What could go wrong?

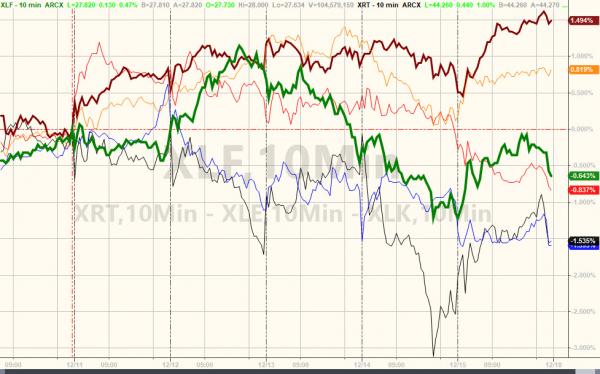

Small Caps exploded higher today, driven by financials, presumably on tax reform hype.. but after Bob Corker said “yes” there was some notable “sell the news”…

On the week, Nasdaq (green) and Dow (red) outperformed as Trannies (blue lagged)…

Tech outperformed on the week but financials lagged…

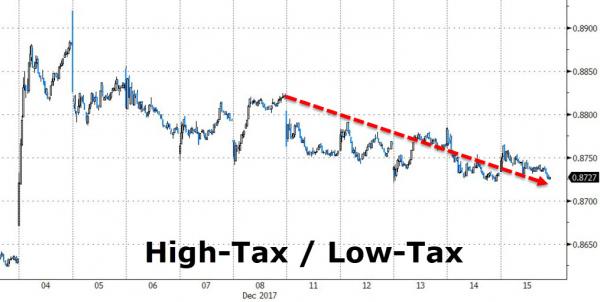

Oddly, high-tax companies notably undeperformed low-tac companies on the week….

High yield bonds lagged notably on the week…

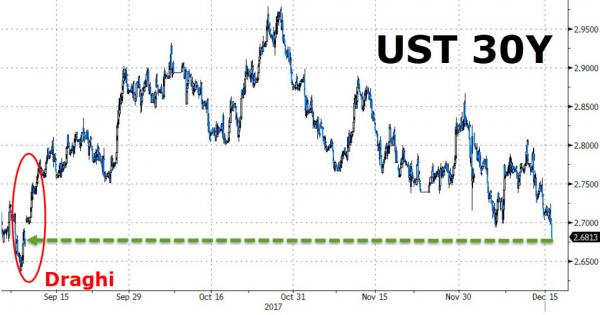

Yields were mixed on the week with the short-end higher and long-end outperforming…

30Y Treasury yields are at their lowest since September’s Draghi taper tantrum…

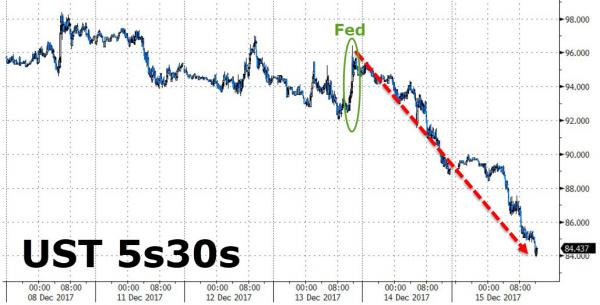

The 5s30s yield curve crashed 10bps this week to 52bps (the last two days post-Fed have seen the biggest curve flattening since June 2009)…

The weekly plunge is the biggest percentage flattening of the Treasury curve since the US downgrade in the fall of 2011…

The yield curve is down 5 straight weeks

The Dollar ended the week modestly lower, after chopping around on The Fed and tax headlines (and CPI)

Huuge week for copper but crude ended the week lower…

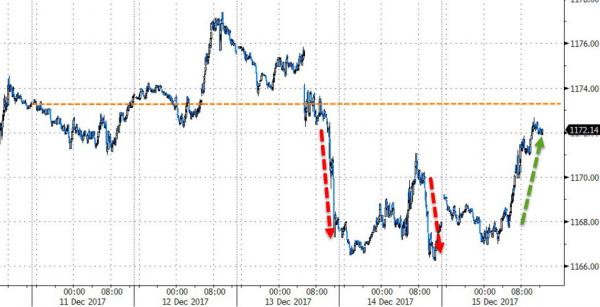

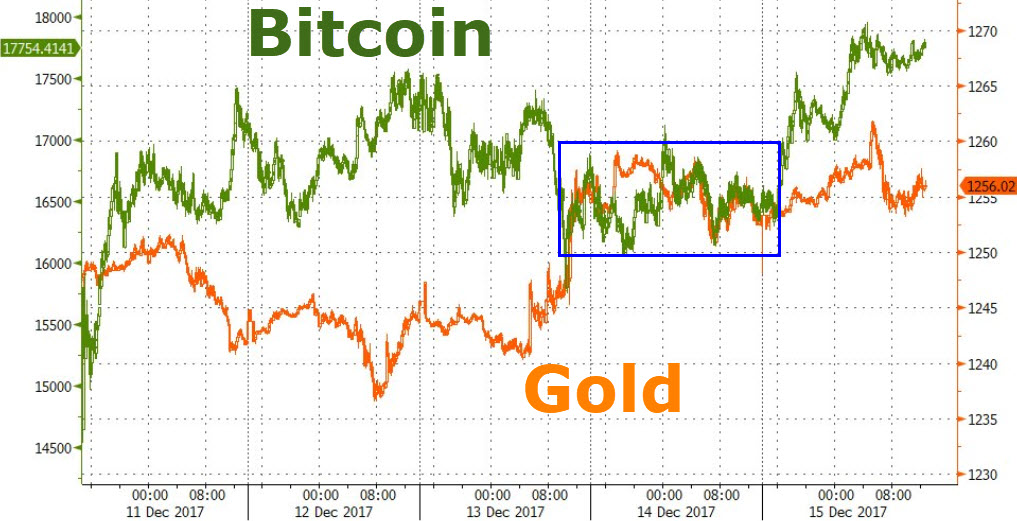

Bitcoin rose 13.5% this week – the 5th weekly gain in a row to a new record high…and gold managed to hold gains…

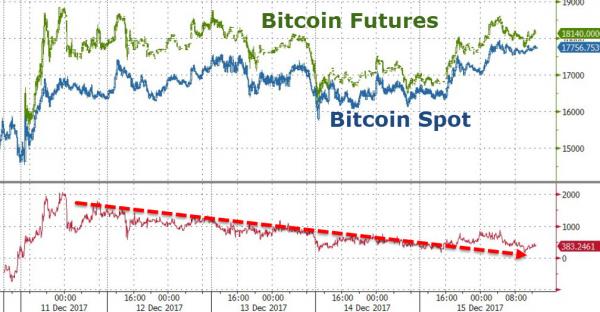

And Futures compressed their premium to spot…

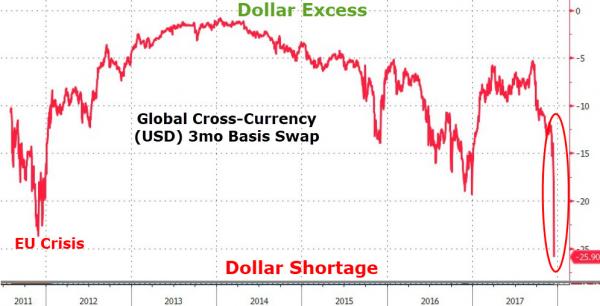

And finally, there is a very serious dollar shortage around the world…signalling ominous signs of growing funding stress in the financial “plumbing”.

Leave A Comment