As Equities continued to skyrocket today, it seems we are experiencing some early signs of risk-off as the Catalonia/Spain saga continues, and the US Economic Optimism Index falls. Oil continues to rise with Saudi Arabia cutting production, and production was stifled in the US due to the Hurricane. Watch for signs risk-off at these Equities price levels.

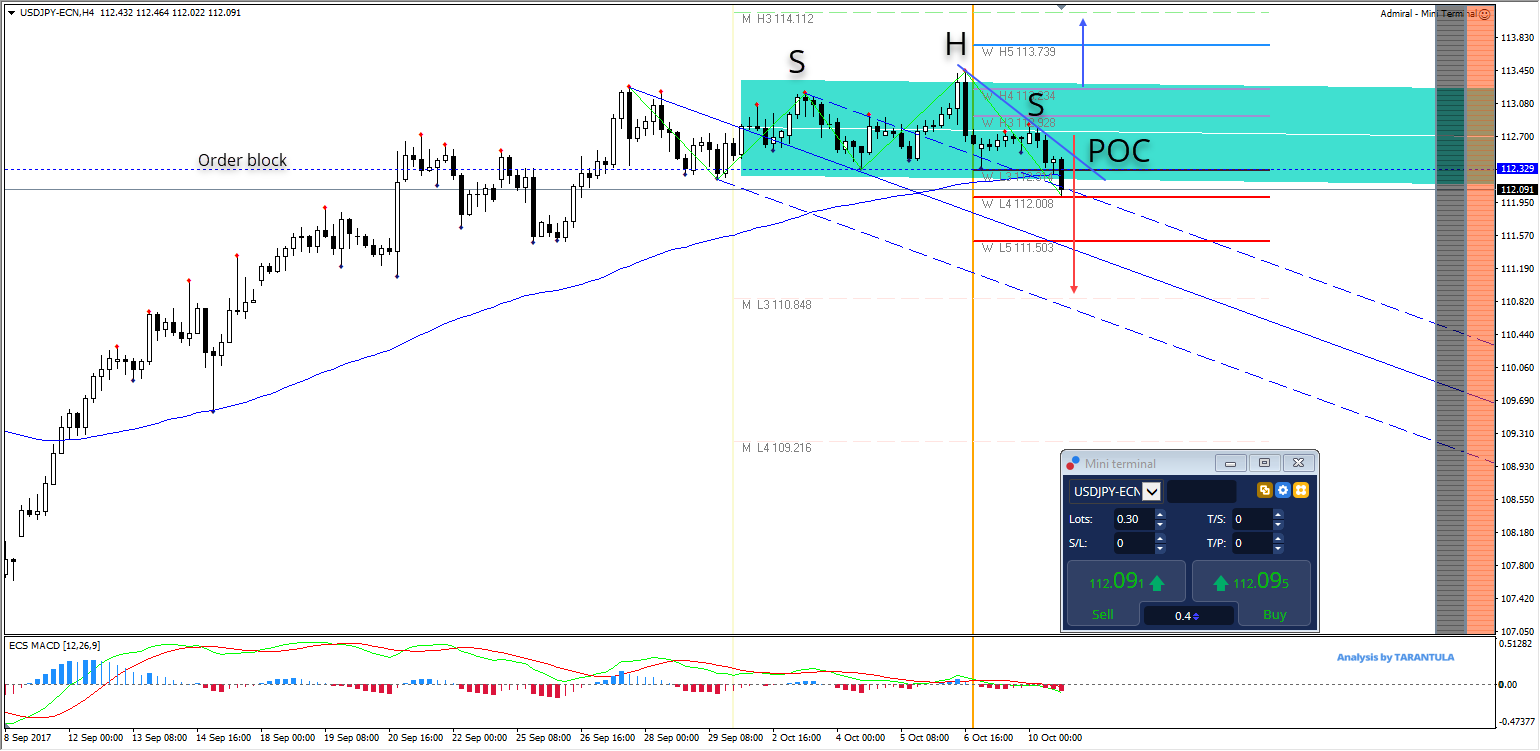

The USD/JPY has made a bearish SHS pattern and at this time it is trying to get into the AP channel again. The PPR channel has been broken to the downside and ideal situation for bears is that the price closes below the W L4 – 112.00 level. Pullbacks towards 112.35-70 could possibly be shorted into but have in mind that volatility might get even higher due to uncertainty over the Spain situation. targets are 112.00, 111.50 and 110.84. However, if the price makes a 4h close above 113.25 we could see 113.70 and 114.11.

W L3 – Weekly Camarilla Pivot (Weekly Interim Support)

W H3 – Weekly Camarilla Pivot (Weekly Interim Resistance)

W H4 – Weekly Camarilla Pivot (Strong Weekly Resistance)

D H4 – Daily Camarilla Pivot (Very Strong Daily Resistance)

D L3 – Daily Camarilla Pivot (Daily Support)

D L4 – Daily H4 Camarilla (Very Strong Daily Support)

PPR – Progressive Polynomial Channel

AP -Andrew’s Pitchfork

POC – Point Of Confluence (The zone where we expect price to react aka entry zone)

Leave A Comment