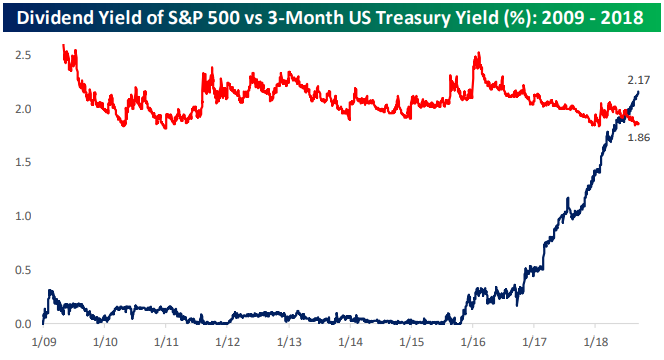

As interest rates have risen in the last year, we have seen a number of charts similar to the one below comparing the yield on the 3-Month US Treasury (UST) to the dividend yield of the S&P 500. For the vast majority of the current bull market (up until only a couple months ago) short-term interest rates have been below the dividend yield of the S&P 500. Since the FOMC began hiking rates over two years ago, short-term UST rates have risen. This year, they rose above the S&P 500 dividend yield; a key inflection point creating a talk that the higher yield on cash makes UST more attractive than equities.

Relative to the current bull market, this may seem impressive. On a longer time horizon, though, this is not the case. Prior to 2009, instances, where short-term Treasuries yielded less than the S&P 500, were few and far between. This cross in yields is by no means a red flag for equities, rather, it is a return to what has been historically normal.

Leave A Comment