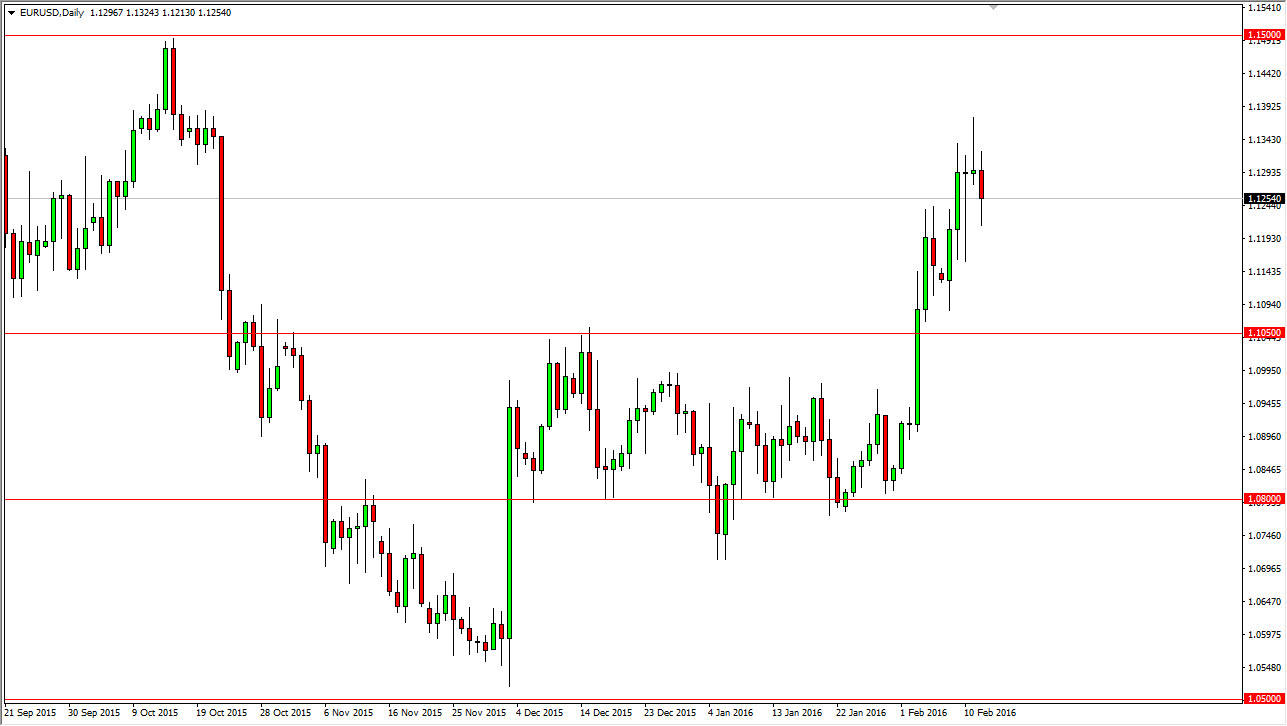

EUR/USD

The EUR/USD pair fell during the course of the session on Friday, as we did get a little bit exhausted above the 1.13 handle. Having said that though, the market certainly has plenty of support below, so we are not likely to see a significant sell off at this point. I think it’s only a matter of time before we formed a supportive candle, and that supportive candle will be reason enough to start going long. I think that we will probably try to reach the 1.15 handle, but it might take a minute to get there. Ultimately, this is a market that I believe you can only buy for any real length of time as the significant breakout that has recently happened signals that the market is ready to continue going higher, especially considering that Janet Yellen has suggested that we are not likely to see any interest-rate hikes anytime soon out of the United States.

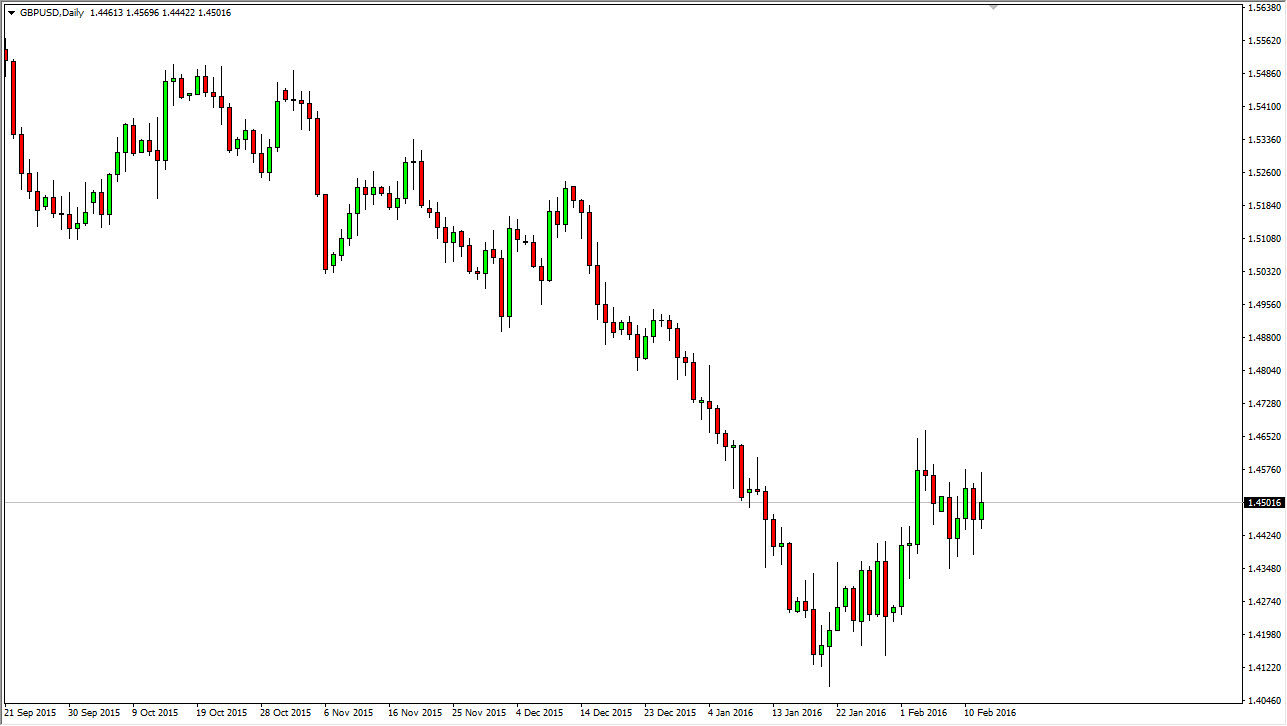

GBP/USD

The GBP/USD pair rose during the course of the day but gave back quite a bit of the gains in order to form a shooting star of sorts. This is a market that is going to continue to chop around in my opinion and quite frankly I have no interest in putting any serious money into this market. Ultimately, the one thing we do have to look at is the weekly candle did form a hammer, and that of course is a positive sign, but I think we need to break above the shooting star from roughly 7 days ago in order to start buying. If we get that, then we should probably go to the 1.48 level. It’s going to be difficult to sell this market though, because there is so much in the way of support near the 1.44 level. Because of that, I think it would be difficult to break down from here with any real strength.

Leave A Comment