The U.S. dollar struggles to hold its ground following the Federal Open Market Committee (FOMC) interest rate decision as the central bank largely sticks to the current script, with the greenback at risk of giving back the advance from the previous month as market participants scale back bets for four rate-hikes in 2018.

USD/JPY EXTENDS POST-FOMC LOSSES FOLLOWING LACKLUSTER ISM NON-MANUFACTURING SURVEY

![]()

USD/JPY remains under pressure following the Federal Open Market Committee (FOMC) interest rate decision as the ISM Non-Manufacturing survey narrows more-than-expected in April, and the pair stands at risk for further losses as the bullish momentum starts to unravel.

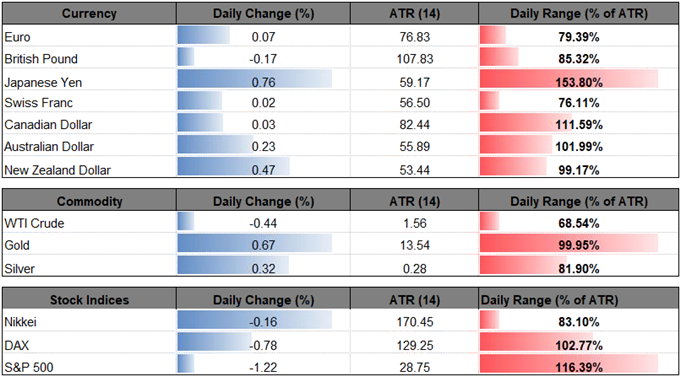

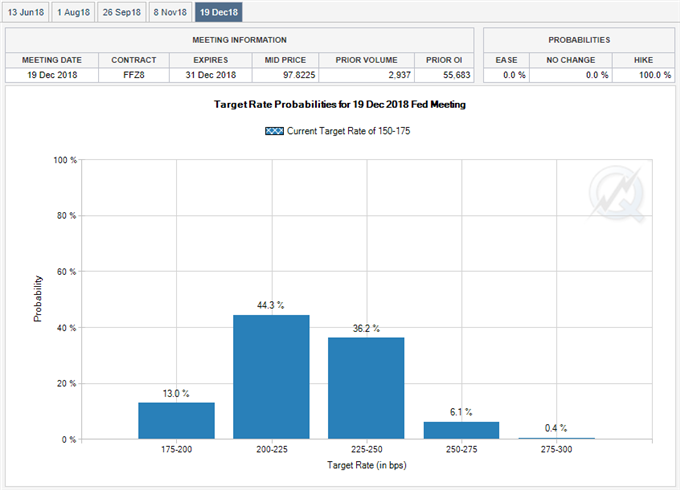

Recent remarks from the FOMC suggest the central bank is in no rush to extend the hiking-cycle as ‘inflation on a 12-month basis is expected to run near the Committee’s symmetric 2 percent objective over the medium term,’ and it seems as though Chairman Jerome Powell and Co. will tolerate above-target price growth for the foreseeable future as ‘risks to the economic outlook appear roughly balanced.’ As a result, Fed Fund Futures are starting to show waning expectations for four rate-hikes in 2018, with the benchmark interest rate now anticipated to end the year around the 2.00% to 2.25% threshold.

In turn, market participants may pay increased attention to the U.S. Non-Farm Payrolls (NFP) report as Average Hourly Earnings are projected to hold steady at an annualized 2.7%, and another batch of lackluster data prints may fuel the recent decline in USD/JPY as it dampens the Fed’s scope to extend the hiking-cycle.

USD/JPY DAILY CHART

Leave A Comment