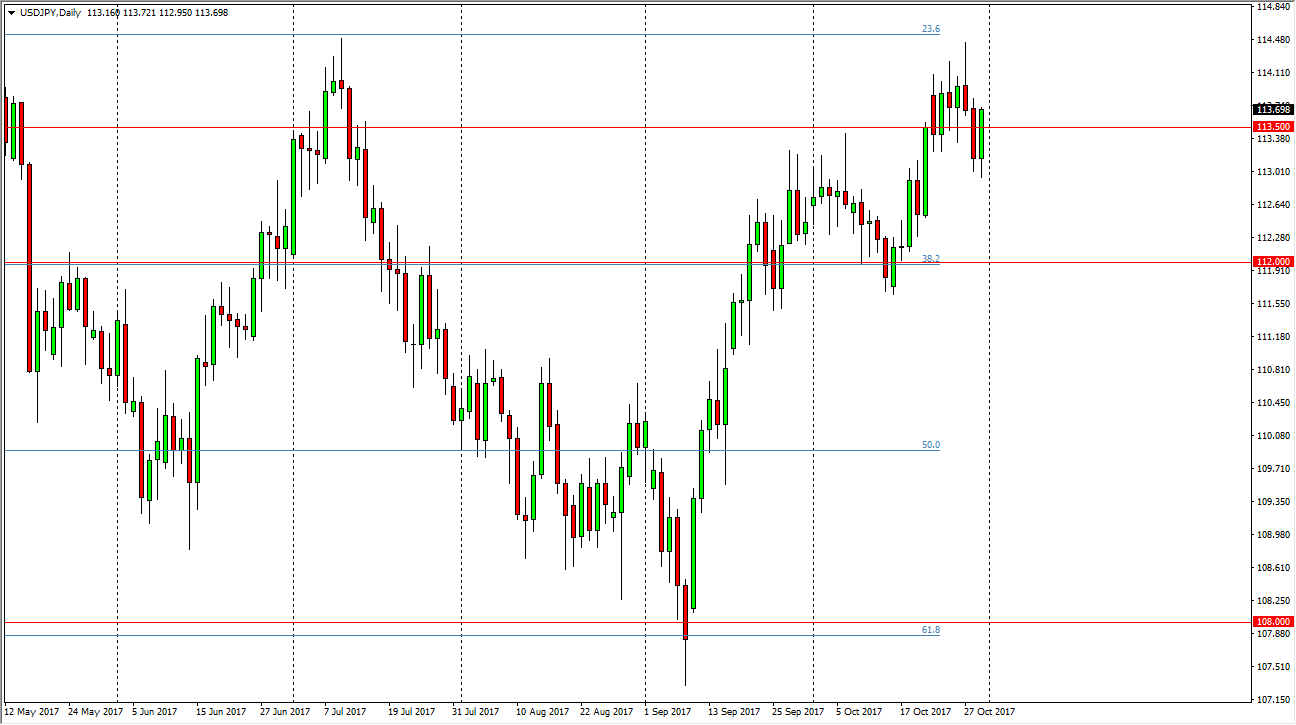

USD/JPY

The US dollar fell initially during the day on Tuesday but turned around to break above the 113.50 level. The market should continue to go higher, perhaps reaching towards the 114.50 level. However, I think that once we break above there, the real fight is close to the 115 handle. A clearance of that level allows the market to continue to be more of a “buy-and-hold” situation. If we do fall from here, I think there is more than enough support at the 112-level underneath. Ultimately, the market should go higher as interest rates look likely to continue to rise in the United States. That of course is very positive for this market and if the stock markets around the world continue to rally, typically we see the USD/JPY pair rally as well.

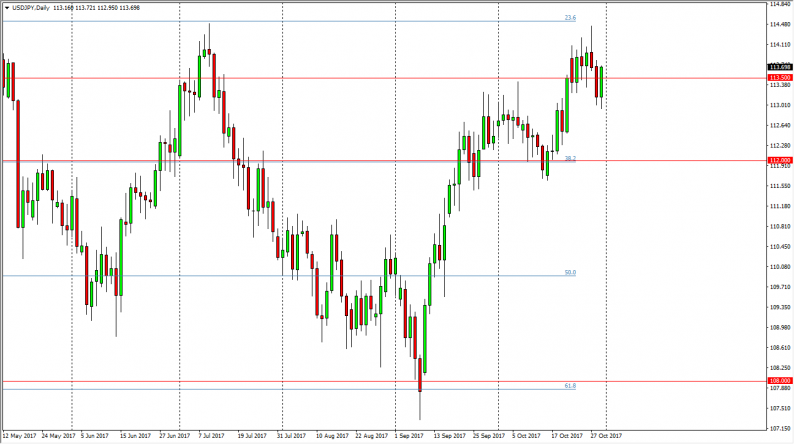

AUD/USD

The Australian dollar has rolled over after initially trying to rally on Tuesday, as gold markets continue to look a bit soft. On top of that, the US dollar has been rallying anyway and it looks likely that we are going to test the hammer from Friday. A breakdown below the bottom of that candlestick is a very negative sign, and should send the Australian dollar down to the 0.75 handle. If we do rally from here, there is so much in the way of resistance near the 0.7750 level that I will look to sell in that region. I don’t have any interest in going long, and quite frankly the vague attempt at a rally has all but been wiped out. That is not a good sign, and I believe the Aussie is going to continue to fall over the next several sessions. If we broke above the 0.78 handle, that changes everything.

Leave A Comment