The probability that a recession has started is virtually nil at the moment, but it’s debatable if low macro risk will deliver robust growth in the preliminary estimate of first-quarter US GDP release that’s due on Friday.

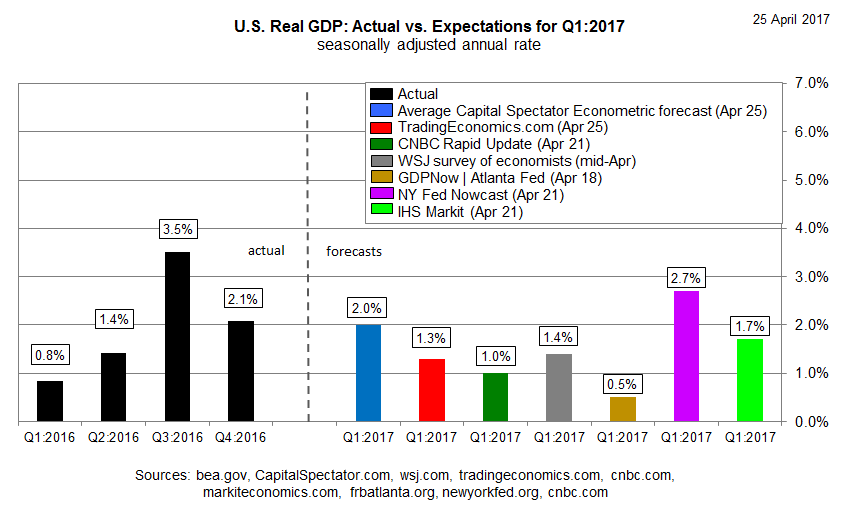

Projections are wide ranging for what the Bureau of Economic Analysis will report at the end of the week. On the low end of the spectrum is a 0.5% estimate for Q1 output via the Atlanta Fed’s GDPNow model (as of Apr. 18) – a sharp slowdown from the 2.1% increase in last year’s Q4. By contrast, the New York Fed’s 2.7% econometric estimate (Apr. 21) sees a moderate pickup in economic activity.

Recent surveys of economists are roughly in the middle of those two outliers. This month’s estimate via The Wall Street Journal, for instance, calls for a 1.4% advance, based on the average forecast. The average in CNBC’s Rapid Update survey (Apr. 21) is a bit lower at 1.0%.

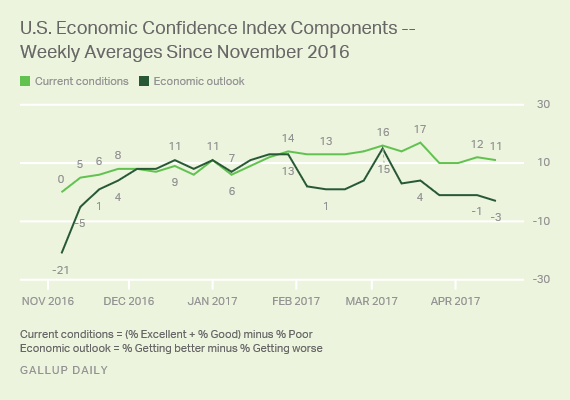

The public’s opinion of the US economy remains upbeat, but Gallup noted recently that its US Economic Confidence Index has been dipping lately. “Economic confidence is back to where it was shortly after President Donald Trump won the election in mid-November, when the index hit +4 due to surging Republican optimism,” the survey firm reported last week, based on data for the week ending Apr. 16.

Yesterday’s surge in the US stock market, however, holds out the possibility that economic sentiment will perk up again. The S&P 500 jumped more than 1% yesterday, moving close to its record high, suggesting that animal spirits may reviving.

But an old debate endures, namely: Will the real economy catch up with rosy expectations? Hope springs eternal (again) in the stock market, but the latest business survey numbers from Markit Economics leaves room for doubt. The implied GDP growth rate for Q1 is expected to dip to 1.7% in Friday’s update, based on the Composite PMI, and the slide is on track to persist in Q2, based on the preliminary figures for the current quarter.

Leave A Comment