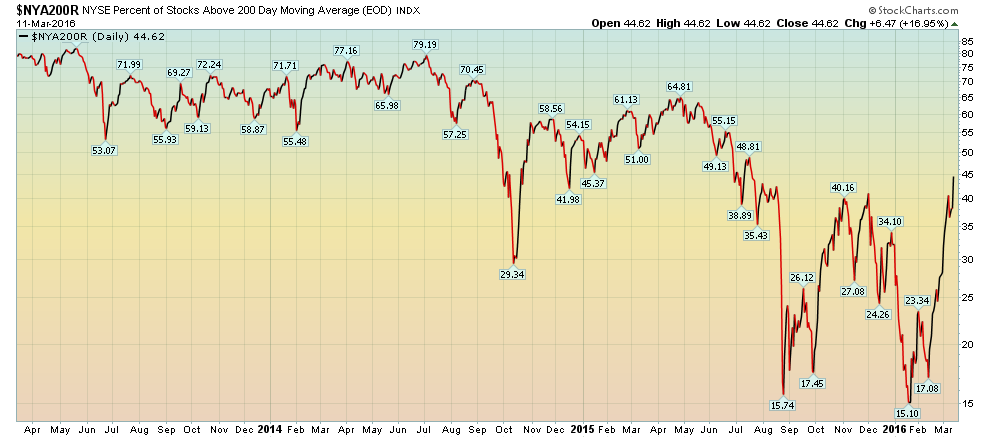

Now, let’s turn to several broader indicators:

The top chart shows the number of NYSE stocks above their respective 200 day EMAs while the lower shows the number above their respective 50 day EMAs. The former level is 45 while the latter is 85. This indicates two key points. First, more stocks are below their respective 200 day EMAs than above.This explains why the number of stocks over their 50 day EMA is higher than those of their 200 day EMA. Second, the high level of stocks above their 50 day EMA indicates this latest rally is probably nearing the end.

Let’s look at the same charts for the Nasdaq:

While the respective percentages for both indicators is different, the conclusion is the same: a large number of Nasdaq equities are below their respective 200 day EMAs. And, with a fairly high percentage of stocks (69%) over their 50 day EMA, this latest rally is probably nearing its end.

Leave A Comment