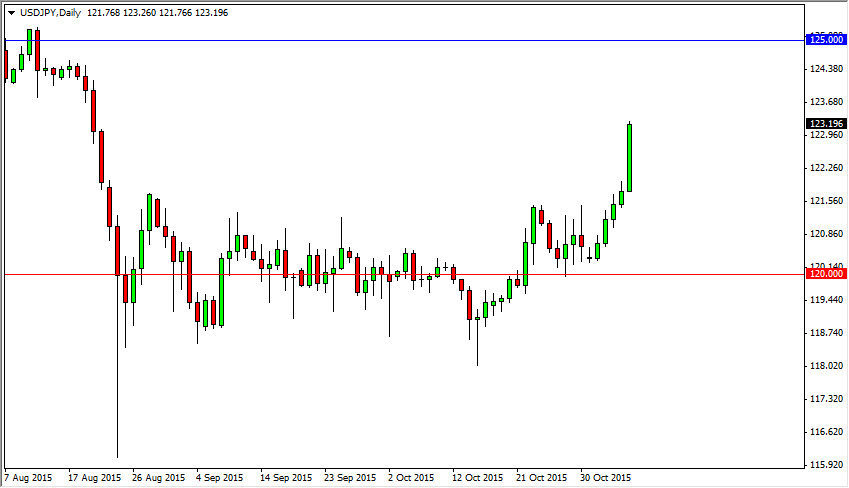

The USD/JPY pair broke out during the course of the session on Friday, as the jobs number came out much stronger than anticipated. This pair tends to be very sensitive to that particular announcement, so it makes sense that the market rose as money flooded into the United States. After all, it’s very likely that interest rates will have to climb in America, and it certainly isn’t going to happen anytime soon in Japan as the Bank of Japan is so very dovish.

Ultimately, I also look at this candle and recognize that the buyers are very much in control as we are at the top of the range. A break of the top of the range should send this market looking for the 125 handle, but I also recognize that a pullback might be a nice buying opportunity as well. Pullbacks and showing signs of support will be looked at as value by myself, and they of course will start going long.

US dollar strength worldwide

The US dollar has been strengthening against almost everything out there right now, and as a result it makes sense of the Japanese yen would be) line with everything else. After all, commodity markets are showing weakness, which is generally signs of US dollar strength. The Euro has collapsed, and so is the British pound. In other words, everything is running to America at the moment.

In a world which has a very soft economies in the forefront, the fact that the United States has been reasonably stable and is adding a fair amount of jobs suggests that it’s very likely that the Americans continue to lead the way. Ultimately, the US dollar will strengthen due to not only interest rates, but also stock markets going higher in America as investors will look to the Americas for return him of investments. At this point in time, I believe that we will eventually break above the 125 handle, and continue the uptrend for the longer-term “buy-and-hold” move.

Leave A Comment