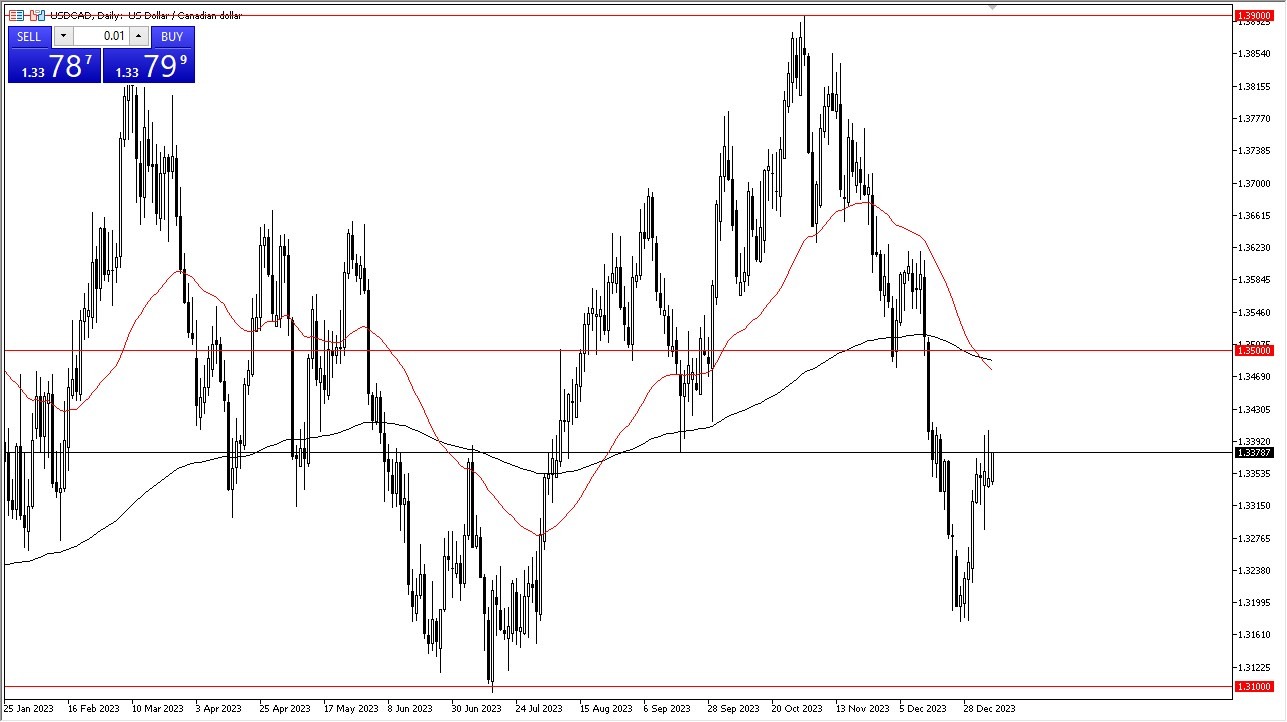

In the short term, I’ll be looking at the 1.34 level and seeing whether or not we can break out to offer another 100 pips to the upside.

It’ll be interesting to see how this plays out. It’s probably going to be tied to the crude oil market. And the fact that although the Federal Reserve is likely to cut rates, signaling that perhaps they’re worried about the economy, the reality is that the Canadian economy is essentially parasitic to the US economy, meaning that the Canadian economy is highly levered to what’s going on in its southern neighbor, the trade between the two countries is pretty extreme. Anybody who’s been to the Ambassador Bridge or especially the Peace Bridge in Buffalo can tell you just how many semi-trucks there are. So, if the United States has economic trouble, the Canadian economy does. And therefore, traders tend to punish the Canadian dollar due to the inability to export. We’ll have to see how this plays out.  Short-termIn the short term, I’ll be looking at the 1.34 level and seeing whether or not we can break out to offer another 100 pips to the upside. That being said, keep in mind that the USD/CAD does tend to be rather choppy, so you have to be very patient. It is a scenario where the US leads the way and Canada follows. After all, if you are a Canadian producer and your largest customer suddenly finds itself struggling, there’s no way your business will continue in the same way it had previously. Also, oil has that knock-on effect on the Loonie to begin with, even though the United States actually produces more than enough oil for itself but the correlation is still there.More By This Author:BTC/USD Forecast: Pulls Back From Major Resistance BarrierNASDAQ 100 Signal: Takes OffEthereum Forecast: Look For A Final Push

Short-termIn the short term, I’ll be looking at the 1.34 level and seeing whether or not we can break out to offer another 100 pips to the upside. That being said, keep in mind that the USD/CAD does tend to be rather choppy, so you have to be very patient. It is a scenario where the US leads the way and Canada follows. After all, if you are a Canadian producer and your largest customer suddenly finds itself struggling, there’s no way your business will continue in the same way it had previously. Also, oil has that knock-on effect on the Loonie to begin with, even though the United States actually produces more than enough oil for itself but the correlation is still there.More By This Author:BTC/USD Forecast: Pulls Back From Major Resistance BarrierNASDAQ 100 Signal: Takes OffEthereum Forecast: Look For A Final Push

Leave A Comment