As the BoJ commences a slow process of tapering, this, in theory, has pushed traders into buying JPY. In addition, this has the side-effect of selling risky assets, and we saw Equities pullback from recent highs in alignment with rising JPY demand. Whilst US data has been mixed, with Consumer Credit rising, but lower JOLTS jobs openings, all eyes will be on US CPI and Retail Sales data later on Friday.

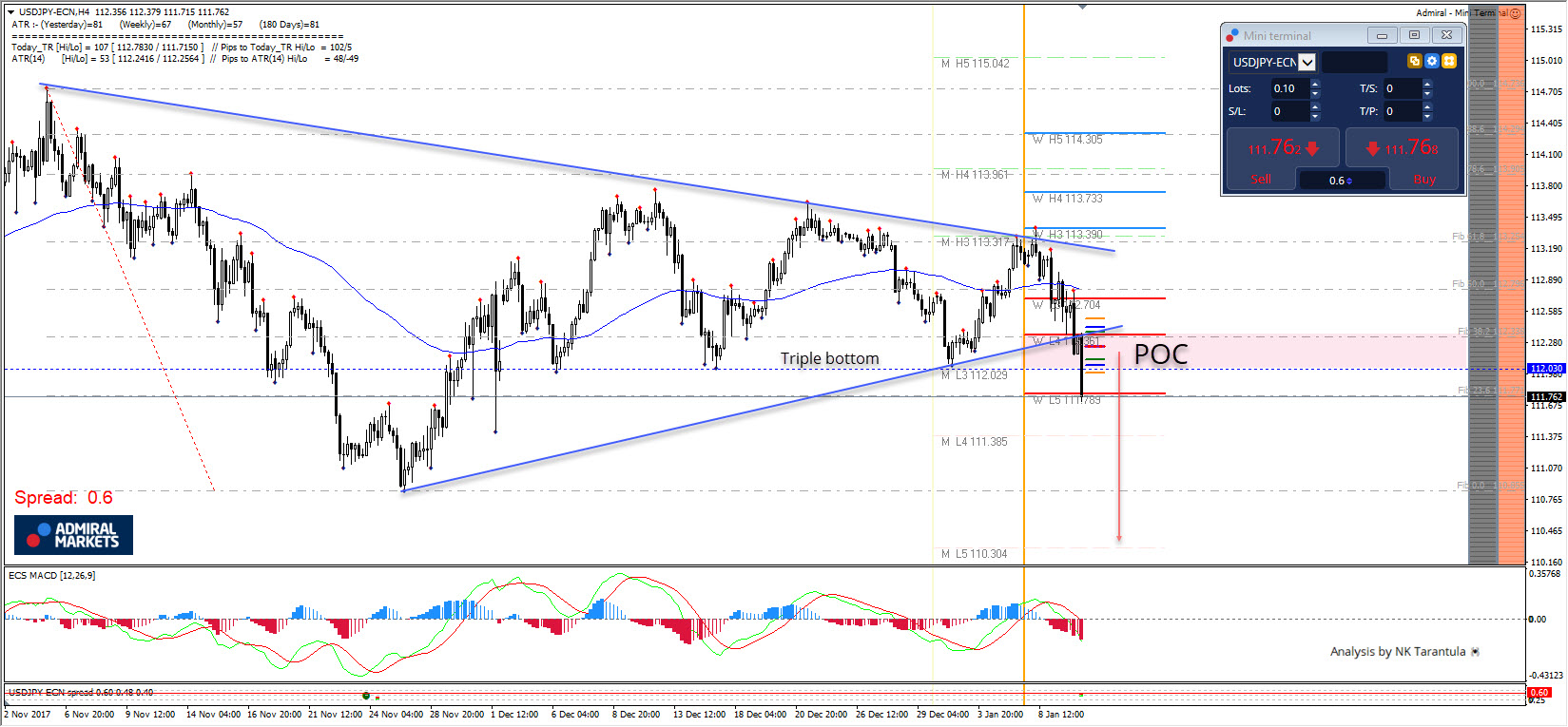

The USD/JPY has been consolidating (yellow highlight) within a larger running triangle, and it has formed a triple bottom pattern precisely at M L3 support. The pair broke lower trend line/ W L4, and now it is trying to break W L5. A retest of the POC zone 112.00-35 could reject the price again but a 4h close below the W L5 111.78 could target lower camarilla levels. Targets are 111.38 ( M L4), and if it breaks next target is 110.84 (previous low), followed by 110.30 M L5 camarilla

W H3 – Weekly Camarilla Pivot (Weekly Interim Resistance)

W H4 – Weekly Camarilla Pivot (Strong Weekly Resistance)

M H4 – Monthly Camarilla Pivot (Very Strong Monthly Resistance)

M L3 – Monthly Camarilla Pivot (Monthly Support)

M L4 – Monthly H4 Camarilla (Monthly Strong Daily Support)

POC – Point Of Confluence (The zone where we expect price to react aka entry zone).

Leave A Comment