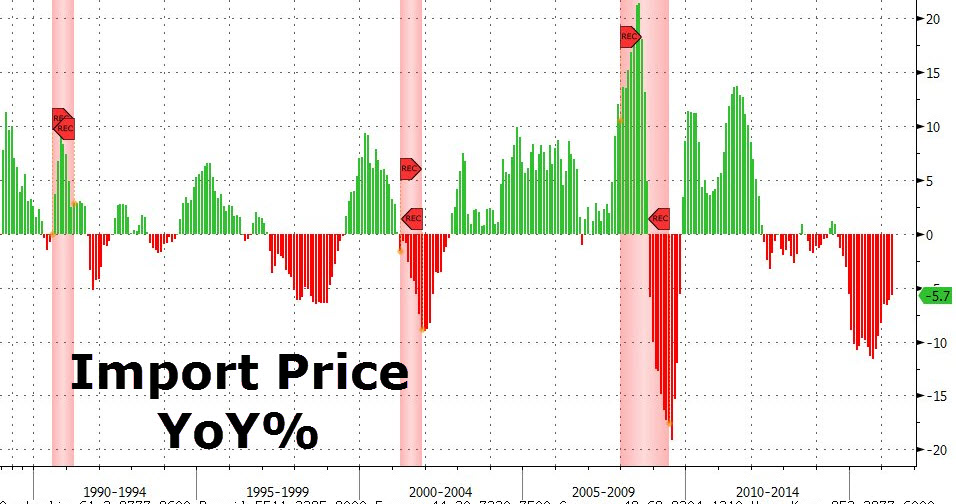

For a near record 21 months in a row, US Import Prices dropped in April compared to last year (down a worse than expected 5.7% YoY, and rising only 0.3%, less than the 0.6% expected rebound from March) with China exporting deflation at the fastest pace since 2009.

Looking at the breakdown, while a major culprit for the collapse in imported deflation remains sliding energy prices, it wasn’t the only reason for the slowdown as imports ex-fuel and food fell a notable 2% Y/Y in April. Additionally, industrial supplies prices rose 1.5% after rising 2.7% in March; capital goods prices fell 0.1% after falling 0.1% in March; consumer goods prices fell 0.3% after falling 0.3% in March.

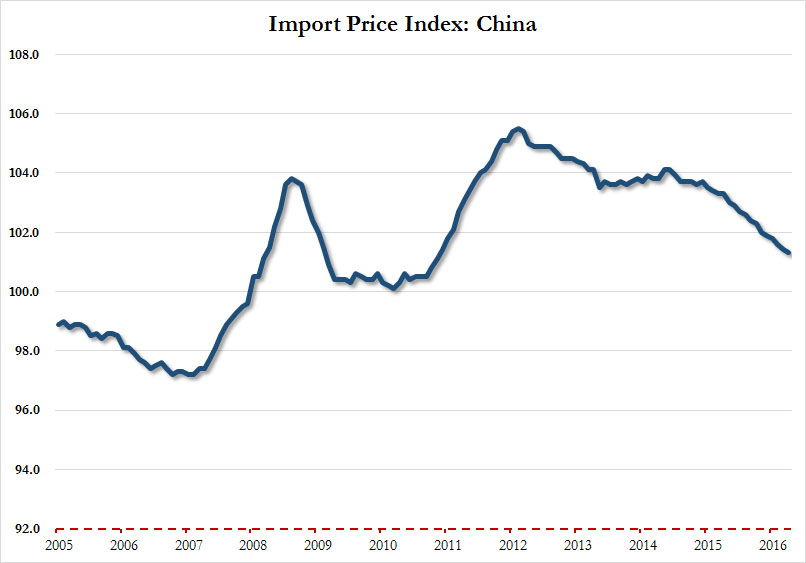

As for the biggest culprit, it remains a well-known one: China. Acording to the BLS, China’s import price index dropped again, sliding from 101.4 to 101.3, the lowest print since 2010…

… while the annual rate of change was a -1.9%, the biggest decline since 2009.

For all the bluster about Chinese inflation picking up, it appears it is mostly in pork and domestic commodity prices. The prices of everything else continues to drop.

Leave A Comment