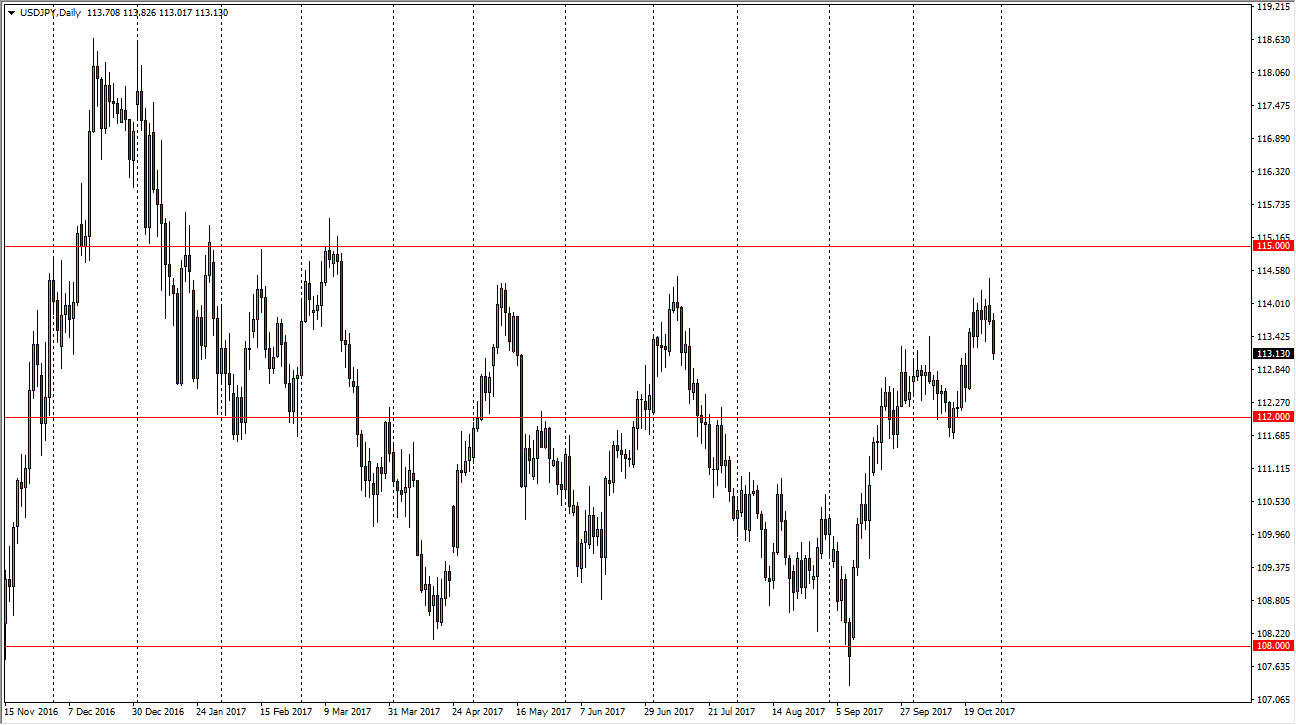

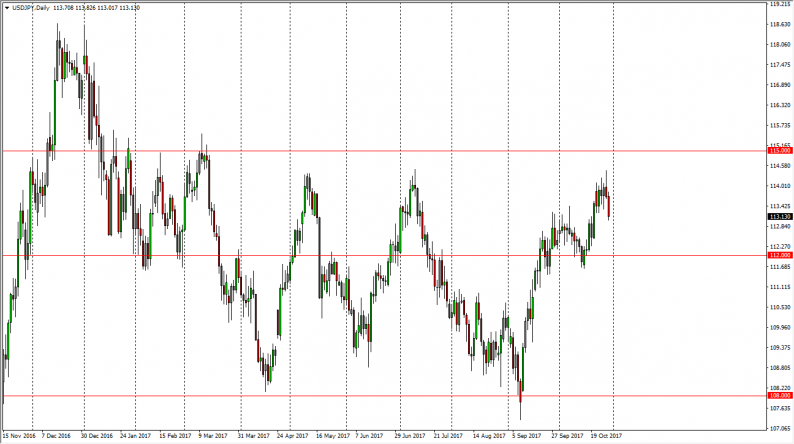

USD/JPY

The US dollar initially tried to rally during the day on Monday but rolled over significantly. Because of that, it’s likely that we will reach towards the 113 handle, and then eventually the 112-handle underneath. I think that the market should continue to see a lot of volatility, as this pair tends to be most times. I think that there is more value to be found at the 112 level, and I like the idea of buying down at that lower level. The 114.50 level extends to the 115 handle as resistance. Pay attention to the ZN futures market, as interest rate differential does come into play. If the 10-year note starts to sell off, that means we are getting higher interest rates in the United States, and that almost always means of this pair goes higher. It also has a bit of a risk appetite factor to it, so if stock markets rally, that can quite often help this market as well.

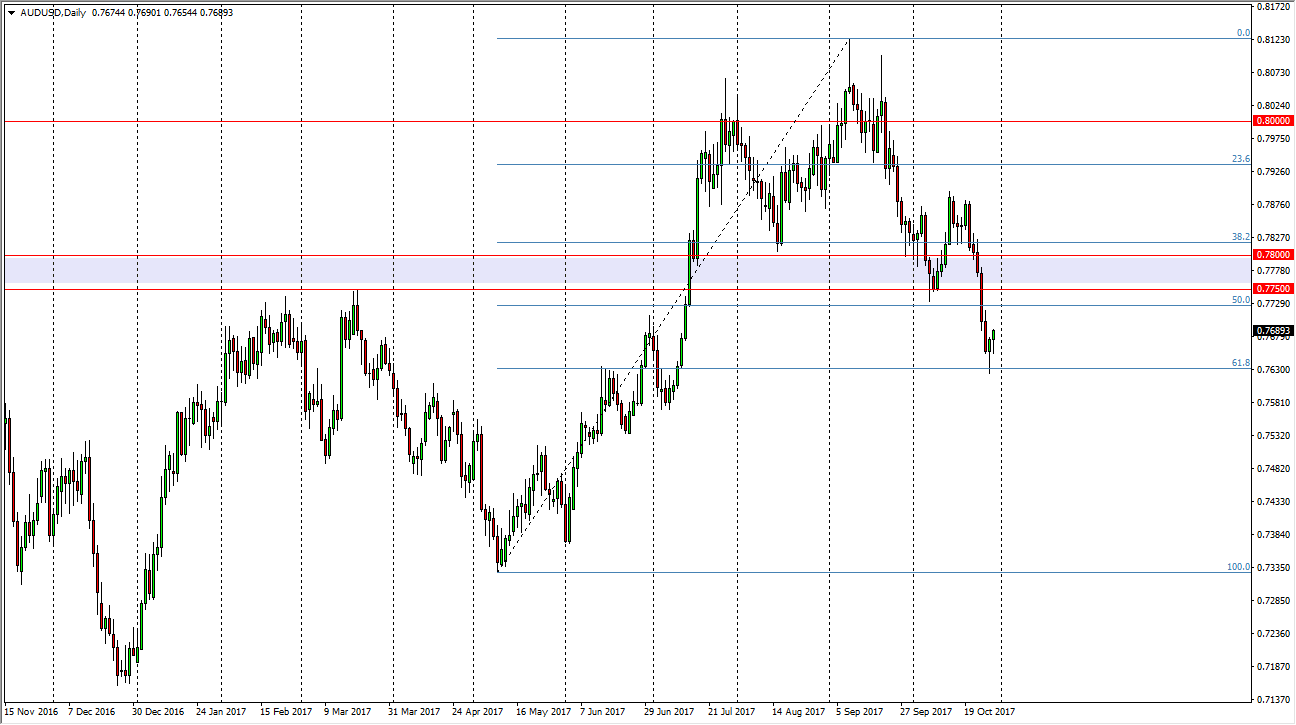

AUD/USD

The Australian dollar initially fell during the day on Monday but turned around to form a hammer yet again. The 61.8% Fibonacci retracement level has been tested for support, and I think we will probably bounce from here. However, the purple rectangle on the chart signifies an area that was previously massive resistance, and it should have been massive support. However, that support failed, and that, of course, is a very negative sign. I think that if we run into that area and get any type of resistance, I am more than willing to start selling this market. Alternately, if we can break above the 0.78 handle, the market should go much higher. In the short term, I think that the buyers are going to come back into the market. However, I don’t think this is a long-term move.

Leave A Comment