European, Asian stocks and S&P futures are all up again in early trading, a repeat of the Monday session, buoyed by a generally upbeat corporate earnings season, rising economic confidence and signs of improvement in the world’s biggest economies.The Bloomberg Dollar Spot Index held near its highest level since March as fed fund futures prices Monday indicated there’s a 71 percent chance of a rate increase this year, up from 68 percent last week. The dollar rose after Chicago Fed President Charles Evans said it’s likely that interest rates will be hiked three times by the end of 2017 (although one year ago we were supposed to get 4 rate hikes in 2016).

“If we look at the health of the U.S. economy, it just makes absolute sense to hike in December,” said James Woods, a strategist at Rivkin Securities in Sydney. While stocks may head higher, “it would not be a significant rally until we get the U.S. presidential election and rates out of the way,” he said.

Factory surveys in the United States and Europe had boasted the best readings of the year so far on Monday and a six-month high for Japanese stocks in Tokyo overnight had followed a record close for the tech-heavy U.S. Nasdaq. European markets started with Germany’s Dax nudging its highest level of the year as the closely-watch Ifo sentiment survey beat expectations a day after purchasing manager numbers had done the same.

“We are seeing a pick up of economic activity against the backdrop of only one central bank — the Fed — that is likely to tighten policy and that is supporting asset markets,” said CMC Markets senior analyst Michael Hewson.

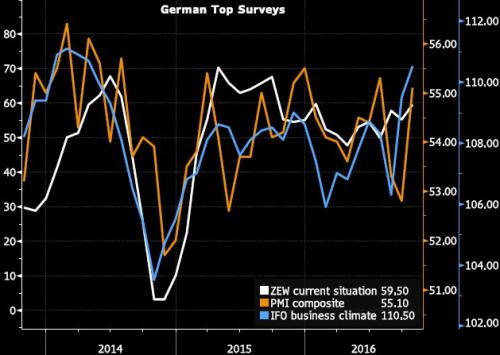

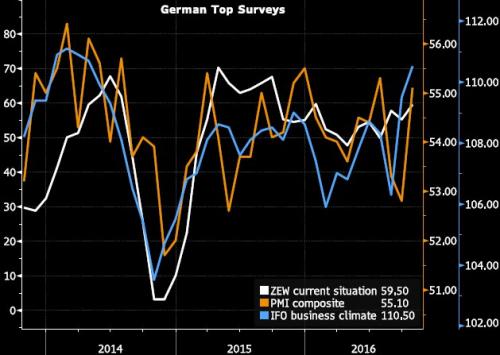

German business confidence rose to a 2 year high after the German IFO business climate survey rose +1.0pt in October, rising from 109.5 to 110.5. Today’s print builds on the strong gain in the previous month and takes the level of the IFO to the highest it has been since April 2014. Yesterday’s PMI also showed robust improvement in Germany. As the following chart shows, the various German confidence indices are on a tear recently after yesterday’s stronger than expected PMI data. Now if only hard data can confirm the booming “soft” surveys.

x

Attention has turned to commodities, and especially the metals complex, after iron ore surged by the daily 6% limit on China’s Dalian Commodity Exchange, and rising steel prices in China spurred a rally from aluminum to zinc. This boosted the currencies of resource-exporting nations, with South Africa and Australia leading gains versus the dollar.

Industrial metals have gained steadily this year with an index of London Metal Exchange contracts poised for the first annual increase since 2012 as a pickup in manufacturing in the U.S. and euro area point to an economy that’s getting more robust. A report Tuesday showing German business sentiment rose to the highest level in more than two years in October added to the sense of optimism.

“We’ve had a whole host of better-than-expected manufacturing data,” said Ole Hansen, the head of commodity strategy at Saxo Bank A/S in Hellerup, a Copenhagen suburb. “Strong gains in China, led by steel and iron ore, are supporting the sentiment, which in turn has attracted increased speculative trading across the metals space.”

What is curious is that the recent bout of strength – compounded with a lack of market volatility – comes at a time when the Chinese currency is plunging again, and just yesterday the offshore traded Yuan tumbled to the lowest on record since it began trading in 2010. The onshore exchange rate declined in all but one of this month’s 11 trading sessions through Monday, a sign the central bank has reduced support since the currency’s inclusion in the International Monetary Fund’s Special Drawing Rights on Oct. 1. Confused traders are wondering if this time really is different or if the market will simply react to this latest sign of deterioration in China’s fund flows with its usual delayed reaction time.

The Stoxx Europe 600 Index headed for its strongest close in three weeks as earnings reports fueled optimism about the profitability of the region’s companies. Spanish and Italian bonds outperformed top-rated German bunds as the region’s improving political and economic outlook sapped demand for haven assets.

The Stoxx 600 rose 0.1 percent, with miners leading gains; 14 out of 19 Stoxx 600 sectors rise with basic resources, banks outperforming and autos, health care underperforming; 59% of Stoxx 600 members gain, 40% decline. Orange SA led the charge among telecommunications stocks, adding 4.7 percent after posting an increase in quarterly profit. Randstad Holding NV rose 1.2 percent after announcing better-than-estimated revenue and saying growth trends were resilient across regions. Luxottica Group SpA jumped 7.7 percent after the maker of Ray-Ban sunglasses said sales growth will accelerate in 2017.

S&P 500 Index futures climbed 0.2%. U.S. equities added 0.5 percent on Monday as deal activity boosted sentiment. Earnings remain in focus this week. Visa Inc. (V) posted higher-than-expected profit after the close, and investors will be looking Tuesday to reports from Procter & Gamble Co. (PG) and General Motors Co. (GM) for indications of the health of corporate America. Caterpillar Inc. (CAT) is among companies scheduled to release earnings that may provide more insight on the sustainability of the recovery in energy and mining. Apple Inc. (AAPL) is due to announce earnings after markets close Tuesday.

In rates, the yield on Italian 10-year bonds declined two basis points to 1.37%, while Spanish 10Y bonds fell three basis points to 1.08%. The yield on benchmark German bunds fell one basis point to 0.17%. Yields on Treasuries due in a decade were steady at 1.76%, after climbing three basis points on Monday. U.S. yields will have to rise if Evans proves to be correct in his 3 rate hikes predictions for 2017, according to Kim Youngsung, head of overseas investment at South Korea’s Government Employees Pension Service in Seoul.After one increase “for sure” in December, two more in 2017 will send the 10-year yield past 2.5 percent, Kim said. Economists predict the benchmark will end next year at 2.14 percent, according to a Bloomberg survey with the most recent forecasts given the heaviest weightings. Japan’s 20-year government bonds rose for a fourth day after demand picked up at an auction of the securities on Tuesday. The yield fell 1/2 a basis point to 0.37 percent, matching its lowest level of the past three weeks.

Leave A Comment