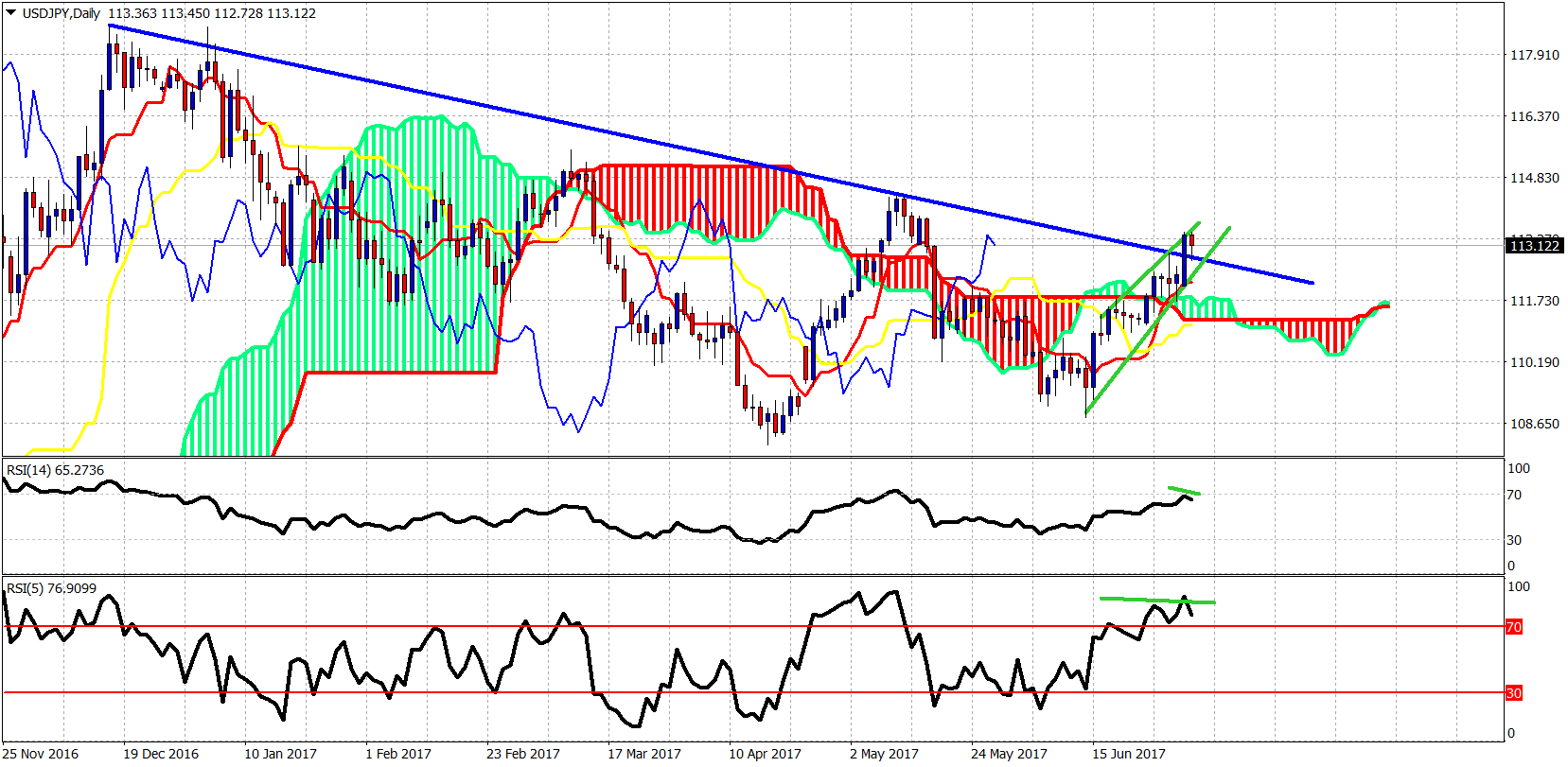

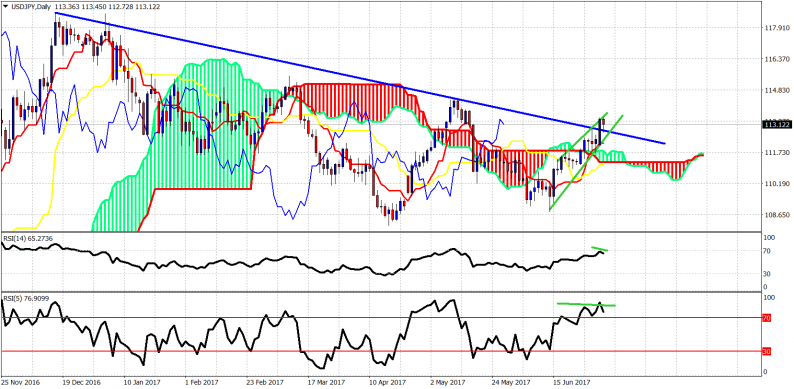

The USD/JPY is at an important crossroad. Any pull back from current levels is justified for the short-term but could also be seen as a false break out above the medium-term resistance trend line.

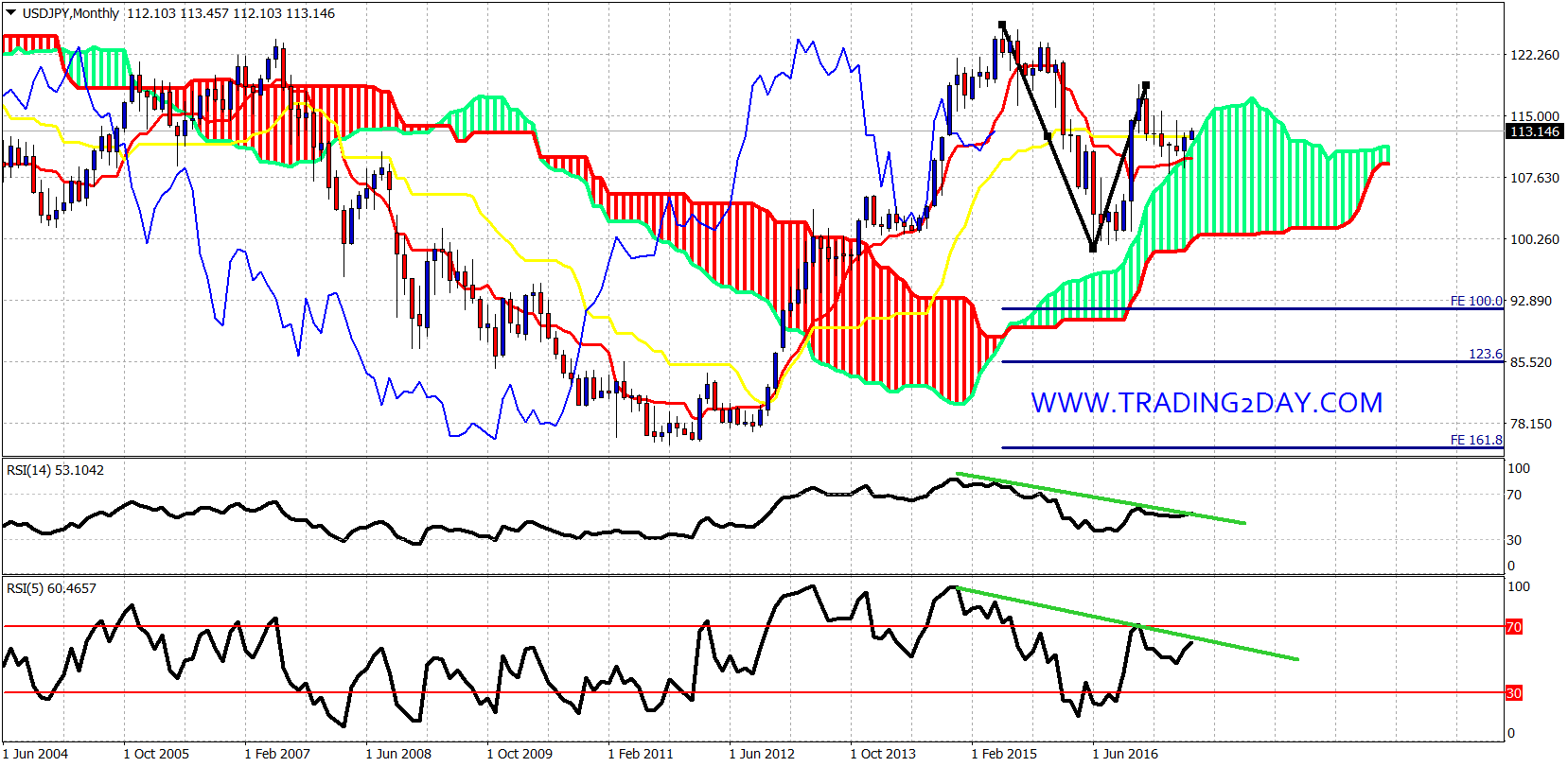

So far on a monthly basis the USD/JPY is respecting the monthly Kumo (cloud) support and has bounced off it. Will it do the same and start a new up trend towards 127 or will it reverse from current levels for a new downward move towards 94?

As long as price is above 110-111 bulls are safe. A monthly close below 111-110 will open the way for a push lower towards 101 at least.

If USD/JPY is about to make a similar leg down to the decline of 125-99, then we should expect a reversal from current levels and a move towards 94-92. If on the other hand we manage to hold above the monthly cloud support, a sequence of higher highs and higher lows will show us the way towards 126 at least.

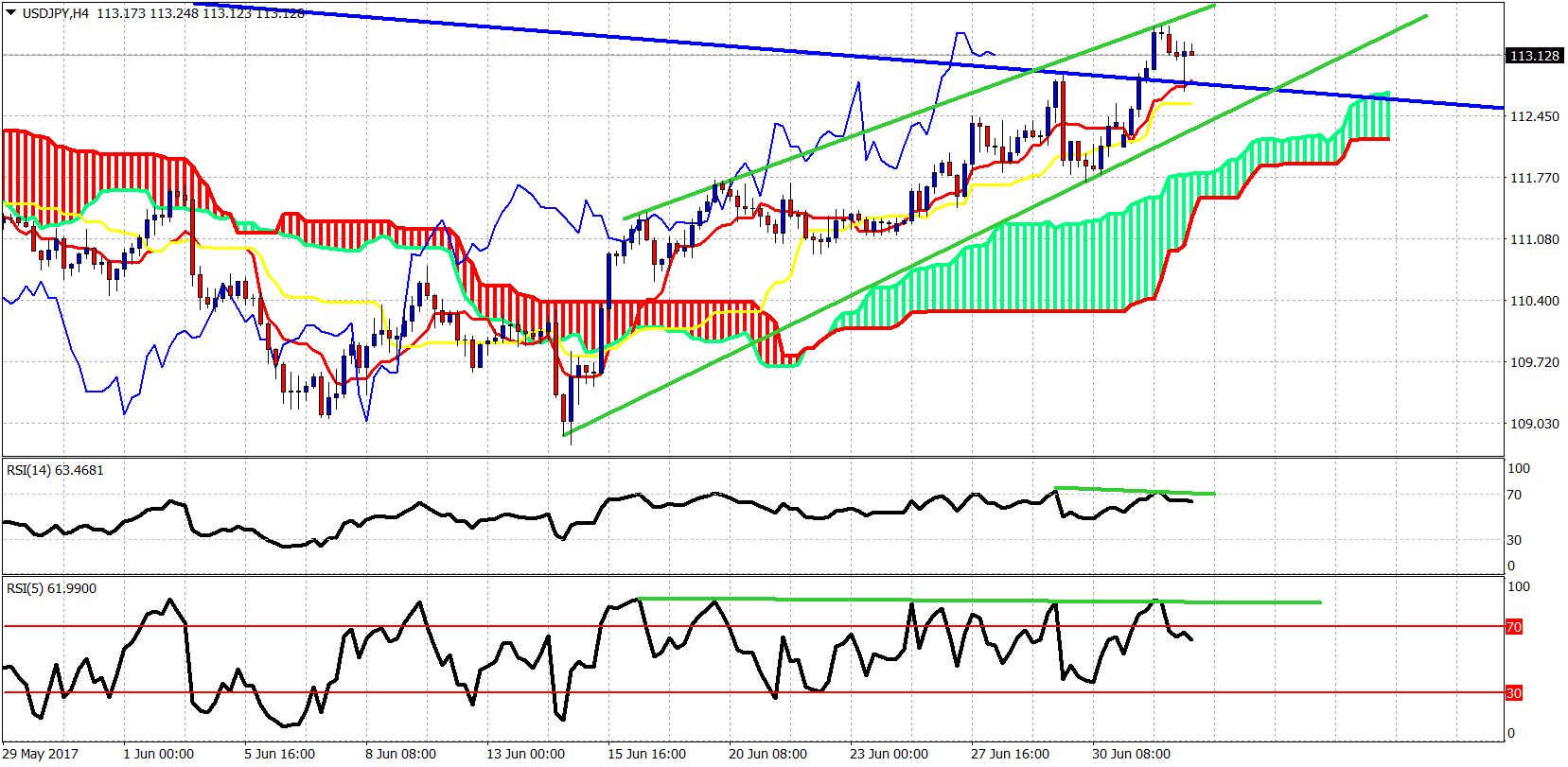

In the short-term price is trading inside a bullish channel and has broken above the 112.50-112.80 resistance trend line. So far we have seen one successful back test of the broken trend line and price remains above both the tenkan- and kijun-sen indicators.

A break below 112.60 will be the first reversal signal. Short-term weakness should be expected if we also break 112.70. So 112.60-112.70 is important for short-term traders. As said above, 110-111 is the support area bulls should hold. Breaking below it will open the way for a test of 108. Breaking 108 will strengthen the bearish scenario for 92-94 USD/JPY.

Leave A Comment