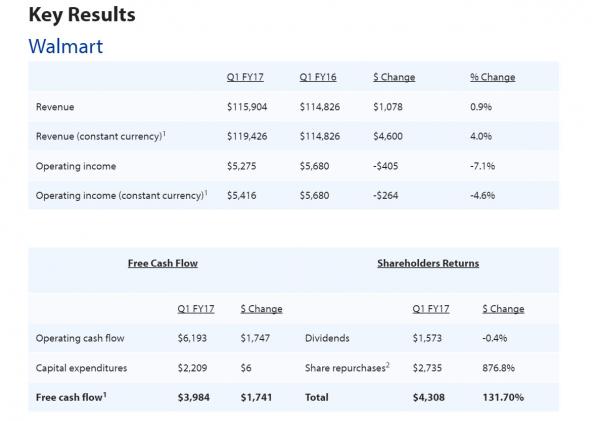

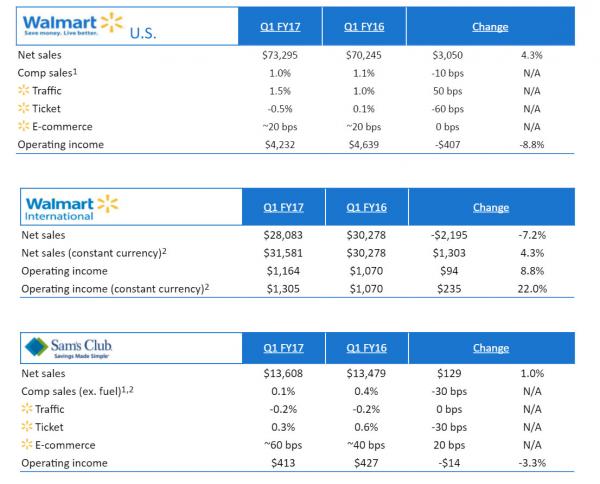

In what is the traditional end to earnings season, moments ago the second biggest employer in the US after the government, Walmart (WMT) reported results which after several quarters of disappointment solidly beat expectations, reporting Q1 EPS of $0.98 (down 4.9% Y/Y), higher than the $0.88 expected even as revenue of $115.9 billion (up 0.9% Y/Y) missed expectations of $133.3 billion. However, the reason the stock is soaring over 8% in the premarket is WMT’s big beat in comp stores, which same store sales rising 1.0%, double the 0.5% expected, driven by the sixth consecutive quarter of positive traffic, up 1.5%. Comps ex-fuel rose 0.8%, also double the 0.4% expected.

It wasn’t all good: operating income tumbled 7.1% to $5.2 billion (down -4.6% in constant currency even though the dollar was weaker in Q1 Y/Y). This however was offset by a surge in Free Cash Flow, which rose by $1.7 billion to $4 billion in Q1.

The full breakdown of WMT results by division is shown below:

Perhaps one of the reasons for the dramatic improvement in margins is the loss of quality control, because in the official press release the company was so excited to release its report it was unable to even do a rudimentary spell-check.

That said the guideance was good, and the company expected to report Q2 EPS of $0.95-$1.08, above the $0.98 expected.

“We are proud of the overall results in the first quarter, and there is momentum in many parts of the business. Based on our views of the global operating environment, and assuming currency exchange rates remain at current levels, we expect second quarter fiscal 2017 earnings per share to range between $0.95 and $1.08,” said Brett Biggs, Wal-Mart Stores, Inc. executive vice president and CFO. “Additionally, we expect comp sales for Walmart U.S. to be about +1.0 percent, and Sam’s Club, without fuel, to be slightly positive for the 13-week period ending July 29, 2016,” added Biggs.

Walmart also announced that it spent $4.3 billion in buybacks and dividends in the quarter, even as it created $4.0 billion in Free Cash Flow.

Leave A Comment