2016 was the year when, in the aftermath of the Fed’s first tightening cycle in a decade, the yield curve was supposed to not only rise substantially but also steepen, providing a much needed NIM arbitrage for commercial banks. That has not only not happened, but as a result of the Fed’s relent according to which the Fed will no longer hike 4 times in 2016 but at peast 2, and according to the market 0, yields have tumbled.

Which brings us to a fascinating report by Citi’s Vikram Rai in which the rates strategist tries to find if there is any upside to Treasury yields and is unable to find any. This is what he says.

More than 4 months have passed since lift-off and the first rate hike was largely transmitted to most money market rates (with T-bills rates being the occasional exception). But now, the prospect of another hike this year seems to be diminishing with the steady stream of underwhelming economic data, though Citi Economists believe that one more hike is likely this year.

While we await the next hike (whenever that may be), we search for factors which might influence yields higher in the short term markets. But, after examining the technicals in the G10 fixed income sector, this search seems like a fool’s errand.

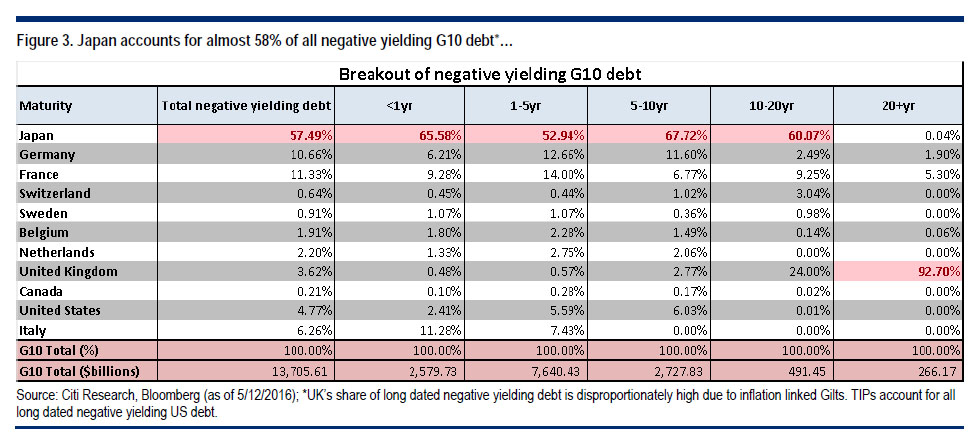

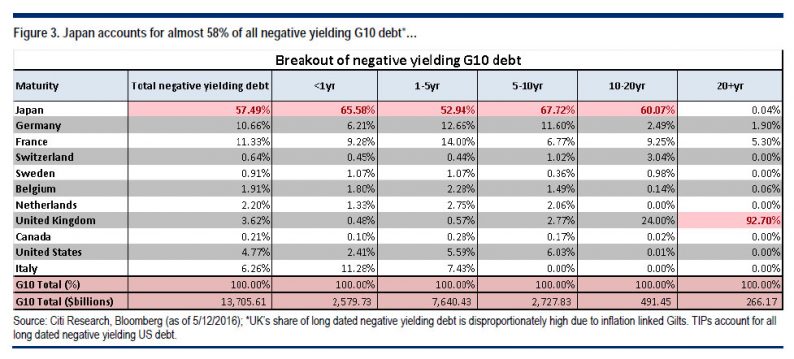

However it is what Rai finds next that is absolutely stunning. According to Citi, the technicals that the report refers to are the rising proportions of negative yielding debt in the G10 fixed income sector; at present there is about $39 TR of outstanding G10 debt (Figure 3). Negative yielding G10 debt has jumped to $13.7 TR and accounts for 35% of all G10 debt. In this, the proportion of short-term debt is rising quite fast and about $2.6 TR of negative yielding G10 debt is in the 0 < 1YR sector.

As shown in the table above, Japan accounts for almost 58% of all negative yielding debt followed by France (11.33%) and Germany (10.66%). UK’s share of long dated negative yielding debt is disproportionately high due to inflation linked Gilts. And, TIPs account for all long dated negative yielding US debt because most short and intermediate maturity TIPs trade at negative real yields.

Leave A Comment