Dollar/CAD dropped on the hawkish rate hike by the BOC but then climbed up as the greenback gained fresh strength. What’s next? The jobs report and GDP stand out. Here are the highlights and an updated technical analysis for USD/CAD.

The Bank of Canada raised interest rates as expected. Moreover, they decided to remove the word gradual from the statement and expressed optimism after the conclusion of a new trade deal in North America, the USMCA. This lifted the loonie. In the US, data was mixed: new home sales disappointed while pending home sales were up. Durable goods orders beat on the headline but missed on the core figure.

Updates:

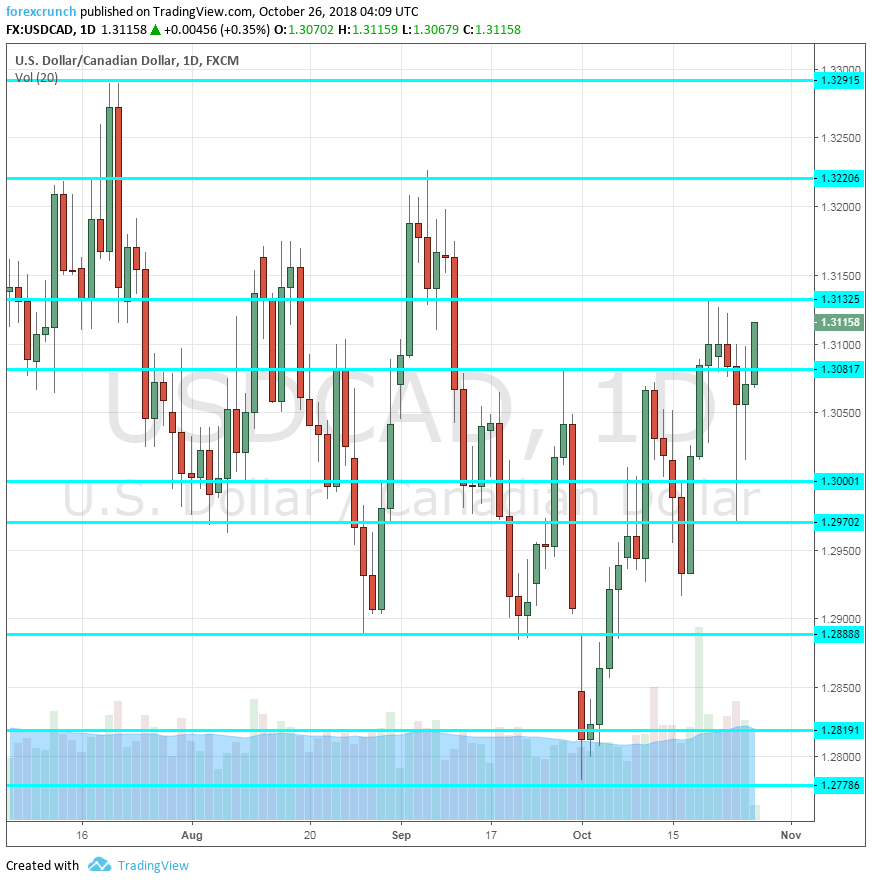

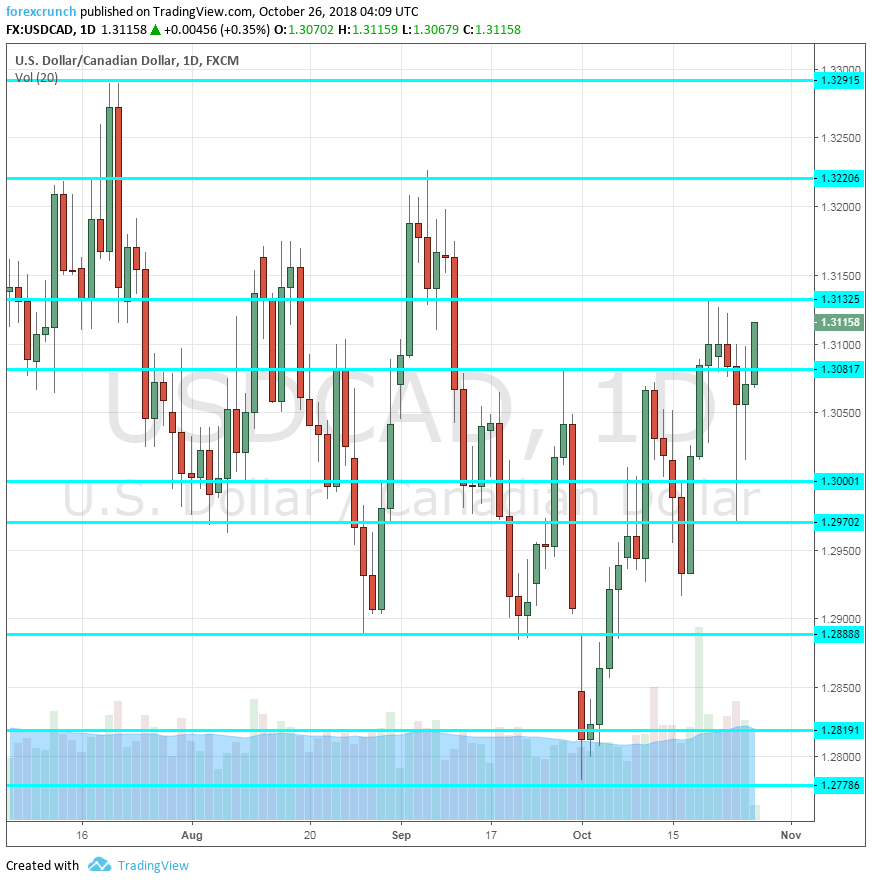

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

GDP: Wednesday, 12:30. Canada publishes GDP on a monthly basis, providing up to date data on the economy. The Canadian economy grew by 0.2% in July, the first month of Q3. The report for August could be similar. Uncertainty about NAFTA prevailed during the summer and may have caused a slowdown. The effects of the new trade deal, called the USMCA, will be seen only in Q4.

RMPI: Wednesday, 12:30. The Raw Materials Price Index is important for Canada and its energy exports. The RMPI dropped by 4.6% in August. September may see a bump up. The indicator is quite volatile.

Manufacturing PMI: Thursday, 13:30. Markit’s purchasing managers’ index for Canada’s manufacturing sector stood at 54.8 points in September. This reflects OK growth. The 50-point threshold separates expansion and contraction. The number could rise now, after the USMCA deal.

Jobs report: Friday, 12:30. Canada’s jobs reports have been volatile of late. The Canadian economy gained no less than 63.3K positions in September, but it was accompanied by slower wage growth. The unemployment rate dropped back below 6% to 5.9%. Apart from the headline numbers, it is important to watch the composition of the changes: part-time vs. full-time positions.

Trade Balance: Friday, 12:30. Somewhat overshadowed by the jobs report, Canada’s trade surplus seen in August may not prevail for another month. The previous months saw significant deficits, making the 0.5 billion surplus a rare feat.

Leave A Comment