A Surprise Rout in the Bond Market

At the time of writing, the stock market is recovering from a fairly steep (by recent standards) intraday sell-off. We have no idea where it will close, but we would argue that even a recovery into the close won’t alter the status of today’s action – it is a typical warning shot. Here is what makes the sell-off unique:

30 year bond and 10-year note yields have broken out from a lengthy consolidation pattern. This has actually surprised us, as we felt that the large speculative net short position in bonds and notes was prone to trigger a short covering rally. Alas, the opposite has happened.

Since the 1998 Russian crisis, the prices of stocks and bonds have been negatively correlated most of the time (note that they were positively correlated from 1942 to 1998, so the negative correlation is a fairly recent phenomenon from a longer term perspective). We did not really expect bond yields to break out, mainly due to the legacy CoT report, which recently looked as follows:

According to the legacy CoT report, large speculators recently held a record high net short position in 10-year treasury note futures. Usually these traders are wrong at extremes.

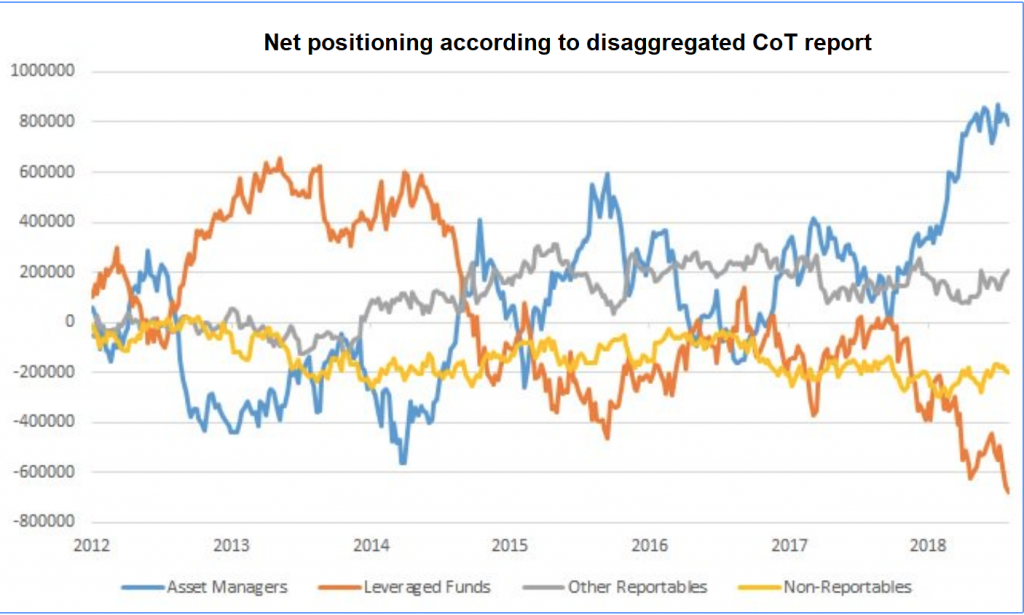

It is of course possible that the breakout in yields turns into a “false breakout”, in which case this position would be quickly unwound. However, in a recent post by Macro Tourist (Kevin Muir) it was pointed out that the disaggregated CoT report indicates the situation is not as simple as it appears at first glance. Here is a chart illustrating the disaggregated data:

Net positioning in treasury futures by trader group according to the disaggregated CoT report – asset managers actually hold a very large net long position – only leveraged funds and non-reportables (small speculators) hold large net short positions.

In other words, the breakout could easily be “legit” and yields may have even more upside from here (perhaps after a retest of the breakout).

Leave A Comment